Sugar #11 May’21

Following on from a weaker close last night the market remained towards the lower end of the recent trading band, however with no significant selling on show to push into the underling scale support it simply plotted a narrow course north of 16c. The arrival of US based specs did bring a little more selling to the environment and the front month nudged down to 15.94 as a result however with volumes remaining so low there was insufficient impetus to continue onward despite a negative leaning macro picture. Further consolidation either side of 16c followed and lasted until the final hour at which point we finally saw some reaction to the lower macro and energy sector with a spike down to 15.86 having triggered light sell stops. This mark held through into the close to leave settlement at 15.89, but renewed pressure for the post close then pushed the price below 15.85 to a new monthly low mark of 15.81 which will raise concerns over the markets bullish credentials tomorrow.

Sugar #5 May’21

The day began quietly by recent standards and though prices held marginally higher during the morning period there was precious little volume to get anyone excited either for the flat price or the spreads. With so little fresh sugar news to provide direction we are remaining heavily reliant upon the macro but though this was leaning lower as we moved into the afternoon its impact was proving limited with the specs even quieter than they have been, and as such we continued to centre around unchanged values. Nothing changed until the final hour when in reaction to some sell stops on the No.11 we saw May’21 spike down to $455.70 before attempting to stabilise ahead of the closing call. It did this successfully with May’21 settling at $456.00, however a final push on the post close then sent the price down to a daily low $454.10 to end the day on a negative note and bring the recent $452.20 lows firmly into view. White premium values remained steady today though there was little volume seen from either direction to provide major influence. Closing values see May/May’21 at $105.75, Aug/Jul’21 at $99.25 and Oct/Oct’21 at $90.75.

