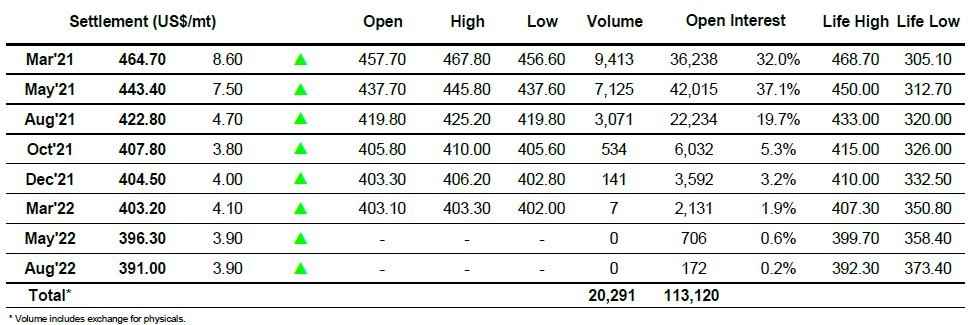

Sugar #11 Mar ’21

Having concluded January away from the broad initial support at 15.55 and 15.40 we found macro strength prevailing this morning to encourage early buying and pull us further away from this area to reach 16c over the course of the first hour. Friday’s COT report showed that the spec long had reduced by almost 17,000 lots to 219,809 lots, illustrating how the smaller specs have reduced their position which potentially gives them some renewed ammunition should a fresh move higher develop with the hedge funds appearing content to hold their current position as is. The specs pushed March’21 a little further to reach 16.11 however the late morning and early afternoon saw a resumption of the recent pattern with a retreat back into the 15.90’s based primarily upon illiquidity. The market came to life during the afternoon as a more concerted spec push sent us more convincingly upwards into the 16.20’s and in the process filled in some light producer scale selling that had been placed around/above last weeks highs. While this move was not conclusive it certainly shows that there remains a strong desire from the specs to pursue the upside and despite then consolidating ay the upper end of the days range for some three hours it was a far stronger performance than any of last week’s efforts. Closing activity saw some MOC buying emerge to ensure a solid settlement level at 16.15 for March’21 while spreads also remained firm even though they were shy of session highs, March/May’21 at 0.85 points, March/Jul’21 at 1.35 points and March/Oct’21 at 1.51 points.

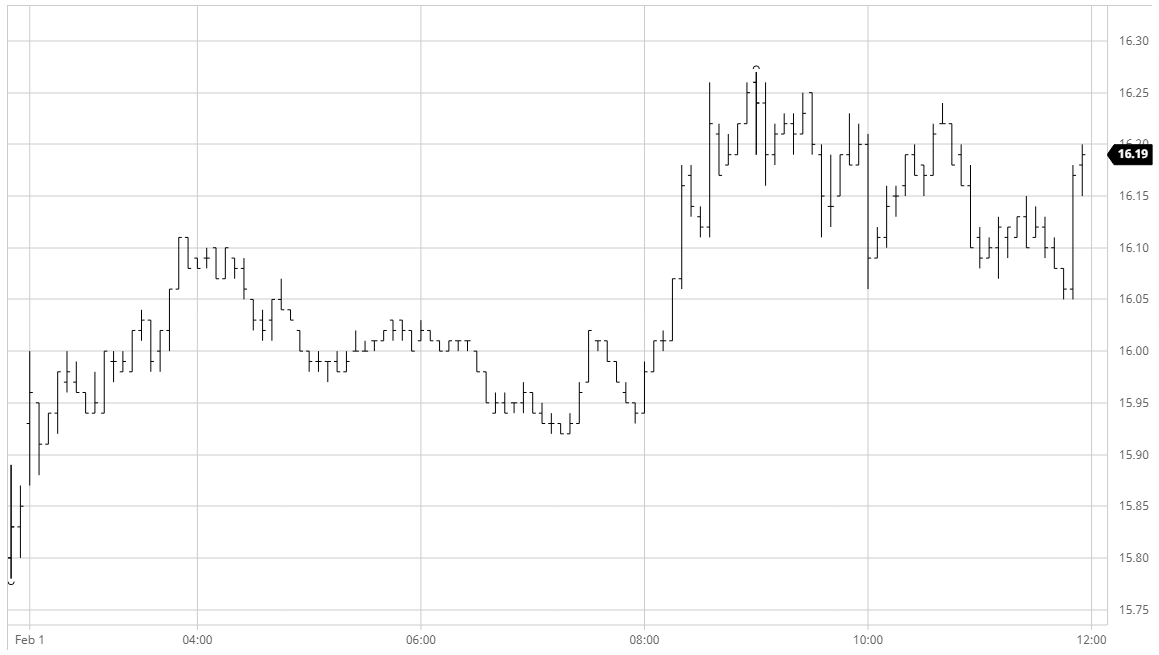

Sugar #5 Mar ’21

Friday’s strong conclusion acted as a springboard for a continuation of the move with buying for nearby prompts leading both March’21 and May’21 to fly out of the traps this morning and record sweeping early gains. There was very little selling on show which enabled March to trade above $465 on an outright basis with huge movements also seen for the white premiums which saw March/March’21 working beyond $111.00 and May/May’21 above $106.00, though these values eased back a touch alongside the flat price later in the morning. The afternoon saw prices begin the journey north once again and interestingly on this move it was the March contract that led the way despite being only two weeks from expiry with the March/May’21 spread reaching a mighty $23.50 as the outright reached $467.80 to suddenly be just 0.90c shy of the contract highs. Of course such moves can be tough to maintain but despite an easing in the pace of buying during the final three hours we remained firm with steady consolidation taking place at the top end of the days range. The closing stages saw significant volatility albeit against low volume as nearby values swung downwards and then were pushed back up with MOC buying that left March’21 settling positively at $464.70.

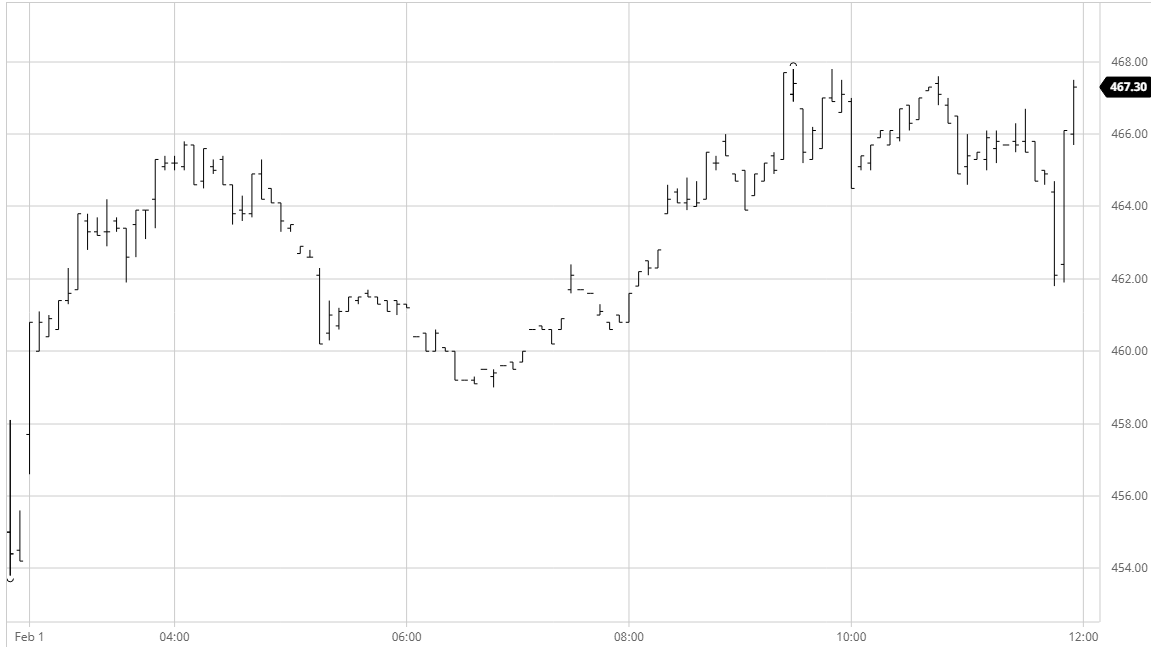

ICE Futures U.S. Sugar No.11 Contract

ICE Europe White Sugar Futures Contract