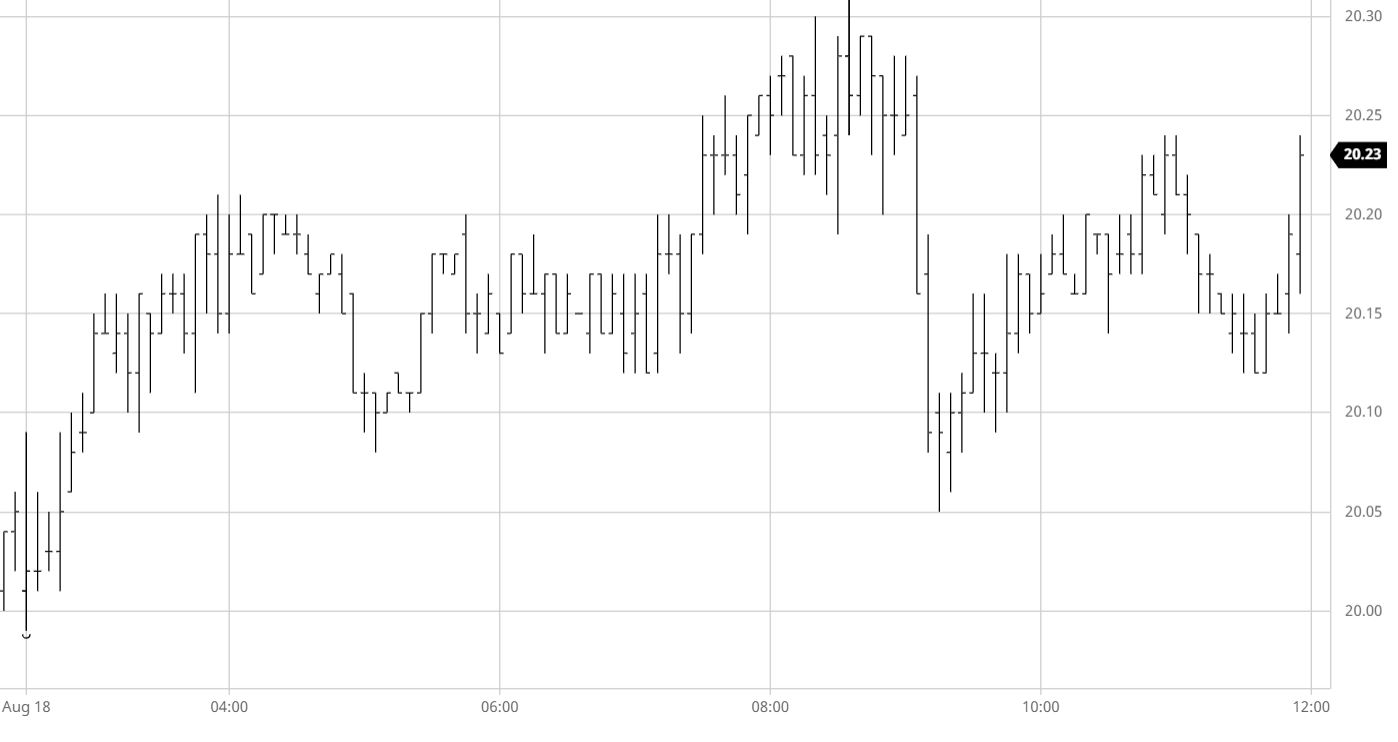

Sugar #11 Oct’21

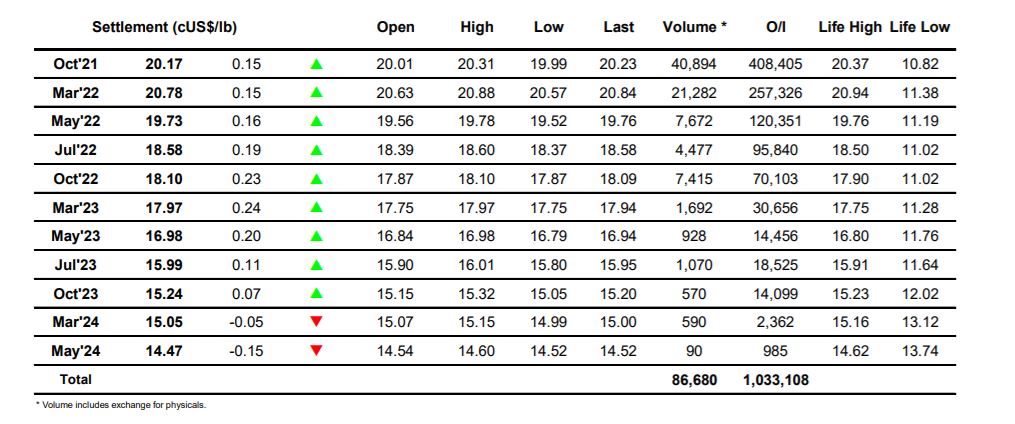

A morning of continuing positivity kicked off with a steady climb to the 20.20 area for Oct’21 with the gains then maintained on calm volume. Despite there being less drive from the specs in the last couple of days with many of the smaller traders now anticipated to be loaded up on the long side, there continues to be some steady underlying support and it was this that held prices sideways through into the US day though the continuing absence of any significant producer selling is also playing its part. During the early part of the afternoon there was a little more effort to extend the upside though the move fell short of yesterday’s 20.37 high and led to a small dip against long liquidation soon afterwards. This dip was picked up in front of unchanged levels and on quiet volume we edged around back in the centre of the range once again, temporarily struggling to find much direction. Spreads too were calmer over the day and though the higher levels saw a small recovery for the Oct’21 and March’22 spreads it was merely bringing back the losses incurred late yesterday. The final couple of hours saw prices see-saw within the range before pushing to a mildly higher 20.17 settlement level. This left us with an inside day which will do little in itself to cool the overbought situation, whether it is merely a cooling or a sign that we may see some corrective action remains to be seen.

Sugar #5 Oct’21

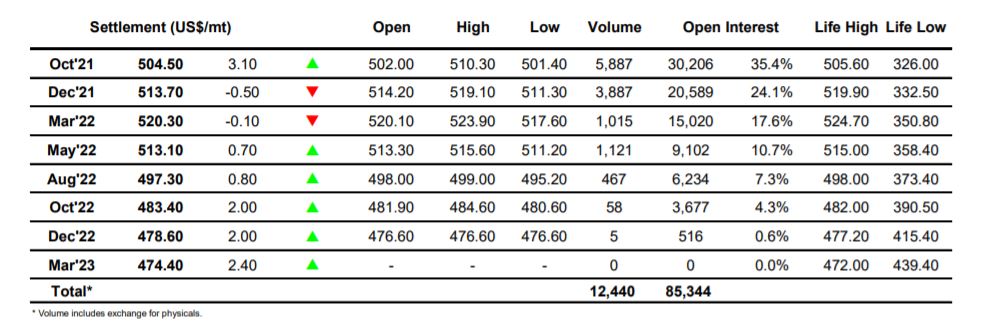

Buying was against prevalent from the off and this drove Oct’21 quickly onward towards the $505.50 area where we encountered some selling against yesterdays highs. This merely represented a pause in the continuing drive upward and as we broke into fresh contract high ground for the fourth successive day soon afterwards there were signs that the specs are prepared to continue pushing despite the current overbought short term technical picture. Through the late morning/early afternoon the steady climb took Oct’21 to $510.30, with particular support for the flat price found via the Oct/Dec’21 spread which has climbed from the doldrums in recent day to trade all the way back up to -$8.30 as buyers who had been sitting on scale down orders chase to cover in. A few of the longs washed back out midway through the afternoon to take Oct’21 back towards overnight levels and placing 2022 values marginally into the red before sideways consolidation re-commence. A dip back towards the lower end of the range during the final hour was picked back up with closing activity ensuring another moderately higher close at $504.50, a seventh day of gains though with the pace of increase showing signs of slowing.

Morning gains for the white premium were not maintained and by the end of the day we were little changed at the front of the board with 2022 positions recoding losses for the first time in a week. Oct/Oct’21 was valued at $59.90, March/March’22 at $62.20 and May/May’22 at $78.10.

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract