Opinions Focus

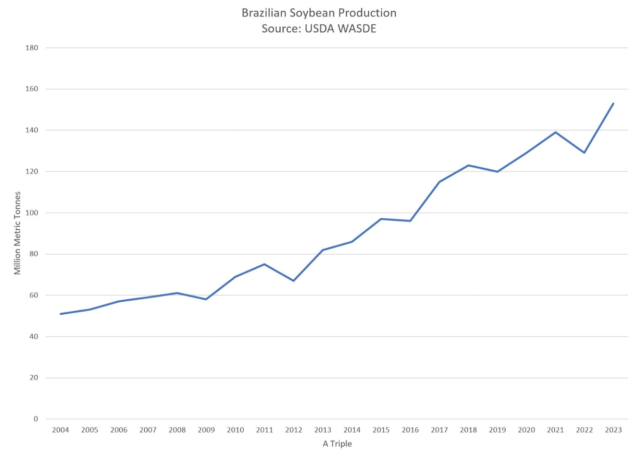

- Brazil will have one of its largest soybean crops on record in 2023.

- Already soybeans are being shipped to Argentina, which is unusual.

- Might they also be exported to the USA this year too?

There is an expression amongst traders that goes like this: “Don’t tell me what to buy, tell me when to buy it.” It is a cousin to the old adage “timing is everything.”

Traders, given the very nature of their vocation, experience “timing is everything” regularly as they frequently see how often the “when” leads to successful outcomes while the “what” may not matter as much. Traders regularly miss the rally having just closed out a long position the prior day or have a package of options expire just before the big move. Traders also regularly observe otherwise unskilled peers make fortunes because they got the day or week or month of the big move just right.

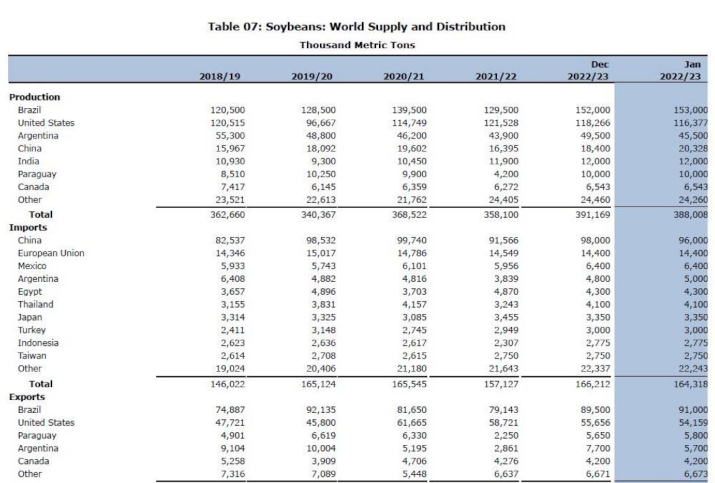

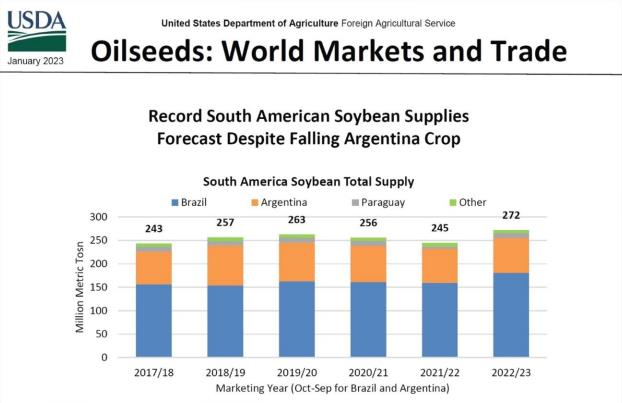

Commodity traders review supply and demand balance sheets, the key fundamental input for discretionary traders who use their brains as opposed to a computer model to discern “when” supply comes to market. For instance, USDA economists forecasted record South American soybean supplies last week with their World Agricultural and Supply Demand Estimates but USDA economists did not forecast when all that supply would come to market. Economists leave the “when” to the traders and the analysts and the market (with a tip of my hat to Jimmy Connor at RJ O’Brien who often reiterates this concept in his analysis: a balance sheet details supply, but not the marketing behavior of the holder of that supply).

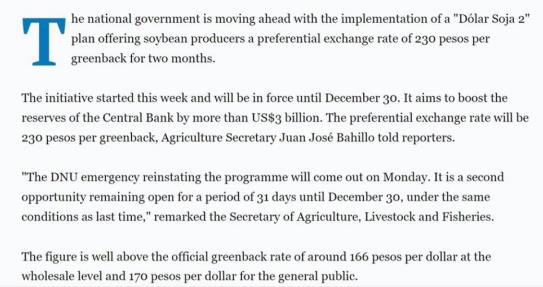

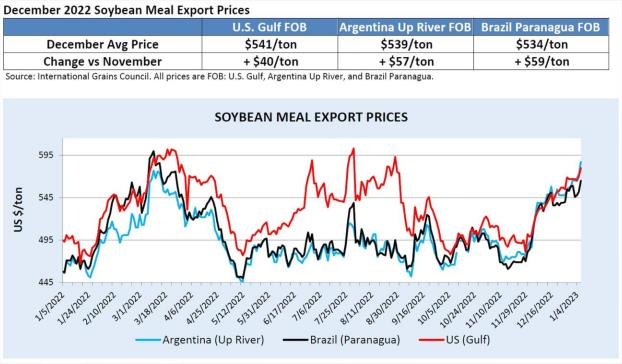

As the price chart on the next page shows, expanding Brazilian crop estimates (from USDA, Brazilian agencies, and private analysts) during December and now January have led to a stable soybean market that has traded sideways around $600 per ton for two of the major origins: Brazil, the black line, and the US, the red line. Prices at the other major origin, Argentina, diverged and spiked higher. Argentine farmers went on a sellers’ strike and ultimately forced the Argentine government and central bank to capitulate to their demands for a higher dollar/peso exchange rate, a special rate just for farmers.

