Sugar #11 Mar ’22

A macro bounce and buying from trade/consumer entities had the market jumping during the early part of today’s session though having reached a high of 19.66 in quick time the price eased to consolidate the 19.50’s. This represented a solid recovery given the state of play on Friday and in calm trading the market comfortably consolidated either side of 19.50 as we awaited the start of the US Day. Initially we saw little change to the picture however with buyers standing back and nerves evident amongst spec longs the price gradually began to slide once more, filling the overnight gap on the intra-day charts and then continuing lower until better support was uncovered in the teens. There was also a small weakening for the March’22 spreads on this move with March/May’22 easing to 0.33 points at one stage, however it then recovered to the upper 0.30’s later in the afternoon despite the flat price struggling to pull clear of the lows. Marginal new lows were recorded as we moved into the final hour, matching Friday’s mark of 19.15, and though the underlying support prevented further losses to generate a double bottom there was no impetus to bounce. Settlement at 19.19 leaves us still vulnerable to further losses and should 19.15 break then attention shifts to the 18.82 low from 19th October.

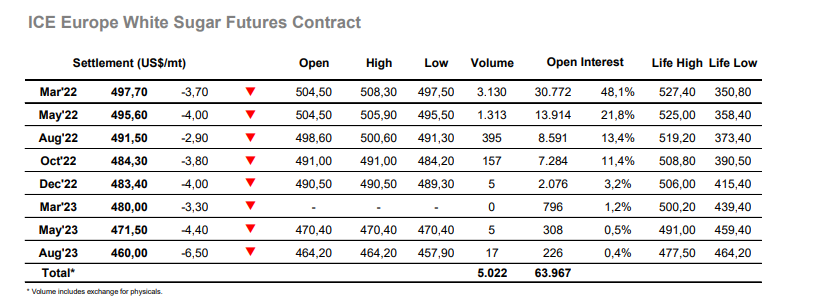

Sugar #5 Mar ’22

A firmer No.11 market had us called higher and an eventful opening saw March’22 ranging between $504.30 and $508.50 before falling back to the $503 area with no additional buying emerging. The macro was broadly positive as buying emerged following the sharp declines seen on Friday however in calm trading the whites were content to simply hold moderate net gains with a narrow 502.50/504.50 range enduring for the rest of the morning. There was little change to the picture at the start of the day for the Americas despite the efforts of bulls who were trying to generate enthusiasm based upon the recovery in the energy sector, but though crude was to the top of the commodity performance chart we showed no desire to follow. When fresh movement did appear it was again sellers driving the movement, possibly a little spec selling creeping back in following Friday evening’s news that their net longs had grown to 18,080 lots last week, much of which will remain despite some liquidation of Fridays fall. The afternoon move was orderly and was picked to at $497.50 to remain within Friday’s parameters and activity settled once again. With prices holding resolutely ahead of $497.50 we were seeing some recovery for white premium values with March/March’22 working back above $75 late in the day while May/May’22 headed back towards $82. The close played out at the lows with March’22 settling at $497.70 to maintain a negative bias as we concluded an inside day.