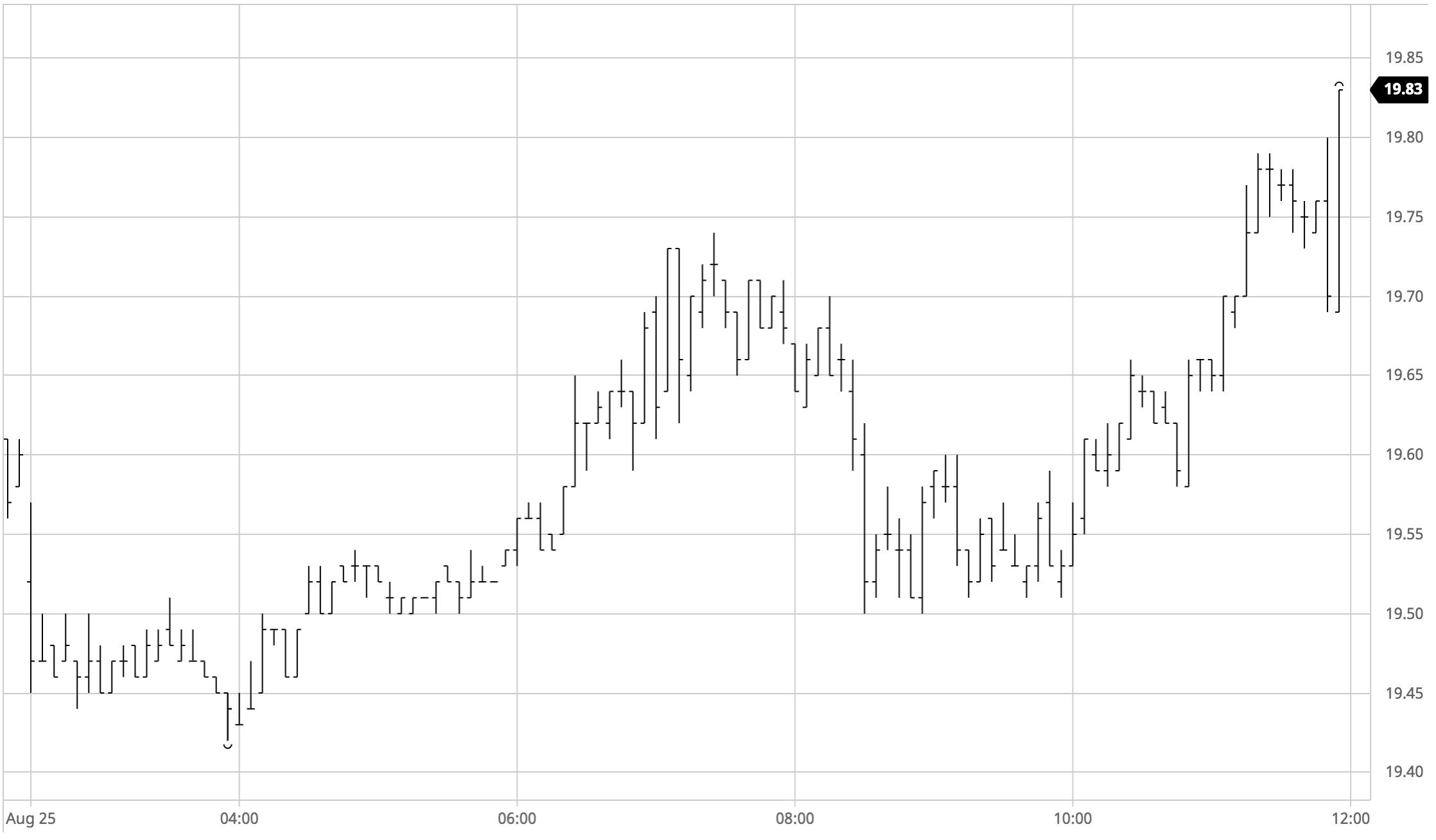

Sugar #11 Oct’21

In a day with relatively low volume, both NY and LDN sugar markets remained rangebound for most of the session. NY opened low at approximately -0.10, and remained very quiet for most of the London morning.

As usual, activity started to boost at the NY morning, and we started seeing a positive price action that took the market to the 19.70s. In the afternoon, upward pressure continued and we managed to hit the 19.80 barrier just after the close. Once again, we noticed the very high (at least, relatively to the rest of the session) buy-side pressure after the close, which suggests that we might have a continuation of the movement tomorrow. All in all, a positive day for the corn, energy and softs markets and the recent news of a higher remuneration approved for Indian cane farmers might have contributed for the upward drag we saw today in the NY, with the sharp decrease in premiums seen today as a sign of the continued low demand for the sweetener at the destinations.

With no big new fundamental news, we keep an eye on the Jackson Hole FED symposium, which (finally!) starts tomorrow.

