Opinions Focus

- American soybean processing continues to expand.

- Cargill is active in the space.

- Their main mission seems to be food first, then renewable diesel.

And the beat goes on…another major US soybean processing industry deal gets announced. Be sure to read the important punch line at the end of this post…the “deal” drives home the bigger purpose for the US soybean processing capacity expansion.

Today the US soybean processing industry received an acquisition announcement today as opposed to an expansion announcement.

What makes this acquisition interesting is this announcement not that long ago on May 17, 2022:

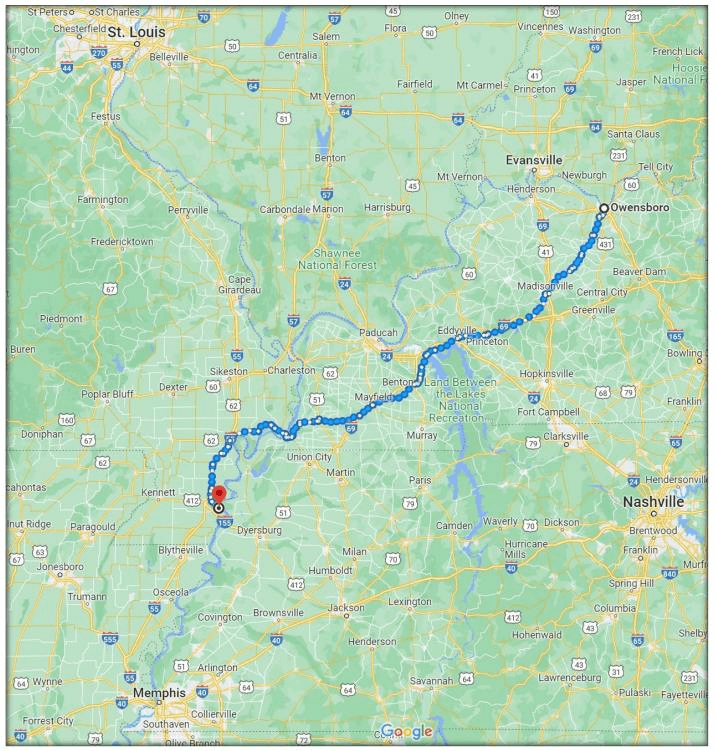

Now, one could have reasonably viewed Cargill’s new Caruthersville, Missouri facility as a potential competitor to Owensboro Grain’s facility at Owensboro, Kentucky. Why? The two companies would likely have competed for local meal demand from the poultry and swine industries but more importantly barges of Owensboro meal would have floated past Cargill’s new facility once it was up and running and head to a common destination: New Orleans, for export to the world. So for sure competitive tension between the two facilities for soybean meal markets. Maybe “some” soybean origination overlaps but the major origination sources would have been more particular to each facility, Kentucky and southern Indiana for Owensboro; Missouri and western Tennessee for Cargill at Caruthersville. Everybody in the US renewable diesel industry (RD) needs the soybean oil so zero battling for soybean oil market share. In sum, the Caruthersville facility would have challenged the Owensboro facility and crimped margins to some degree.

So, if you are Cargill senior management, why not let another company buy Owensboro and then compete directly against it using your MUCH larger, state of the art Caruthersville facility? It could be this: Cargill also re-entered the US poultry industry this year along with my old employer Continental Grain and maybe there are plans for expanding poultry capacity in areas near to both plants. Or maybe Cargill has concluded that the Argentine soy processing industry is dead in the water and US soybean meal “river” capacity is a “must have” to stem export replacement for Argentine production (my bet). That coming mountain of US soybean meal that bothers so many analysts; is Cargill concerned? My bet is they are not.

At the end of the day, I can only guess at Cargill’s strategy but one thing is for certain: press release word order is always intentional and the announcement of the Owensboro acquisition is very telling:

“The addition of Owensboro Grain Company enhances Cargill’s efforts to modernize and increase capacity across its North American oilseeds network to support growing demand for oilseeds driven by food, feed and renewable fuel markets.”

Note that very important order of the reasoning for the purchase:

1. Food

2. Feed

3. Renewable Fuel

Ultimately the expansion of the US soybean processing industry primarily benefits the global purchaser of vegetable protein meals who uses them to produce meat proteins for human consumption. Food is first and feed is second in Cargill’s announcement. Expansion of the US soybean processing industry to meet the needs of the renewable diesel industry (RD) is third and a side benefit to the primary purpose and mission for developing the US industry: feed the world primarily, feed the fuel tank secondarily.