Opinions Focus

- For the time being, it seems Malaysian palm oil output has peaked.

- Argentine soybean oil output is stagnant too.

- As US Renewable Diesel demand keeps growing, where will the world source more vegoils?

A major transition is underway in global vegetable oil production and consumption and the outcomes of the changes underway will determine if the US renewable diesel industry (RD) achieves its expansionary ambitions, if the US soybean processing can grow to meet the feedstock demands from the US RD industry, if Indonesia can blend palm oil into its domestic fuel oil supply at even higher ratios, and if two of the world’s legacy producers, now stagnant, can return to growth mode to allow the world to consume vegetable oils at a reasonable price.

Per multiple prior posts (some of you may say too many posts) I continue to circle back to the production issues for these two major, legacy vegetable oil suppliers to the world: Malaysia for palm and Argentina for soy. If recent production trends continue, each country has apparently peaked in production and will remain question marks for their roles meeting demand from an expanding global population as well supporting the ambitions of the global biofuel industries.

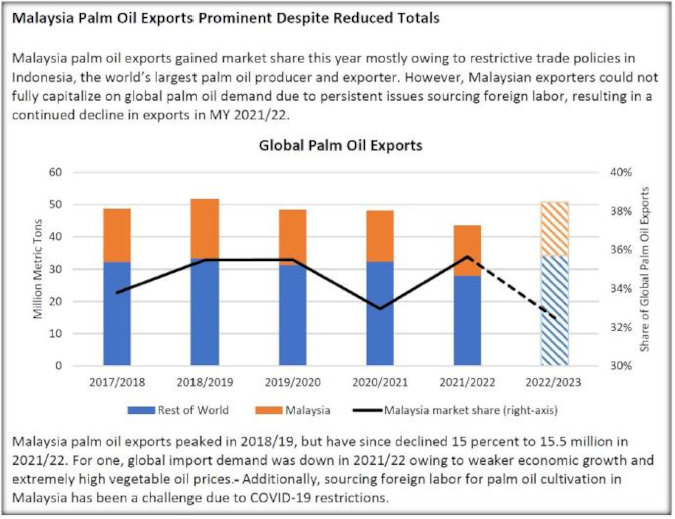

USDA economists, in the November 2022 Oilseeds: World Markets and Trade, highlight Malaysia’s recent inability to expand exports beyond filling in for Indonesia due its short export embargo; the economists forecast a decline in Malaysia’s participation in global palm oil trade to a new five year low in the coming year. See their summary thoughts below.

These are the 2 points to focus on from this USDA snapshot that speak to the production issue:

- Malaysian exports to the world peaked in 2018/19

- Malaysia faces “persistent issues sourcing foreign labor”

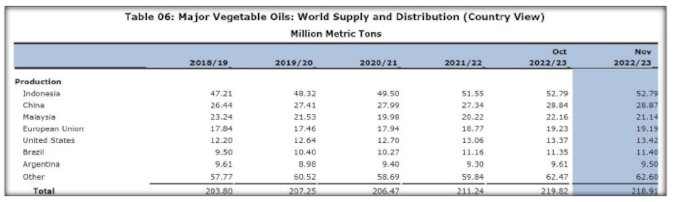

See USDA’s November 2022 forecast for Malaysian palm oil production (table below); take a look as well at Argentina’s soybean oil production; conclusion: these are the two countries NOT growing while all the other named countries plus the rest of the world (the Other category) grow.

