Insight Focus

- EU-27 sugar imports are the highest in 6 years.

- Sugar production has been falling in recent seasons.

- Consumption has remained resilient despite attempts to tackle sugar intake.

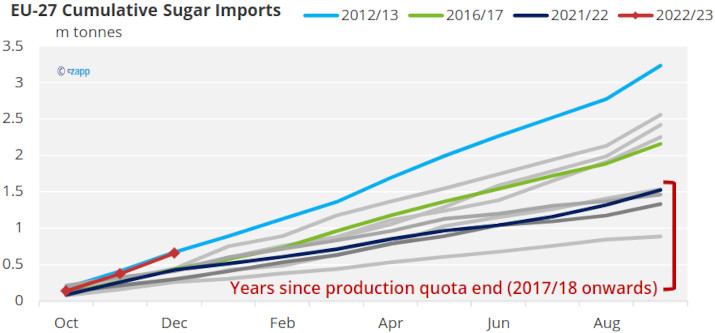

EU-27 countries have imported just over 650k tonnes in the first 3 months of the 2022/23 campaign. Imports haven’t been this strong during the first 3 months of a season since 2012/13, when the EU was still subject to production quotas and the market was quite different.

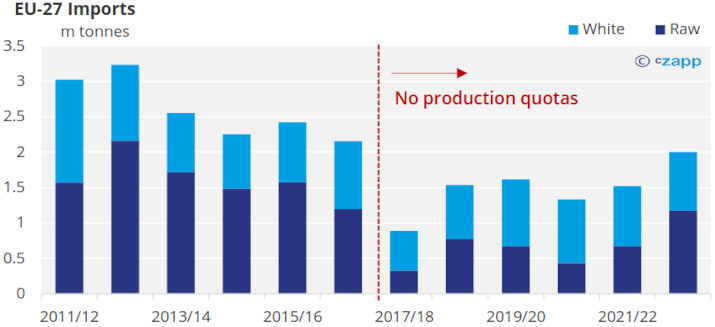

We forecast that by the end of the season (October 2023), EU-27 imports will reach 2m tonnes, making it the largest import programme in 6 seasons. Almost all imports from preferential and free trade origins should flow into the EU plus any volume under CXL quota. Even full duty imports (raw sugar pays 339 EUR/mt, white sugar 419Eur/mt) are close to being workable at current price levels.

For more information on EU imports and the different regimes please read our explainer.

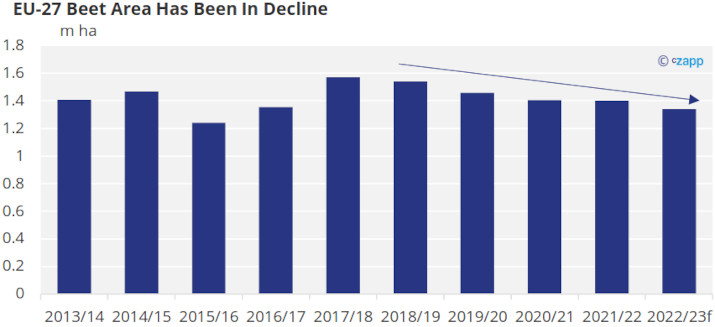

It’s been the perfect storm for the EU sugar market in recent years: production has been in decline as beet area across the continent has fallen each year due to poor farmer returns. Beet prices are now climbing quite dramatically but this is yet to be reflected by a meaningful increase in area.

Processors have also had to battle against record energy prices and uncertainty of their processing costs. At one stage, energy rationing was a possibility and several factories had to look to using alternative sources like coal rather than natural gas.

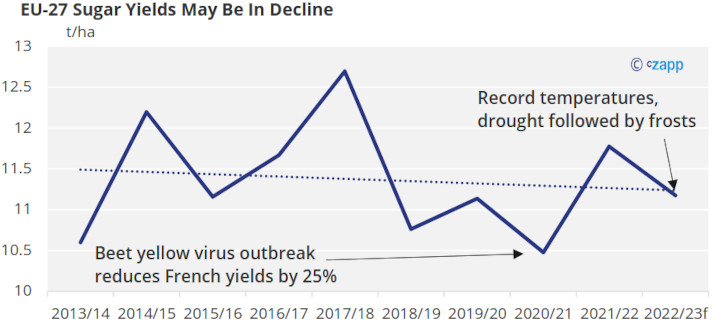

Yields have also suffered due to seemingly more regular occurrences of extreme weather and the ban on the use of neonicotinoids (a pesticide used to protect sugar beet against viruses). The 2022/23 crop was particularly badly affected by record temperatures and drought in the summer months, followed by a prolonged frost which caused significant damage to beet.

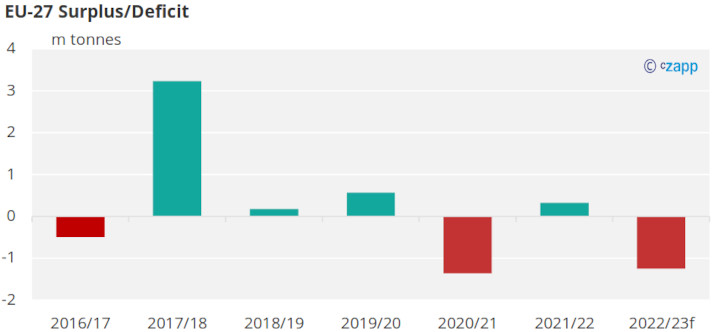

Over the same period, sugar consumption has remained robust (apart from during Covid lockdowns), despite various attempts to encourage reduced sugar intake and reformulation. We think sugar production will fall short of consumption by over 1m tonnes during the current season (2022/23). At no point since 2017/18 has production exceeded consumption by more than 500k tonnes.

All put together, this means imports are needed to meet domestic demand. To ensure these imports can flow the EU market is paying some of the highest prices in the world.

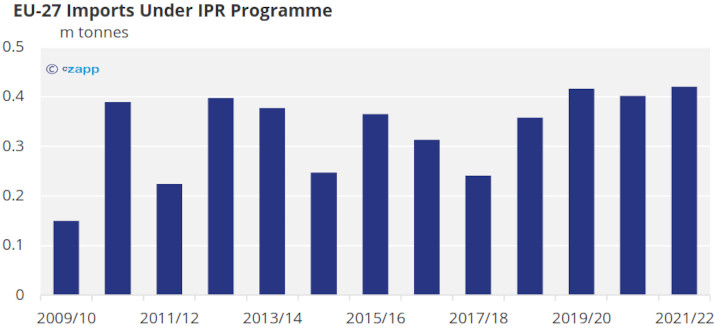

In recent years, we have also noticed a pick up in sugar imports under inward processing relief (IPR) where manufacturers who export finished goods containing sugar can get relief on any import duty payable.