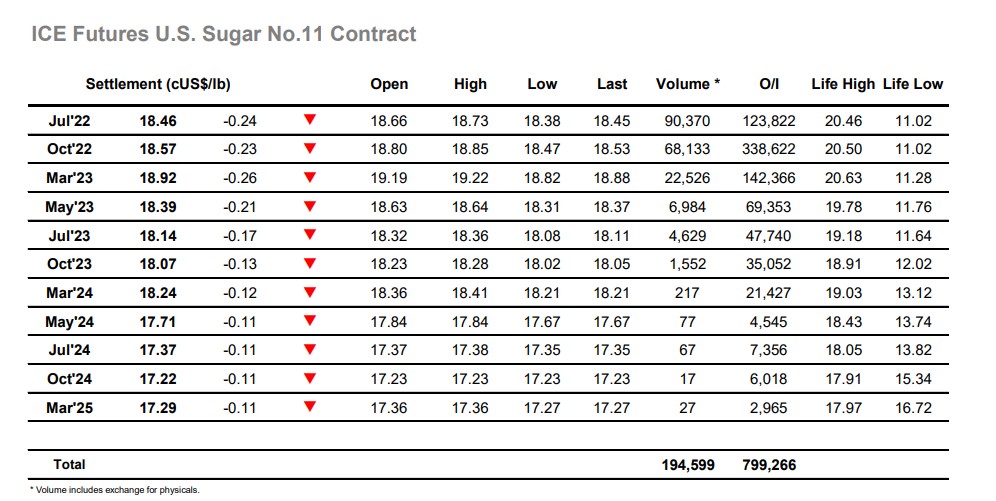

There was a distinct lack of enthusiasm for the market this morning as Oct’22 quickly settled into a narrow trading band, holding largely in the lower 18.70’s throughout a slow morning. The market appeared to be at a point of stalemate with some solid consumer scale buying holding prices in place despite the continuing heavy environment, and the early afternoon brought no change to this scenario with the specs remaining inactive. Gradually that situation began to change as the failure to show any upside interest drew some more liquidation from the specs, and steadily the price worked down into the consumer pricing to test the underlying support. Ove the final few hours Oct’22 declined as far as 18.47 to put it within 2 points of last month’s low mark, though maybe crucially the efforts from seller on the close/post-close could not yield a break of this level. Spreads were reasonably robust despite the nearby weakness with Jul/Oct’22 steady either side of -0.10 points, while Oct’22/March’23 ended the day at -0.35 having reached -0.40 intra-day. This will give some encouragement to any longs heading into tomorrow, as will the fact that Oct’22 settlement at 18.57 was away from the lows. Further support testing seems likely for tomorrow and may well determine the direction of the next 50 points dependant upon whether it can hold.