- Commodity price inflation is front-page news, which might mean a correction is imminent.

- Longer term, higher commodity prices may lead to more investment into production after a decade of neglect.

- Rising interest rates could make commodity financing harder to secure and manage.

Yellen: Rate Increase Ahead…Maybe…Maybe Not

- Last Tuesday, the US Treasury Secretary, Janet Yellen, hinted that rising prices might lead to an increase in interest rates.

- This was the first time a major American official has mentioned raising interest rates since COVID began.

- Many other commodity countries around the world have already been increasing interest rates.

- Even more bizarrely, just hours after hinting at rate rises, Janet Yellen backtracked.

- There’s a strong chance the messy communications we’ve seen in the past week continue, with implications for the commodity markets, including sugar.

Biden: No Easy Decisions

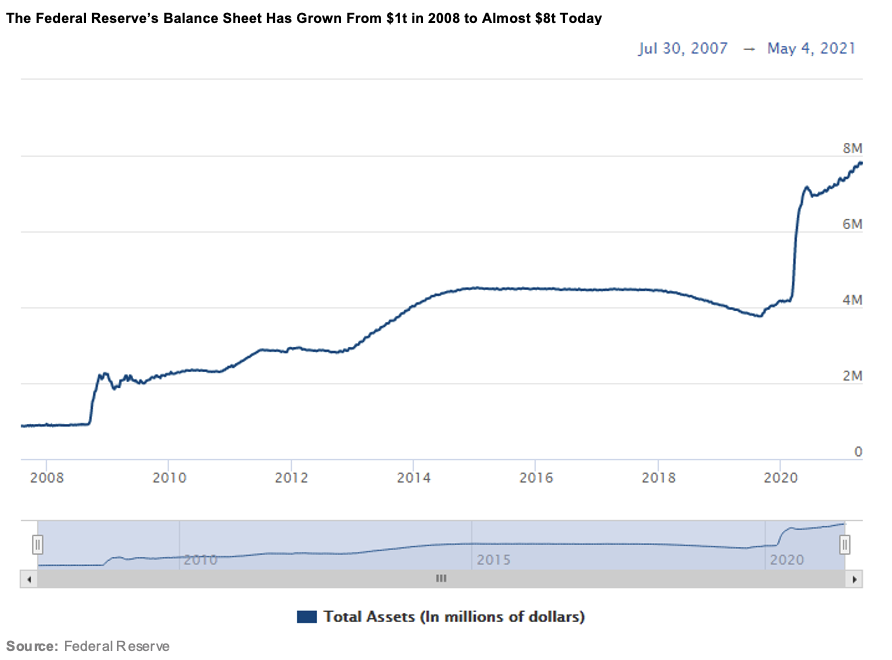

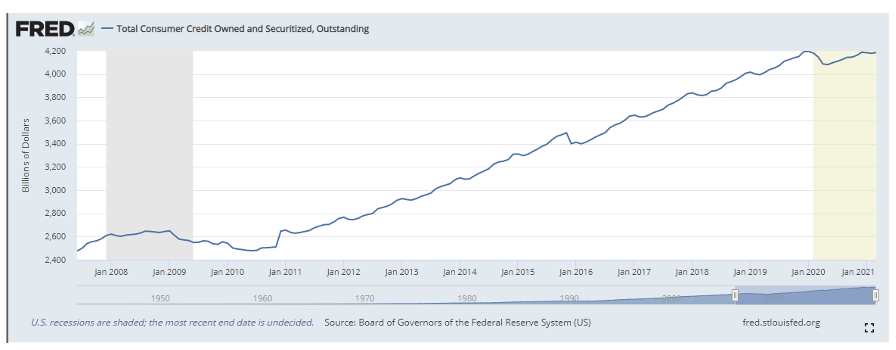

- The American government wants continued economic growth and one of the tools they’ve used repeatedly since the 2008 crisis has been financial stimulus.

- This process reached new extremes during the COVID crisis; the Government went as far as deferring taxes and giving cash handouts/stimulus cheques.

- A further tool used by the Federal Reserve to ensure continued stimulus is low interest rates.

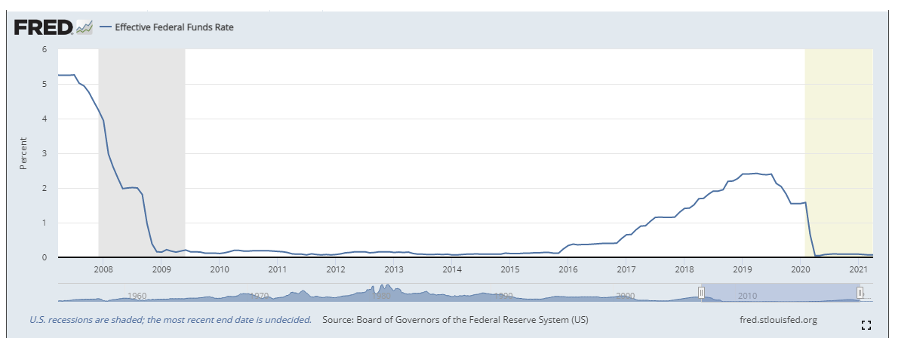

- However, another remit of the Federal Reserve is to control inflation and the traditional way to do this is to raise interest rates.

- The authorities have difficult decisions to make – holding rates low may risk strong inflation, which ultimately hurts consumers.

- Some of the world’s largest companies have already said they’ll need to increase prices in the future to pass costs through to the consumer.

- But raising rates increases the cost of money, reducing access to credit.

- This puts pressure on consumers seeking to refinance mortgages or those with other forms of debt.

- It also risks ruining a stock market boom fuelled in part by access to cheap capital, hence the mixed messages of the last week.

Short Term Impact on Commodity Markets: Correction Ahead?

- The message from the Federal Reserve itself has been that any inflation will likely be transitory.

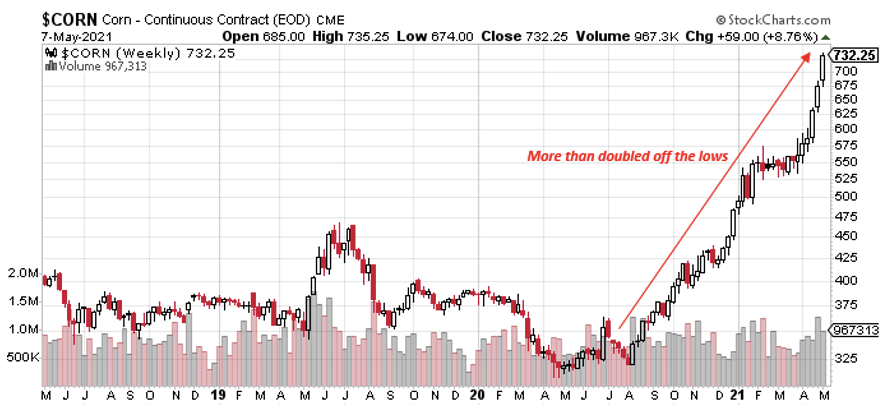

- This sounds ridiculous if you glance at the corn or lumber markets (it turns out money does grow on trees if you own a chainsaw).

- But in the short term, the Federal Reserve is probably correct; global commodity markets are starting to look over-extended.

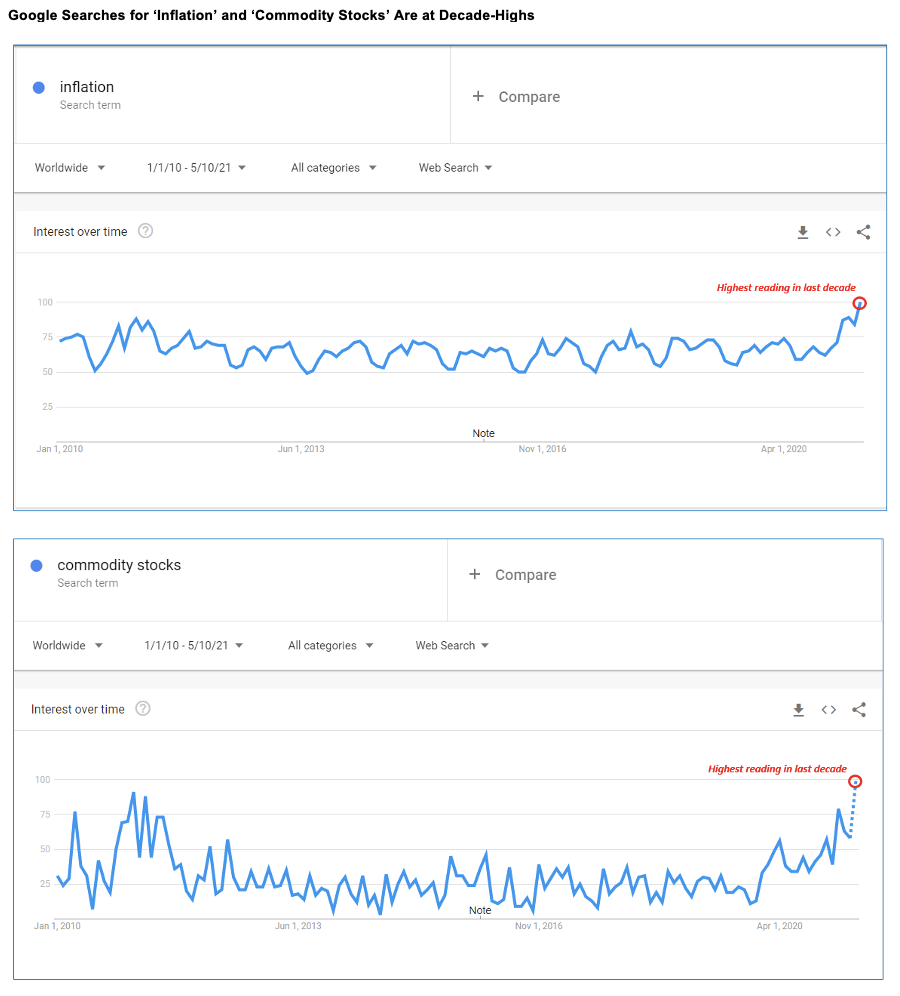

- For a start, there’s now widespread media attention on inflation.

