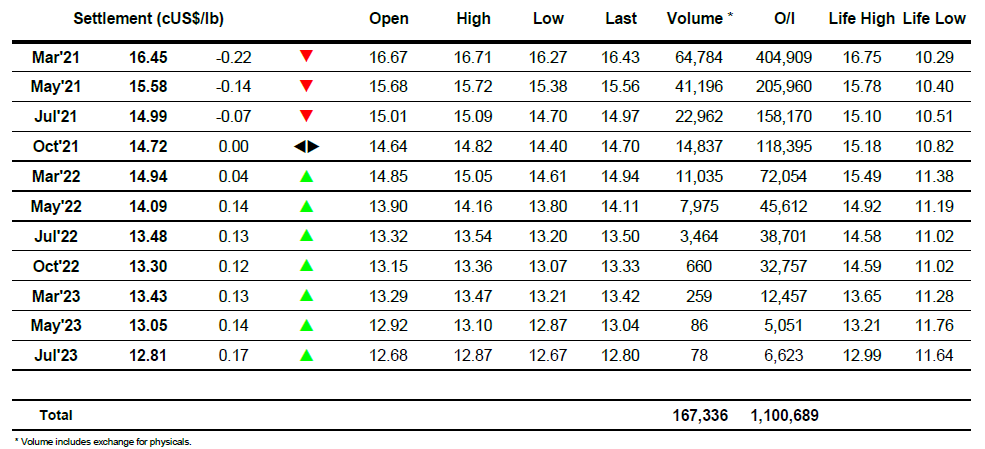

Sugar #11 Mar ’21

The day began with nearby values briefly printing higher however selling quickly emerged to send the March’21 contract shooting down through a relative vacuum to reach 16.34. Following on from such a strong performance yesterday it was not surprising to see some defensive buying creep back in to the market soon afterwards and this led to a morning of quiet consolidation which in itself was positive against a backdrop of a broadly lower macro picture. Such was the scale of yesterdays action that the technical picture has moved back towards overbought while we also printed through the upper Bollinger band, factors which seemed to be encouraging overhead selling that kept things in check as we moved quietly through the afternoon. Increasingly it was the spreads that were dictating the direction as strong March/May’21 selling sent the differential back to 0.83 points and in so doing ensured the March’21 itself struggled to pull back away from the lower part of the range. The same was not true of the middle and forward positions which were holding up better despite being the areas that have been of greater focus to producer pricing, and late in the afternoon these were only showing marginal losses, with May’22 standing out and registering the smallest of net gains. The final stages saw some supportive buying from longs push March’21 back into the 16.40’s, concluding a strong weekly performance and sending the market into its 3 day weekend away from session lows.

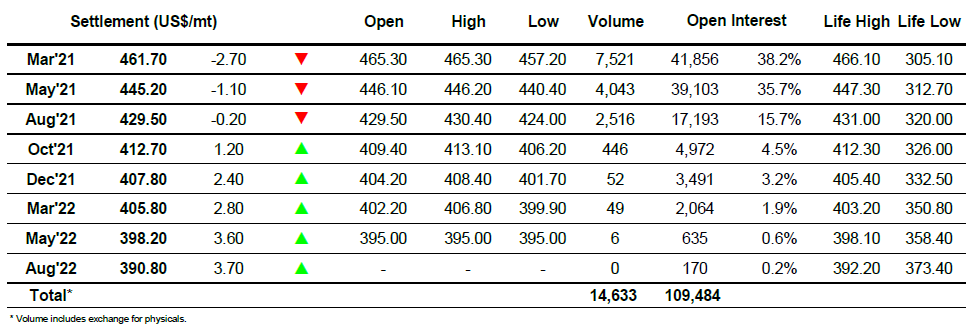

Sugar #5 Mar ’21

The surge to new contract highs yesterday naturally encouraged some selling to the market which caused March’21 to spike downwards on the opening to $457.80, though the lack of any resting buying was a contributory factor in the size of the move. With the scale of technical strength afforded by the recent moves some defensive buying began to creep back in and pull prices back upwards over the course of the morning, though prices were never able to match the opening highs while net losses for nearby spreads were also making progress a little more challenging. As the afternoon progressed we saw some continuing volatility within the range with attempts to move back towards yesterdays highs continuing to falter as nearby spreads turned further back, March/May’21 coming down to $15.80aand March/Aug’21 to $32. White premium values meanwhile firmed a little due to the No.11 coming under additional pressure with March/March’21 spiking above $100 before moving back into the high $90’s and May/May’21 doing the same with some short-lived trades out to $105 though it settled back around the $101 area later in the afternoon. Outright values continued to see out an inside day within the established range, the only excitement being a closing push up which limited the days net losses with March’21 settlement established at $461.70.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract