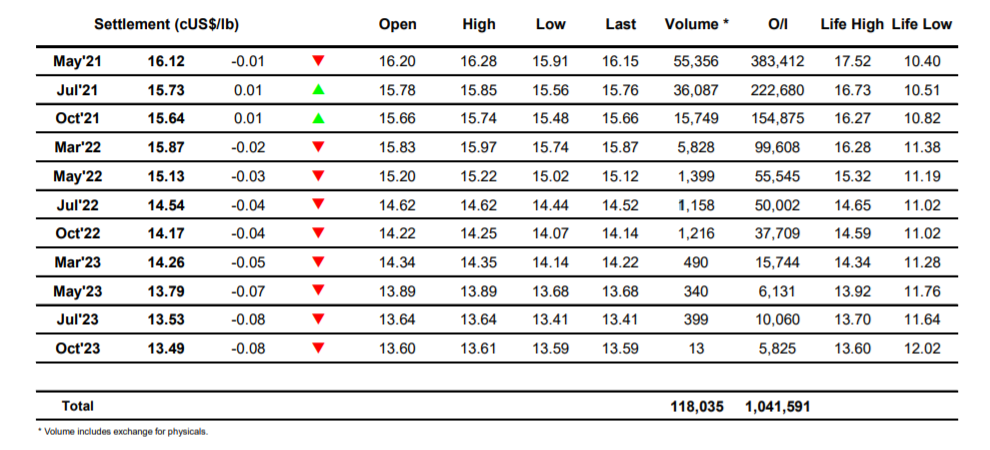

Sugar #11 May’21

The new week commenced with values still caught in the same familiar trading band as we saw May’21 holding very slight gains through the early stages on extremely low volume. Friday’s COT report showed that the net fund long had reduced to 200,673 lots which may be a sign that a few of the funds are starting to become a little disillusioned with the upside potential of the market during the short to medium term, but despite this we did attract a burst of buying which sent the price upward to 16.28 later in the morning. With no follow-on buying coming through we soon began to slip back from the highs and the arrival of US traders increased the pressure with a push down towards 16c where we could again test the underlying support. Further outright selling followed and we saw the front month down to 15.91, and move that was aided by spread selling of May/Jul’21 into 0.34 points, but while there was some volume behind the initial push it soon petered out and yet again we made an about turn and returned to the range. The recovery brought spread values back to unchanged levels with the front month attracting most of the buying and we remained within the confines of the earlier established range throughout the latter stages, settling at 16.12 for May’21 following final round of position squaring from specs/day traders.

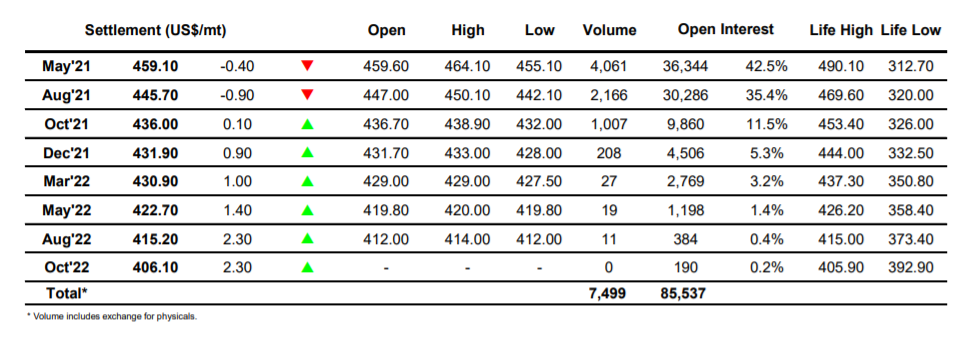

Sugar #5 May’21

The week got underway on a positive footing with light but steady buying across the first couple of hours seeing May’21 rally as far as $464.10. Brief efforts were then made to consolidate at the higher levels but it was not long before prices fell away from this area and with so few resting orders in place the price was quickly back at overnight levels. From here downward there was some slightly better buying in place though that did not prevent prices from continuing lower with sellers probing midway through the afternoon and sending May’21 to a low at $455.10. Remaining comfortably above the $452.20 recent low mark we saw some short covering take place which pulled prices back unchanged once again and it started to become apparent that we would continue within the range which has held throughout this month for at least one more day. Some buying did appear for the closing stages and this ensured that nearby values ended the session only marginally lower, bringing another slow day to a conclusion.

White premiums continue to be quiet within their recent trading ranges, ending today at $103.75 for May/May’21, $99.00 for Aug/Jul’21 and at $91.25 for the Oct/Oct’21.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract