Insight Focus

- Brazilian beef and chicken exports established a new record for Jan-Aug; revenue also up.

- Exports limit the impact of weak domestic consumption, which is headed to a further fall in 2022.

- Pressured by fewer purchases from China, weakening pork exports have weighed on prices and soybean meal use.

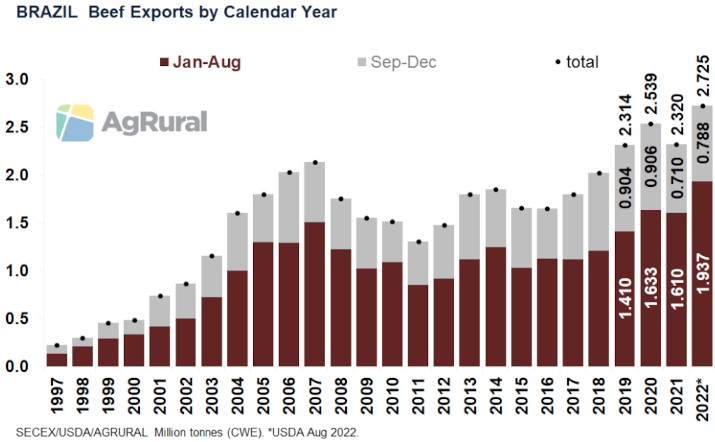

New monthly data released last week by Brazil’s customs proved, once again, that 2022 has been a very good year for the country’s meat exports. From January to August, Brazilian ports shipped 1.937m tonnes (carcass weight equivalent – CWE) of beef, a volume 20% higher than that exported in last year’s first eight months and a new record for the period. The expectation is that beef exports will end 2022 at 2.725m tonnes ,with a 17% annual increase and a new all-time high.

China remains at the top of the list of Brazil’s beef main destinations, with a 59% share of total exports from January to July (data by country are not available for August yet) and a 25% increase over the same period last year. Egypt follows at a distance as the number-two importer, with 6% of Brazilian shipments (but with an annual growth of 176%). The third buyer is the US, with 5% of the total volume and growth of 130% over the same period in 2021.

Brazil is the world’s main beef exporter, with a share of 20%, followed by the USA (14%) and India (12%), according to USDA’s data for 2021.

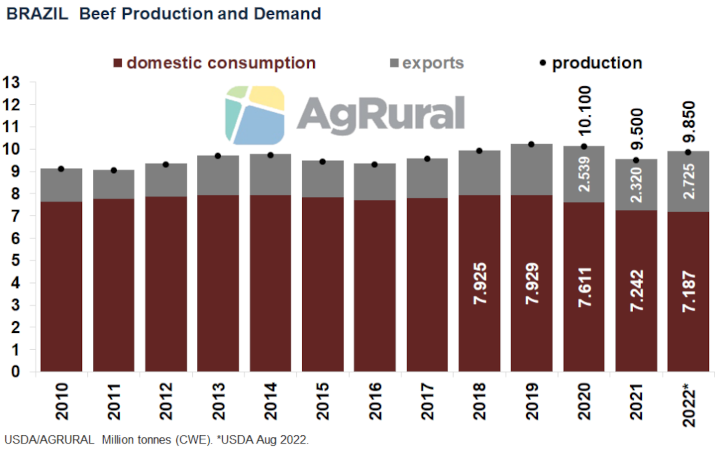

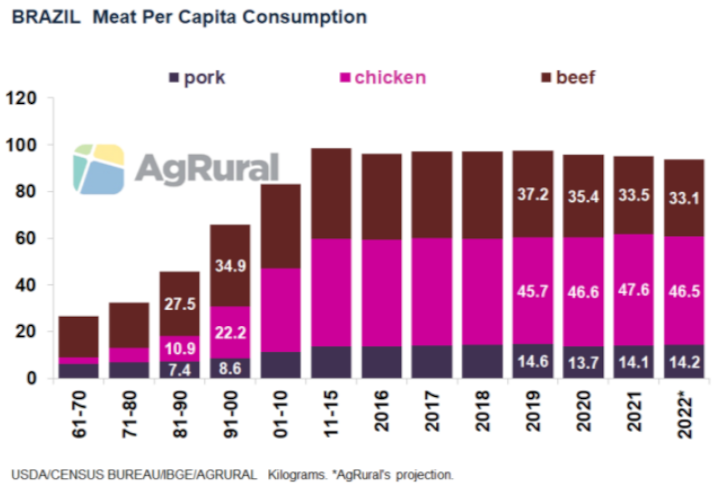

Too Expensive for Brazilians

Even more important than the increase in volume is the growth in revenue. From January to August 2022, Brazilian beef exports totaled USD7.9b, 46% up from USD5.4b in the same period a year ago. Higher international prices are more than welcome by producers now in 2022, a year that will be the third in a row marked by falling domestic demand in Brazil, as a result of the economic impacts of Covid-19 on the population income. Last year, per capita consumption of beef in Brazil fell to its lowest level since the 1980s, and it is expected to decline further in 2022.