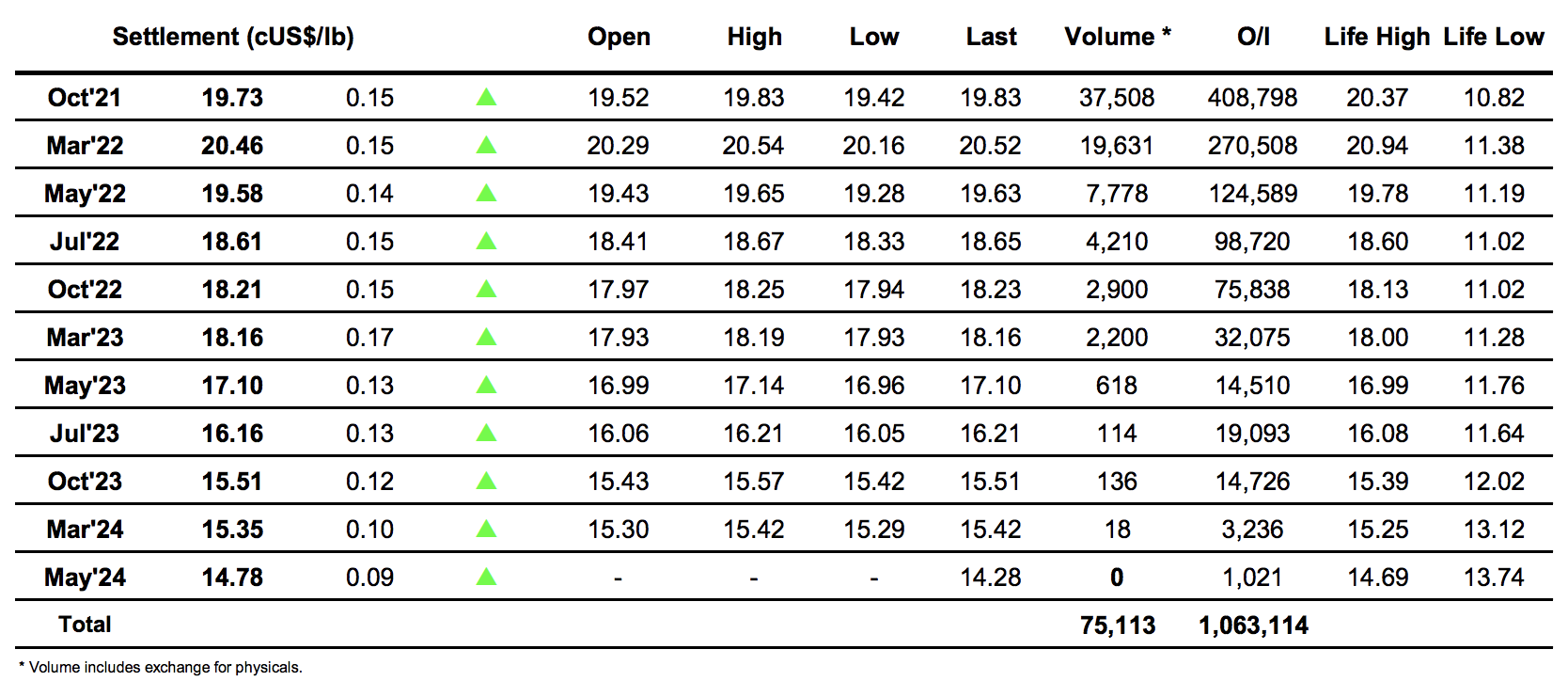

ICE Futures U.S. Sugar No.11 Contract

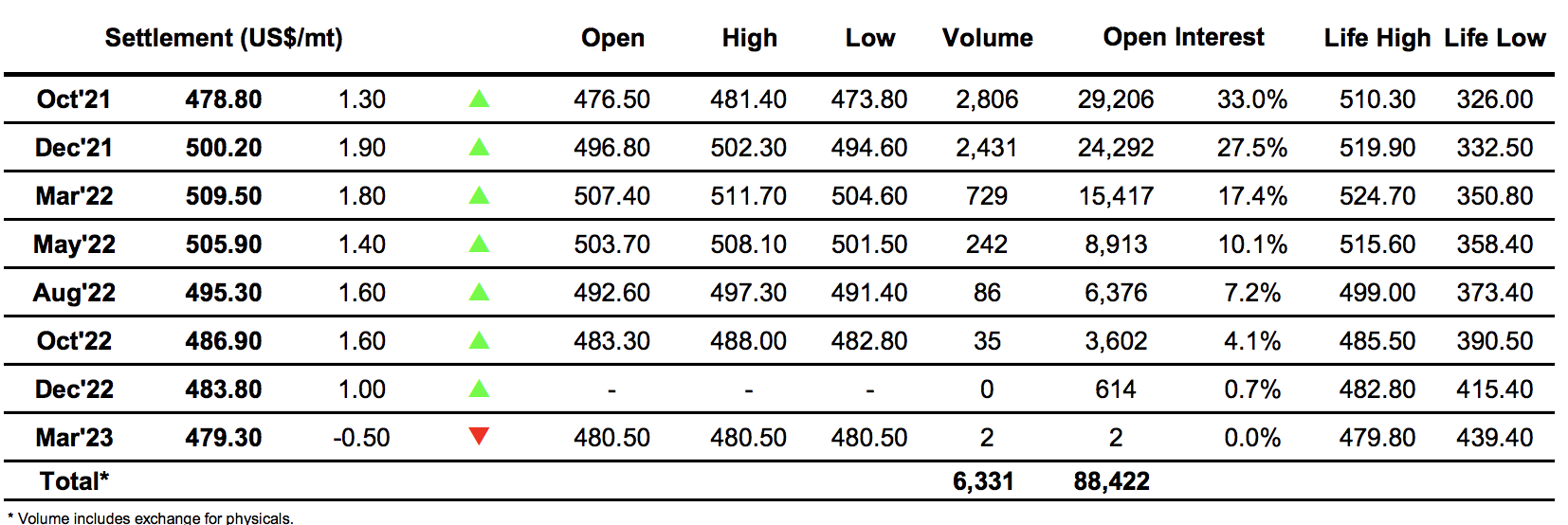

ICE Europe Whites Sugar Futures Contract