This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Higher domestic refined sugar prices forecast.

- Up to 40% of 2023-24 beet sugar production may have already been sold.

- Buyers interested in booking early 2023/24.

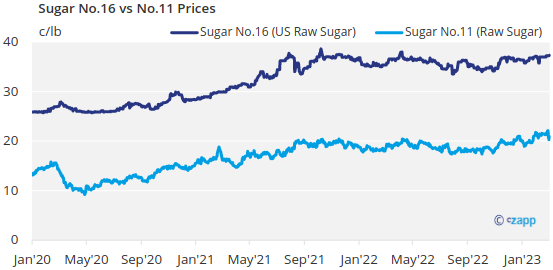

Speakers at the International Sweetener Colloquium in La Quinta, Calif., Feb. 26 to March 1 forecast firm to higher domestic refined sugar prices for 2023-24 (beginning Oct. 1). Meetings on the sidelines of the event were active, and sugar was being booked or talks occurred that would result in bookings in the next few weeks.

Offers prior to the Colloquium for 2023-24 were at 52½¢ a lb f.o.b. Midwest for beet sugar, in the 54¢ to 55¢ a lb f.o.b. range for refined cane sugar in the Southeast and around 53¢ to 54¢ a lb f.o.b. in the Gulf. Those prices did not change, but ideas were values would hold firm or even move higher as the year progresses.

Most business for the October-December 2023 quarter of 2023-24 was previously completed. Traders focused on January-October or calendar October at the Colloquium. There were mixed views about how much contracting was completed on the sidelines of the meetings and how much will be finished in a few weeks. Ideas were contracts were being inked. Prior to the meeting, some estimated as much as 40% of potential 2023-24 beet sugar production had been sold. Estimates were that numbers would jump to more than 80% a few weeks after the Colloquium as speakers gave minimal hope that prices would decline as the year progresses.

Many buyers indicated an interest in booking early for 2023-24. Most speakers also suggested buyers should lock in supply rather than wait and risk paying higher prices on the spot market. One speaker indicated there wasn’t necessarily a rush to buy sugar “today,” but he also thought prices would trend higher.

Spot activity was limited; prices were steady. Buyers were watching reports of a slowdown in buyers’ draw of contracted sugar indicated by some beet processors to see if that could result in new supply available on the spot market.

Sugar users continued to stress that the market didn’t “feel” like the 14.8% ending stocks-to-use ratio estimated in the February USDA World Agricultural Supply and Demand Estimates report, which would indicate adequate supplies. Speakers at the Colloquium said supplies of raw sugar were adequate, but refined sugar of adequate specifications were lacking for food and beverage manufacturers. Most expect that tightness will be at least partially offset by larger high-duty imports as was the case last year, although it was raw sugar, not refined, that mostly was imported with high duties last year.

Barb Fecso, branch chief, commodity analysis, Farm Production and Conservation Business Center, US Department of Agriculture, said it was unlikely the USDA would recommend a tariff-rate increase for refined sugar because the quota likely would be filled by organic sugar of which additional supplies were not needed.