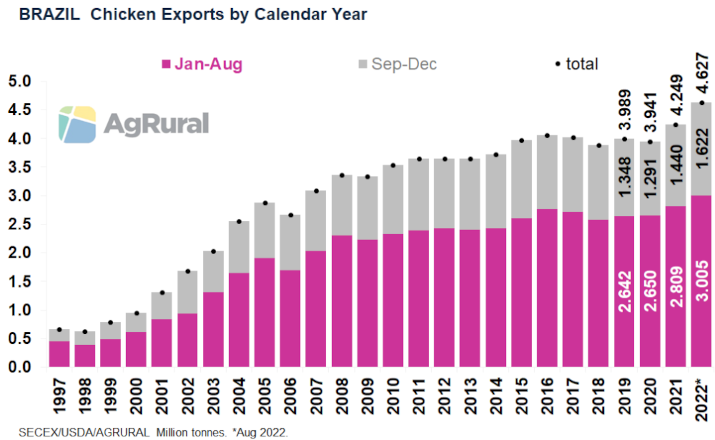

New Records Also for Chicken

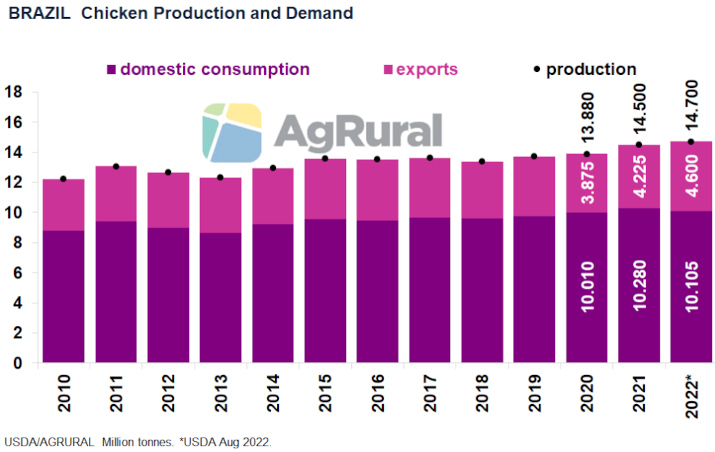

Brazilian chicken exports are also experiencing a very good year. From January to August, shipments totaled 3.005m tonnes, 7% up from the same period last year and also a new all-time high. Revenue reached USD6b, with an annual increase of 35%. China was the main buyer, representing 13% of the volume shipped from January to July, but with an annual decline of 12%.

Number-two and three importers were the United Arab Emirates, with 11% of the total, but an increase of 56% compared to the same period last year, and Japan, with a share of 9% and imported volume 1% higher than in the first seven months of 2021. The expectation is that chicken exports will end 2022 at 4.627m tonnes, 9% more than the record made last year.

Despite being more affordable than beef, chicken is also expected to see a drop in Brazil’s domestic consumption in 2022. Higher exports, however, more than offset the decline and absorb the increase in production. In 2021, Brazil was the world’s top chicken exporter, accounting for 32% of total exports and followed by the USA (25%) and the European Union (14%).