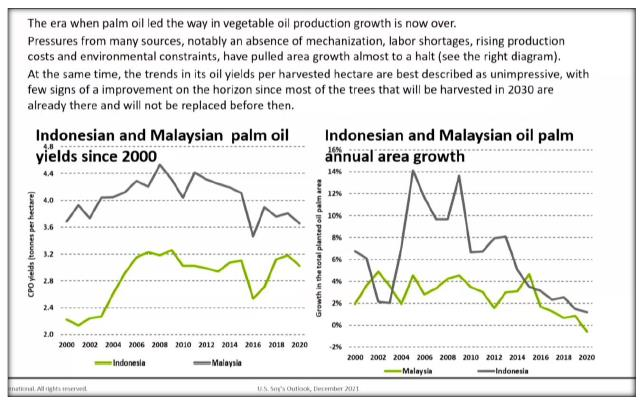

The big three in global palm oil supply and demand analysis (analysts who can change global market prices with their forecasts) are: Thomas Mielke from the Oil World publication, James Fry of LMC International, and palm oil price whisperer Dorab Mistry of Godrej International. Amongst the three, the analyst in my opinion who has been pounding the desk and shouting “PAY ATTENTION! “Peak” palm has occurred!” is James Fry. I have featured this slide from his presentation to the US soybean export council on December 9, 2021, in other posts:

Here is the video for your review should you want to watch it: https://ussec.org/u-s-soys-outlook-production-crush-exports/

And a link to a summary of the presentation: https://ussec.org/analyst-the-world-needs-more-soybean-oil/

If you do have time to watch the video or read the presentation, here are the salient points:

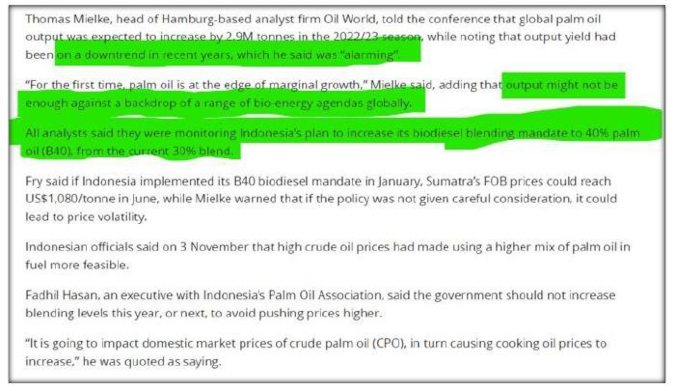

Fast forward from James Fry’s presentation a year ago to the start of this month when the big 3 gathered to address the 18th annual Indonesia Palm Oil Conference.

When an analyst like Thomas Mielke talks about a key global food item, palm oil, arguably the key global food item, having an “alarming” downtrend, it should cause reasonable people to shift nervously in their chairs. When the writer of the article goes on to assert that all 3 analysts are monitoring Indonesia’s increase in palm oil blend to diesel, those of us in the oilseed business might want to do that too.

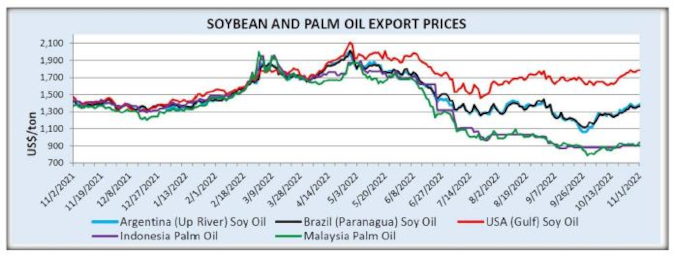

I have featured this chart below each month after the USDA publishes it because it puts perspective on US RD policy’s impact on the price of US soybean oil relative to the other major global vegetable oils. The US renewable diesel industry locomotive is hitched to the global palm industry wagon which is hitched to the global soybean processing industry wagon. To complete the analogy, the RD locomotive is pulling hard but the train’s brakeman forgot to release the Malaysian brake on the palm oil wagon and the Argentine brake on the soybean oil wagon so something must give. How long and how far the locomotive of US policy can move down the tracks without derailing depends in large part on those two brakes getting released via a return to growth for both countries.

In case you think all these global biofuel developments are not causing vegetable oil supply anxiety for certain importers, maybe the below Reuter’s story might convince you of the magnitude of this transition.