That lack of Argentine farmer selling caused disruption in global protein meal markets because Argentine processors who cannot buy soybeans cannot sell soybean meal and the Argentine processors provide more soybean meal (by far) to the world importer than any other processor. Thus, the price spike at the bottom right hand of the below chart led by the blue line, Argentina.

Argentine farmers leveraged their supply position and the economic benefits flowed to them but also to the US soybean processor busy producing soybean meal to ensure a comfortable world supply, the US soybean farmer who enjoyed a sharp rally in physical prices as well futures prices, a rare combination, and to the US renewable diesel industry as the margin structure for the US soybean processor shifted more to soybean meal allowing soybean oil to carry less of the load and trend lower in price.

The losers in this transaction included the Argentine government and central bank (no one or no entity ever enjoys getting leveraged in public), the owners of the enormous crushing capacity along the Parana River in Argentina who dealt with the uncertainty of feedstock supply all year, and the customers of the Argentine processors, the global importers of soybean meal and oil who depend on Argentine supply.

Often we traders talk about “the function of the market”, in other words, we traders ask ourselves do market prices need to move higher to bring supply or lower to bring demand and when. If USDA economists forecasted well and the Brazilian soybean crop has become record and storage for the crop is limited, all safe assumptions in my opinion, the function of the soybean market is clear: Brazilian prices need to move sharply lower and remain the cheapest source of soybeans in the world and stay there for some time to move sufficient supplies from the Brazilian origin to the destination markets.

And maybe, as part of this process, the Brazilians, the Saudi Arabians of soybean supply, cause some dramatic changes in global processing rates and solve problems in many places, including Argentina.

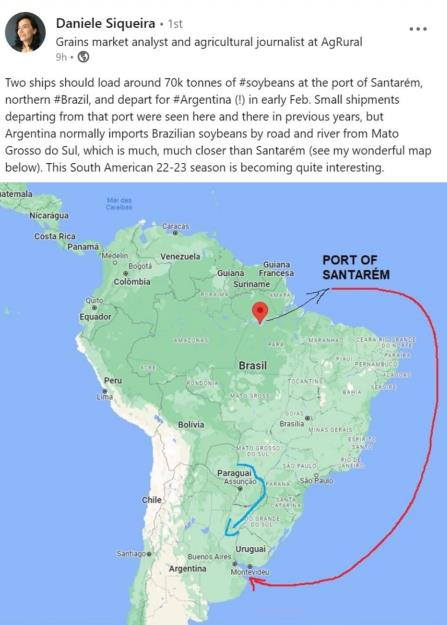

An interesting development took place last week as the above story from the Buenos Aires Herald details.

To simplify the story, it went something like this:

Brazilian soybean merchant: “Hey Argentine soybean processor! Look over here! Your farmer won’t sell you any soybeans but my farmer will. And it looks like your crop is getting smaller every day that goes by with your terrible drought and your farmers are probably getting ready to leverage you and the government and the central bank again in the coming months and you will not be able to operate your assets, and, well, we have all these soybeans in Brazil and can’t store them so how about you buy some”?

Argentina soybean processor: “Let me think about that for a minute. Wait a second. That is a great idea.”

“My farmer won’t sell me soybeans, he continues to leverage his position of supply strength, I can’t operate my facilities, the government cannot earn any tax revenue from soybean crushing activities, and the Brazilians have a huge crop! I am going to buy those Brazilian soybeans and solve ALL these problems.”

And, as Daniele Siqueira points out, those Brazilian soybeans will take quite the journey.

What if the Brazilian soybean merchant just keeps going?

Brazilian soybean merchant: “Hey Argentina! Want some more?”

And again.

Brazilian soybean merchant: “Hey Argentina! Want some more?”

And maybe with time Argentine farmers look around and think to themselves, “maybe I cannot leverage the government again this year, maybe I need to sell my soybeans.”

And the Argentine soybean processor calls the Brazilian soybean merchant and says, “thanks I have enough soybeans, my farmer is finally starting to sell some.”

So the Brazilian soybean merchant just keeps going but this time says this:

Brazilian soybean merchant: “Hey US soybean processor! Look over here! Your farmer won’t sell you any soybeans but my farmer will…”

The next page features the USDA’s global soybean supply and demand table. Look at the bottom, the calculation of ending stocks that shows enormous supplies of Brazilian soybeans forecasted to be held over into next year. My story of the Brazilian merchant above suggests those stocks may not be there but enroute to other places in the world…and this is the “beginning” of a major global impact from the Saudi Arabia of soybeans to soy processing assets around the world, INCLUDING THE US. Hello to the EPA, the RD industry, and the US soybean processing industry with assets on the water that can handle imported soybeans (hint: see Cargill’s recently announced acquisition of Owensboro Grain, Owensboro, Kentucky and its greenfield development in Caruthersville, Missouri). And hello to the US farmer.