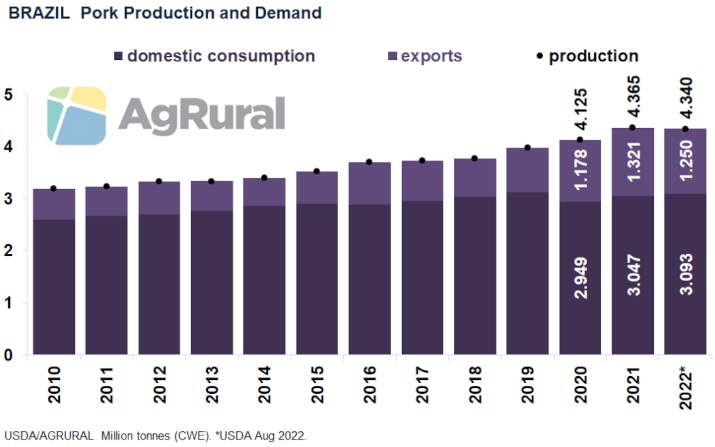

Pork Loses Steam

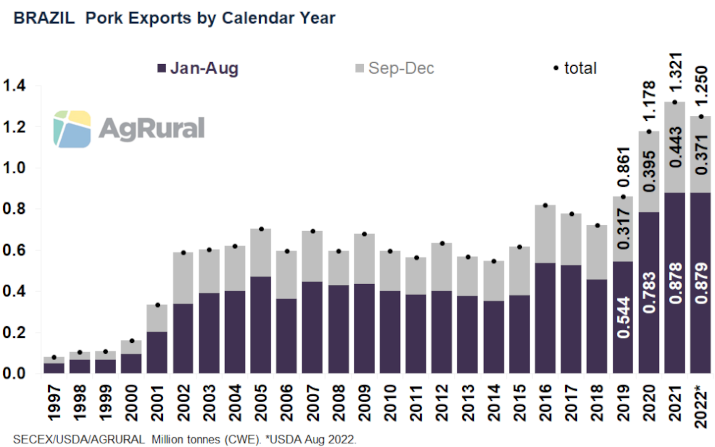

On the other hand, pork, which had a drop in prices due to increased production and lower-than-expected exports, should have a slight growth in domestic consumption now in 2022, but the estimated increase doesn’t quite compensate for the expected reduction in exports. From January to August, Brazil shipped 879k tonnes, in line with the same period last year. But revenue fell 11% from the first eight months of 2021, to USD 1.5b.

Brazilian pork exports in 2022 are seen at 1.250m tonnes (carcass weight equivalent – CWE), 5% down from the record of 1.321m shipped in 2021, when the country was the world’s number-four exporter, with a share of 11%, behind the European Union (41%), the USA (26%) and Canada (12%).

China Buying Less

What has weighed on Brazilian pork exports is the decline in Chinese purchases. From January to July, they fell 38% from the same period last year. Even so, China remains at the top of the list of importers, with a share of 38%. In the first seven months of 2021, when the Chinese were still importing larger volumes to compensate for smaller local production caused by the African Swine Fever, China was the destination of 57% of Brazilian pork exports.

Encouraged by the increase in China’s demand, whose pork purchases jumped from 28% of Brazilian total exports in 2018 to 38% in 2019 and 55% in 2020, Brazilian producers invested heavily in expanding capacity. The resumption of Chinese local production, however, was faster than expected and, in the face of rising production costs and falling prices, Brazilians have suffered losses. As a result, the expectation is that 2022 will end with a small decline in Brazil’s pork production.

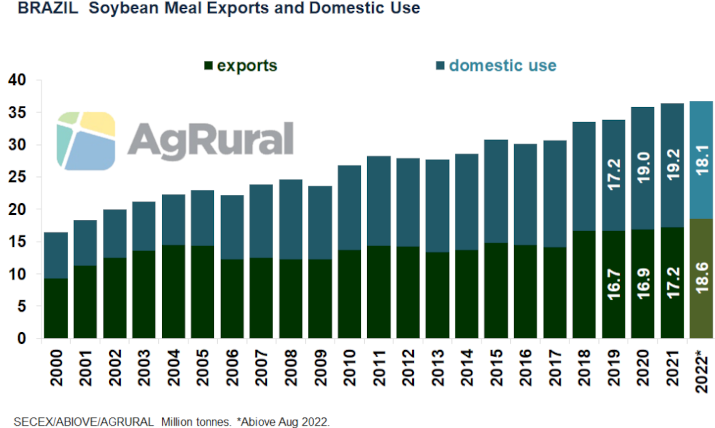

Soybean Meal: Lower Domestic Use, Record Exports

With pork and other meat producers trying to reduce costs, and with the increasing use of DDGs in the feed sector, Brazil’s soybean meal domestic use has also lost steam now in 2022. According to Abiove (Brazilian Association of Vegetable Oil Industries), domestic demand for the by-product is likely to fall by 1.1m tonnes this year, to 18.1m.

But the drop in local use hasn’t been felt by the soybean crushing sector, as meal exports have been strong since the beginning of the year. Shipments from January to August totaled 14.2m tonnes, 22% up from the same period in 2021 and a new record. The year is expected to end with 18.6m tonnes exported, 8% up from 2021.

Dashboards that may be of interest…