Insight Focus

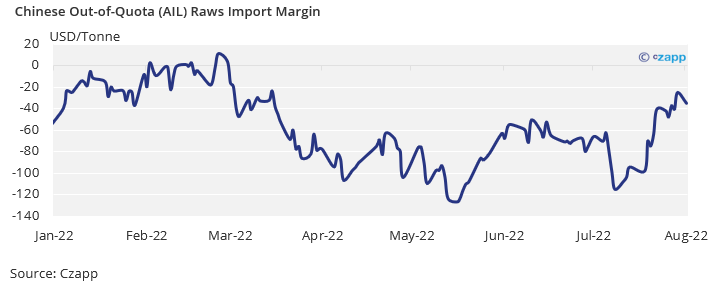

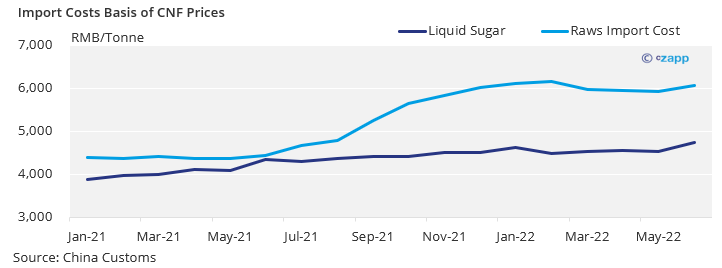

- Chinese raw sugar import margins have mostly been negative so far in 2022.

- Frequent and widespread COVID outbreaks put a major dampen on domestic demand.

- Imports of liquid sugar and blend powder have soared, eating into the sugar market.

Raw sugar import margins into China have been mostly negative for the past seven months. This is despite a fall in domestic sugar production that means production will fall short of consumption by over 5.5m tonnes in the 2021/22 season, up from 4.8m tonnes last season.

Weak Consumption To Blame

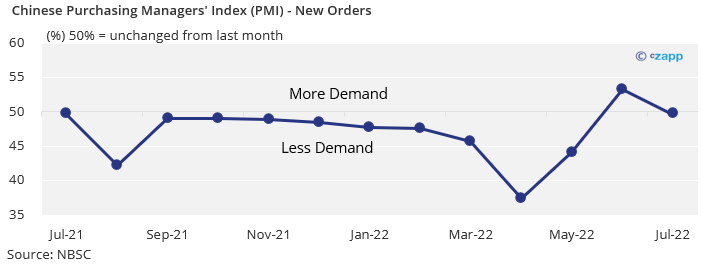

In the first half of 2022, sugar consumption was severely hit by frequent and widespread outbreaks of COVID-19. Despite various policies and measures to promote consumption — such as vouchers and subsidies– it is unlikely it will fully recover over the rest of the year.

This can be seen in manufacturing industry data. Over 50% of manufacturing enterprises registered weaker demand in July, the National Bureau of Statistics (NBSC) reported. The PMI index of new orders in the past 12 months were below 50% threshold, except for June, indicating shrinking demand.

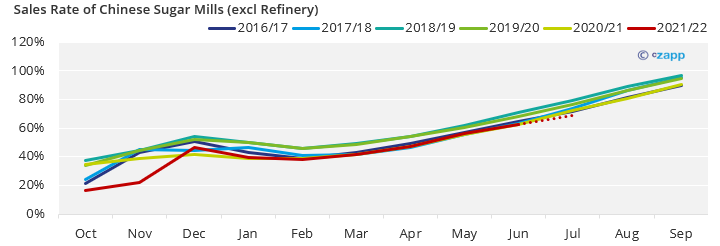

Slow sales by sugar mills painted a similar picture. The monthly sales rates of domestic sugar mills in 2021/22 remained at the bottom of the range and probably hit an eight-year low in July.

Substitution: Liquid Sugar & Blend Powder Imports Surged

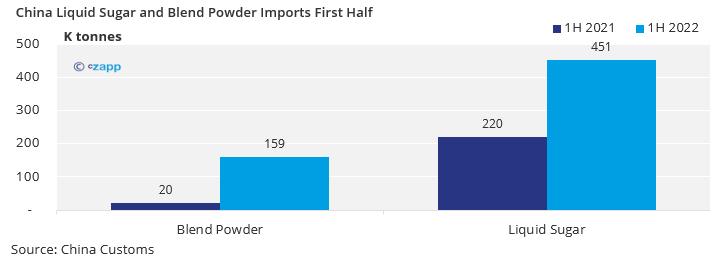

Apart from weak consumption, lower-priced sugar substitutes also weighed on domestic sugar prices. The rising costs and falling demand forced manufacturers to turn to cheaper substitutes. This year, liquid sugar and blend powder have taken market shares from regular crystalized sugar. China imported 159k tonnes of liquid sugar and 451k tonnes of blend powder in H1, 139k tonnes and 231k tonnes more year on year, respectively.

Liquid sugar and blend powder are now both cheaper sources of sugar on the domestic market. Take liquid sugar as an example, its import price was 24% less than raw sugar in H1, and 17% less than domestic white sugar.

Sugar Is Still Being Imported

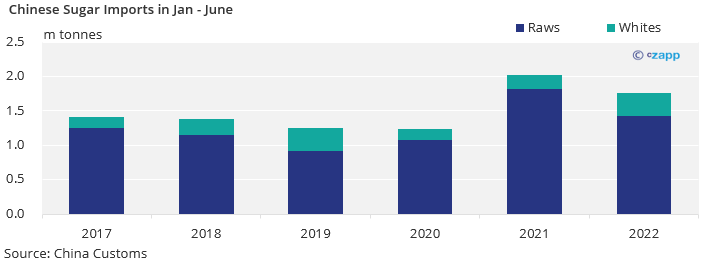

Despite the negative margins there hasn’t been a significant reduction in raw sugar imports. Chinese refiners managed to exploit market opportunities to hedge most of their demand in 2022. China imported 1.42 m tonnes of raw sugar in H1 2022, 400k tonnes lower than a year earlier, but still the second highest since 2017.

Over the same period, there have been some additional white sugar imports, increasing from 208k tonnes to 341k tonnes

Going forward, we still think refiners will look to use the rest of their Automatic Import Licenses (AILs) in full even at a small loss, as discussed in previous report,

Unless consumption grows, and/or there are restrictions on liquid sugar imports, and/or there is a significant drop in sugar imports, the import margin doesn’t need to increase significantly to incentivise extra imports for the domestic market.

.

.