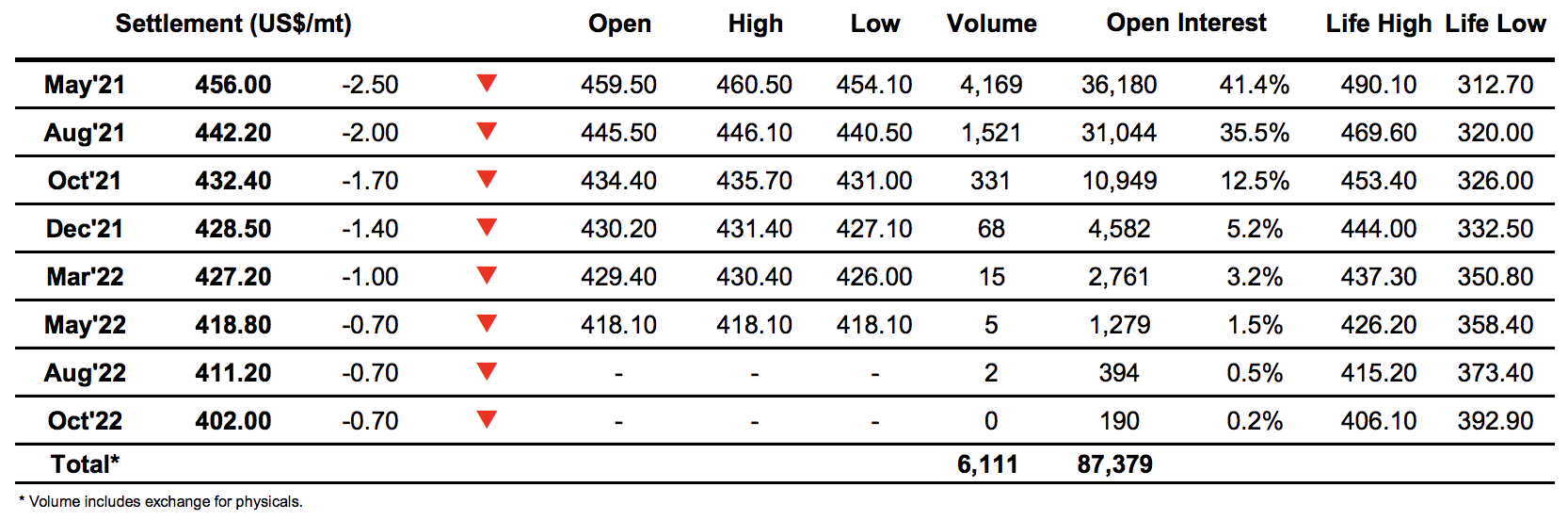

ICE Futures U.S. Sugar No.11 Contract

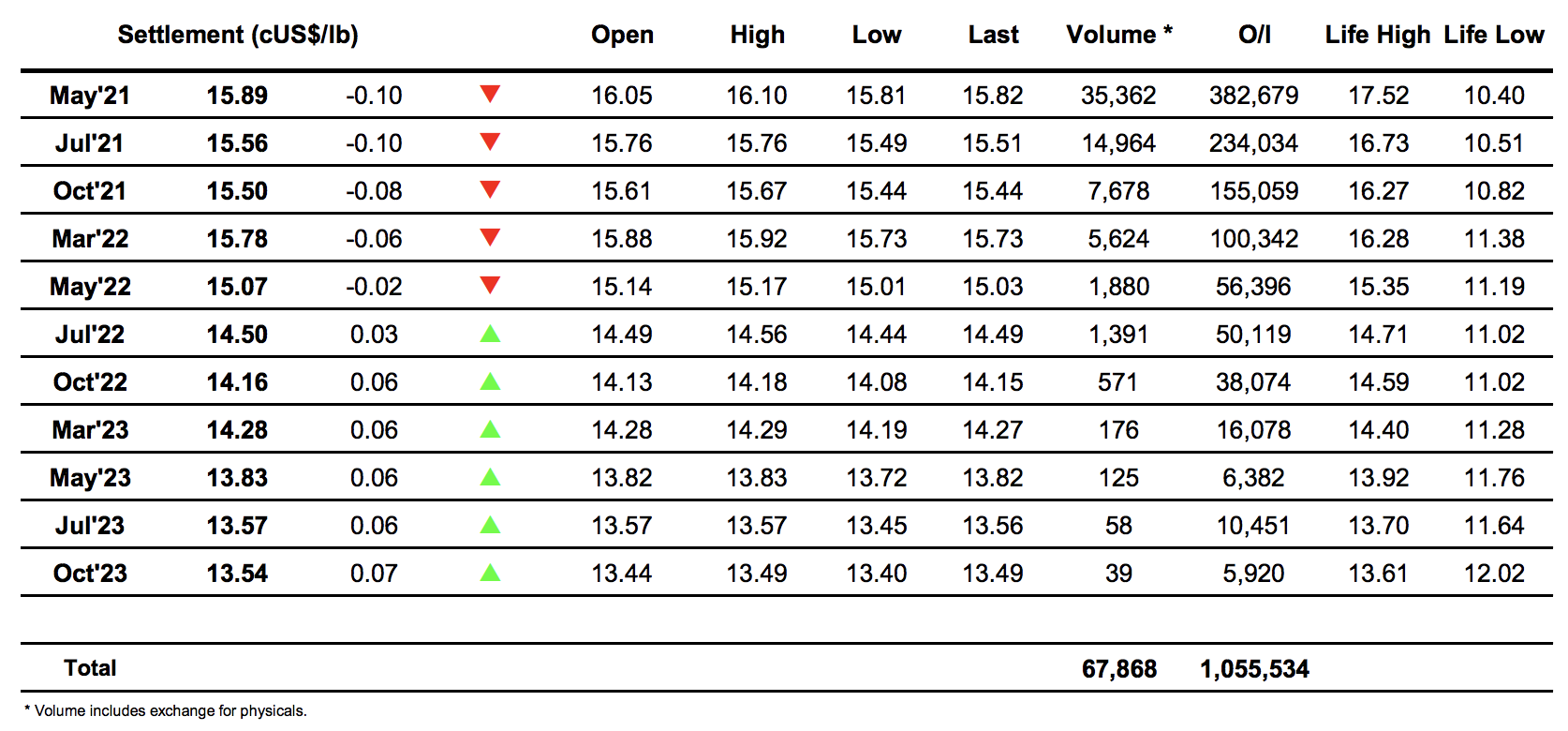

ICE Europe Whites Sugar Futures Contract