Opinion Focus

- There has been talk of an imminent recession for much of 2022.

- The economic indicators are finally beginning to show signs of waning demand.

- But there is optimism that easing of China’s Zero Covid policy could be beneficial for the supply chain.

After a whirlwind 2022, a series of interest rate hikes and a change in the direction of the employment market are set to take a bite out of consumer demand. While GDP data does not quite show a contraction yet, many countries are at risk of falling into recessionary territory.

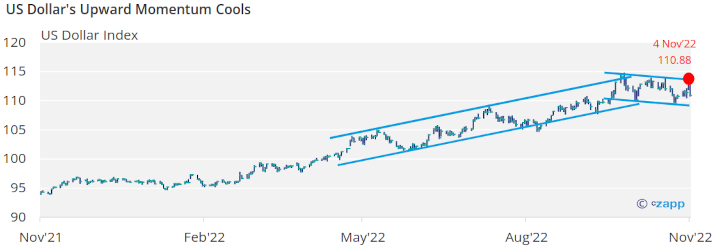

Dollar Strength Wanes Ahead of Midterms

The US dollar has begun to lose steam after a period of strengthening underpinned by the Fed’s aggressive rate hike policy. But now, the general consensus is that the Fed will slow rate hikes in the future, causing a weakening in the dollar and US Treasury yields.

There is room for more losses in the next week or so running up to the Midterm elections in the US. Preliminary forecasts predict a Republican victory in the House of Representatives. If this happens, it will result in gridlock in Congress.

Although the scale and frequency of the rate hikes is expected to calm, that doesn’t mean they will stop altogether. In fact, just last week the bank raised its key interest rate by 0.75% to the 3.75% to 4% range – the highest level since January 2008.

Source: US Federal Reserve, European Central Bank, Bank of England, OECD

Federal Reserve Chair Jerome Powell also refused to rule out a further hike. Although inflation seems to be losing steam in September, Powell called speculation that the crisis is over “premature”.

The ECB and Bank of England also hiked rates again in November. The ECB’s benchmark rate was up 0.75% to 1.5% for the first time since 2009, while the UK’s headline rate was lifted to 3% — its highest level in 14 years.

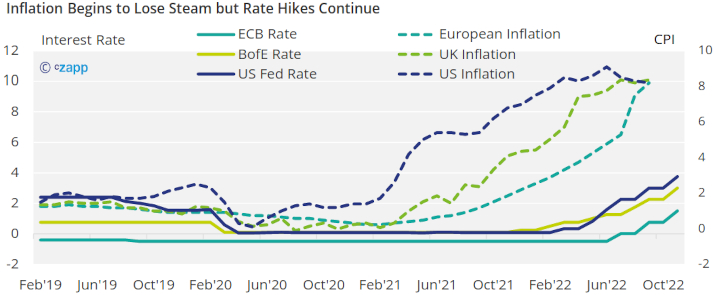

Employment Situation Turns Precarious

One reason for the speculation of a Fed reversal is a change in the dynamics of employment in the US as job gains get smaller. Only 261,000 workers were hired over the month of October, 17% down on September and almost 40% lower than the average year to date.

Source: Bureau of Labor Statistics

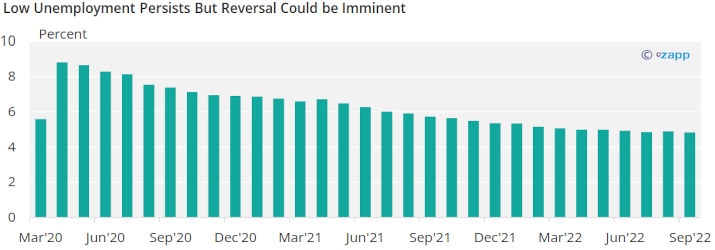

But employment on the whole is yet to show overt signs of the pressure. September marked the sixth consecutive month of an OECD unemployment rate lower than 5% — even tighter than pre-pandemic levels.

Source: OECD

Demand Indicators Begin to Lag

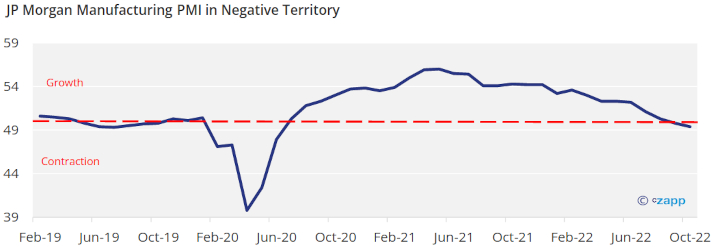

Global manufacturing PMI dipped into negative territory in September for the first time since June 2020, marking the end of the pandemic-induced flurry of demand for goods.

Source: IHS Markit

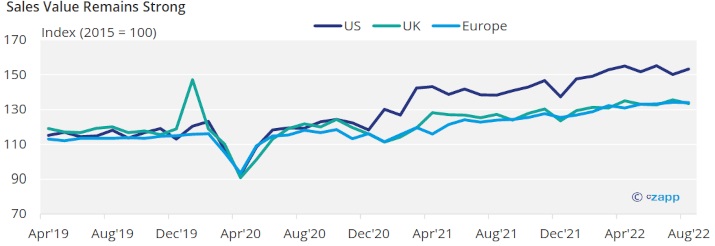

Sales in the US, the UK and Europe remain stubbornly high but the signs of waning consumption are creeping in.

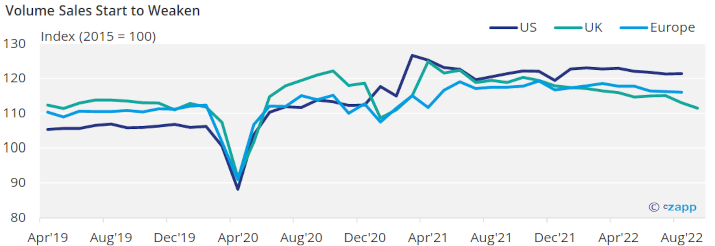

Despite the higher value of sales, which can be accounted for by inflation, sales volumes are finally dropping in these markets. Find out more about recent consumption trends here.

Source: OECD

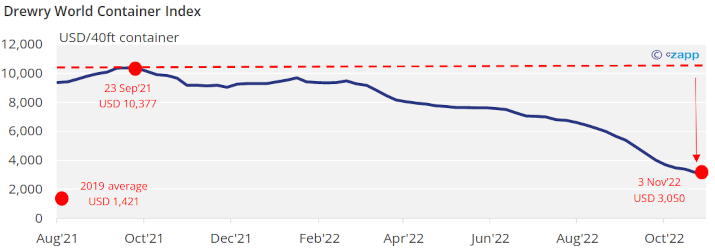

As a result of less congestion and lower demand, freight prices have continued to plummet. The Drewry World Container Index has lost over 70% since its highs last September to reach USD 3,050 as of November 3.

Source: Drewry Container Index

Shipping firm Maersk said in its third quarter results that it expects ocean freight rates to continue on their downward trajectory due to the fall in manufacturing orders.

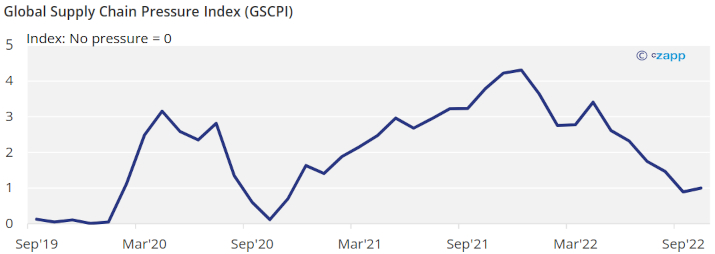

The bright spot for the supply chain is that pressure is finally easing. The Global Supply Chain Pressure Index is now hovering around 1, marking a huge drop in the past six months.

Source: Federal Reserve Bank of New York

This is good news for retailers ahead of a ramp up for the end-of-year holiday season. This year, though, trade might not be quite as strong as retailers work to offload some of their stockpiles and free up warehouse space.

Commodity Prices

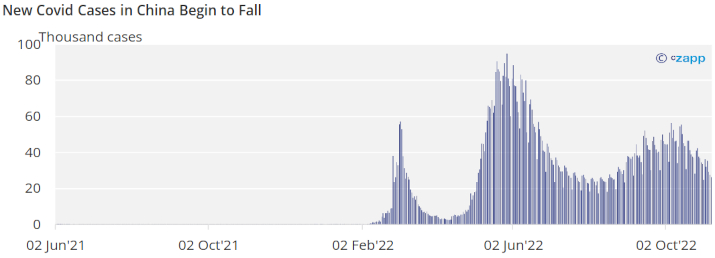

A lack of demand from China has put a major dent in global trade in the past few years. But now, there are question marks over whether China can continue to implement its Zero Covid policy after recent reports of civil unrest. Despite strict containment measures, case numbers in the country continue to rise.

Source: WHO

But a recent fall in case numbers and increasing discontent in China have prompted question marks over whether China can continue to implement the policy. A reopening in China would signal a huge demand increase.

A reopening in China – whenever it occurs – is a major factor in supporting global oil prices. The mixed messages over the Covid policy have created volatility in the market and generated a substantial drop off.

*Includes Brent, WTI and Dubai

Source: World Bank

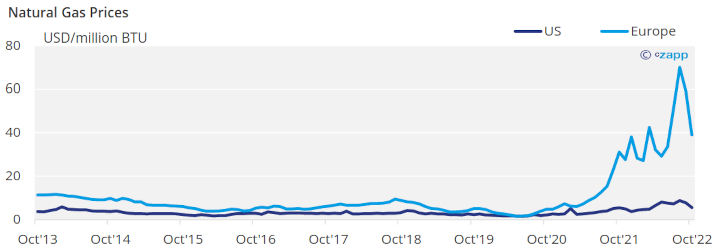

Natural gas prices fell significantly in Europe over October as mild weather continued across the continent. However, November has brought with it more adverse weather, meaning prices are likely to rise again.

Source: World Bank

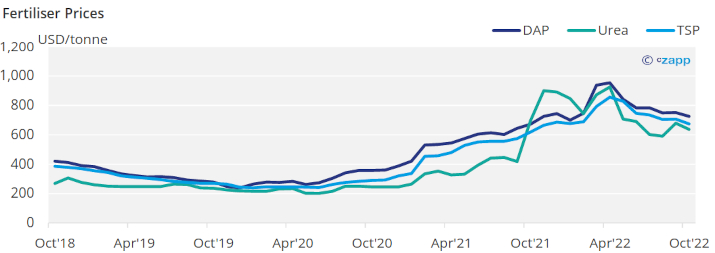

The drop in natural gas prices has not yet knocked on to fertiliser markets as prices remain elevated, although not nearly as high as those seen at the beginning of the year.

Agricultural output is likely to decline even further the longer fertiliser prices remain elevated.

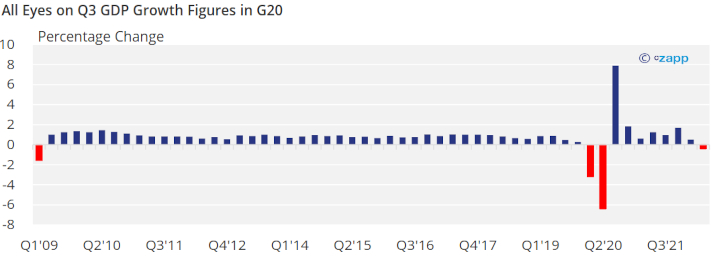

Negative GDP Growth Indicates Recession

Generally, recession is defined as two consecutive quarters of GDP contraction. The OECD has already seen one quarter of negative growth.

Source: OECD

But some countries are in better positions than others. China, India, the UK, the US and South Africa are all in negative territory while Germany teeters on the brink. Most other economies are experiencing marginal GDP growth.

Concluding Thoughts

- There are some indications that interest rate hikes are beginning to cool demand.

- While sales values remain stable, volumes are beginning to drop, which indicates that consumer appetites are starting to falter.

- Although inflation is starting to slow, there is no consensus over whether interest rate hikes will follow.

- GDP data shows that most G20 countries are in danger of falling into negative territory.

- The employment environment is also starting to weaken after a strong 2022 – another negative factor for demand.

- A reopening in China could create some new momentum but it is unclear whether leaders are willing to abandon the Zero Covid policy.

- The cost of living is set to remain elevated after another hike in interest rates.

.

.