- Investors and the public are aware too.

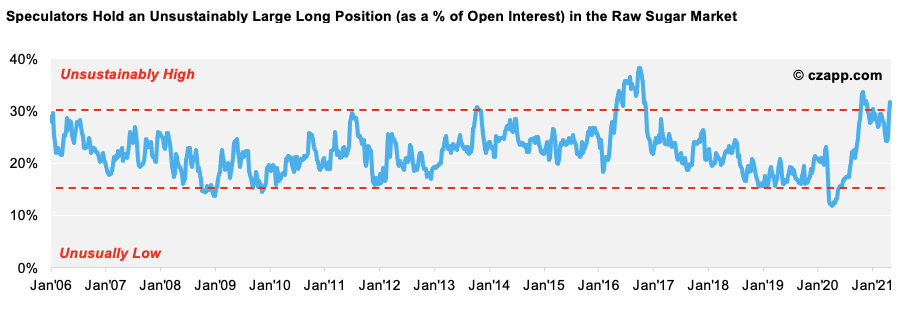

- Speculators are heavily long many commodity markets: in sugar’s case, unsustainably long.

- It’s possibly time for a correction lower.

Long Term Impact on Commodity Markets: Infrastructure Boom

- The classic policymaker response to a crisis is to invest in infrastructure.

- The 1929-1933 depression in the USA was followed by Roosevelt’s huge infrastructure spending plans, The New Deal, building the Lincoln Tunnel and LaGuardia Airport among other projects.

- After the 1939-1945 war, Europe was rebuilt through vast infrastructure building, supported by the USA and the Marshall Plan.

- For COVID it will be the same – the Biden administration has already outlined a $2t eight-year plan to improve infrastructure and move to greener energy.

- This could be positive in the longer term for many commodities.

- As well as encouraging greater mobility and prosperity, governments around the world will probably try to do so in a low or zero carbon fashion.

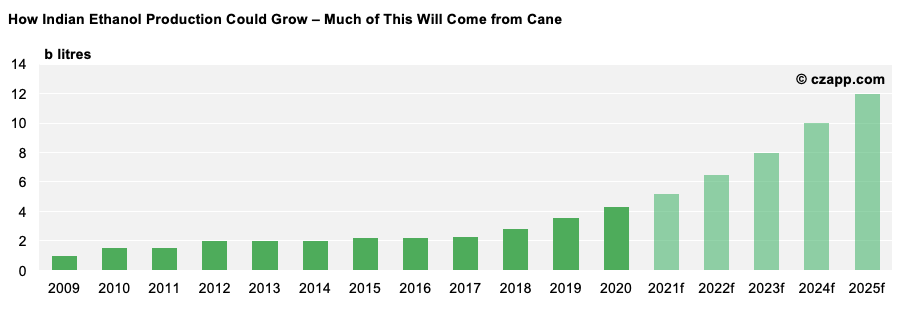

- This is where sugar, as an energy crop, could benefit; for example, look at the Indian government’s ambition to move to E20 by 2025.

- We’re also positive on sugar prices because none of the world’s top ten sugar producers are increasing output, while demand for sucrose is still growing.

- This will all have a profound impact on commodity businesses.

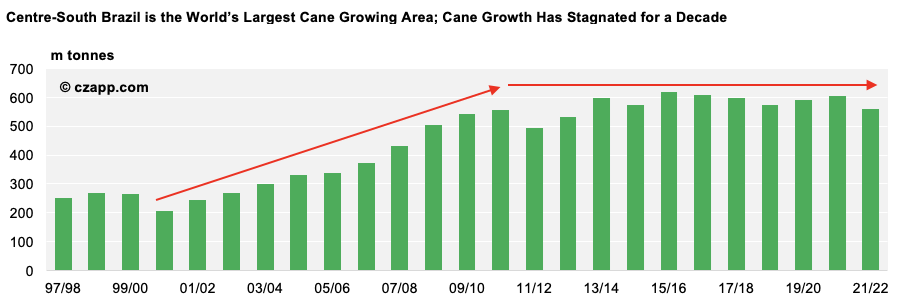

- Higher prices could lead to fresh investment in production capacity – for example, new cane acreage in CS Brazil in the sugar world.

- But higher interest rates could mean alternative financing arrangements could become increasingly important for the industry, especially given the recent withdrawal of many major banks from the commodity finance sector.

- Carrying stock in a high flat price and high interest rate environment could be a challenge for many commodity businesses.

- In short, managing supply chains effectively could be increasingly difficult in the future for commodity producers, traders and end-users alike.

Explainers You Might Be Interested In…