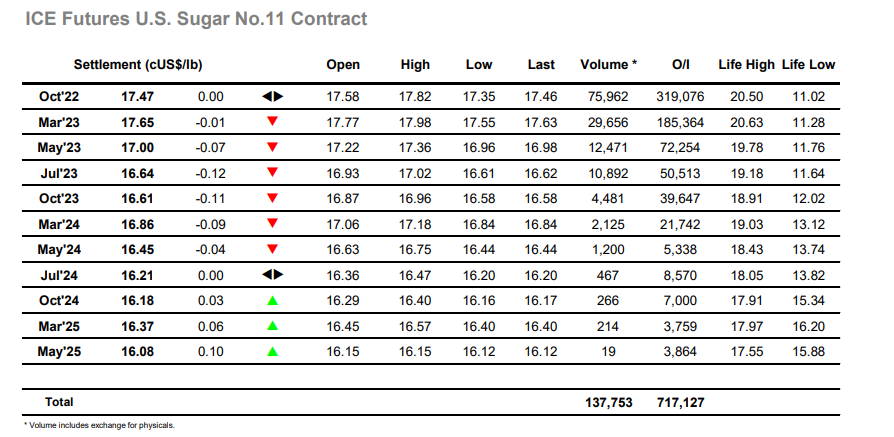

Following five days of almost constant decline the market finally attracted some physical activity with the resultant buying interest/hedge lifting sending the intra-day chart gapping upward to trade 17.82 during the opening minutes. Further buying followed and for a while the Oct’22 contract looked to consolidate these gains, however as the pricing started to dry up so the lack of any other aggressive buying led the price back to 17.60 where sideways trading ensued atop the intra-day gap. For several hours, the market trod along sideways, gradually easing back but seemingly content to hold inside yesterday’s range as traders took stock following the significant recent movements. The picture changed during the second part of the afternoon however, and again it was specs driving things as slipping beneath unchanged provided encouragement to explore the lower end once more. Good buying was in place either side of 17.40 but gradually the probing extended down to new Oct’22 lows for the year with 17.38 breeched and a new mark set at 17.35. Expectations were that sell stops would likely be encountered in this area but with no evidence of any there was something of a pause, mild short covering combining with some head scratching as the market sat either side of 17.40 leaving specs wondering what the next move should be. A burst of short covering provided something of an answer with the price popping quickly back up to 17.53, however there was to be no continuation as an ultimately disappointing performance concluded unchanged at 17.47.

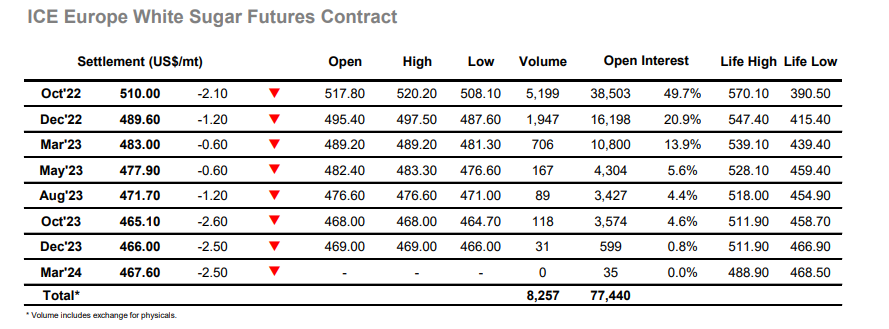

A positive start to the day saw Oct’22 trading as high as $520.20 as some overnight hedge lifting kicked in with physical activity increasing due to the ever-lower market levels. The initial move soon tapered off however consumer pricing was being attracted in for the very same reasons and this continued to support the market throughout the morning with the moderate gains showing down the board a welcome relief to any longs after the last few sessions. Trading was quite patchy at times with few resting orders to be found within recent parameters, and it was not until the afternoon that activity picked up as a more familiar pattern resumed with a little more spec selling sending nearby positions into debit for the day. The slide extended to $508.10 which kept Oct’22 above yesterdays lows and experiencing an inside day on the charts, but while this at least represented an end to the day on day decline the nature of the daily movements is still not healthy for the longer-term prospects. By late afternoon the white premium values were increasingly struggling with Oct/Oct’22 lower on the day at $125.00 having briefly touched against the wall of selling at $130.00 early in the morning, though spreads were little changed due to a fairly flat board. Closing activity continued to the lower end of the range with Oct’22 settling at $510.00, and while at last the market has stopped haemorrhaging the performance offered scant consolation to any longs with a meaningful rally seeming a distance away at present.