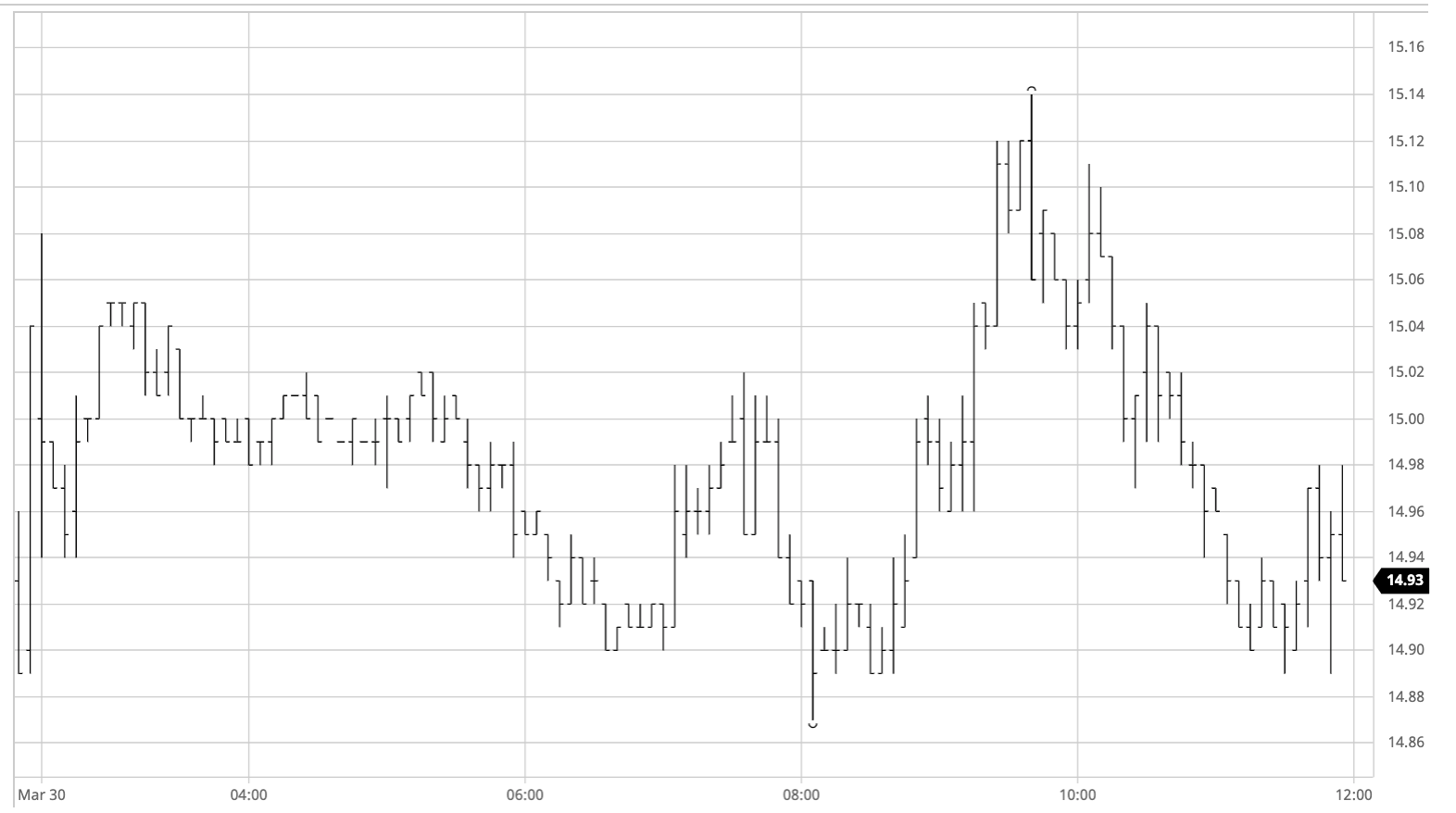

Sugar #11 May’21

A choppy start to the session saw May’21 trading between 14.94 and 15.08 during the first few minutes though activity soon settled with underlying consumer pricing holding the prices in the vicinity of 15c. In fact so mundane was the morning that we remained inside of the opening parameters throughout, only moving beyond during the early afternoon as a little more selling emerged to send prices into a marginal net deficit. Volume was proving to be particularly low both outright and for the spreads and this contribuited to a continuing slow environment with underlying scale buying interest proving sufficient to support prices in front of yesterdays 14.84 low mark. The little activity that was being seen for outright prompts was emerging from light spec and algo flows, and it was these movements that caused May’21 to push up to a session high 15.14 midway through the afternoon as short covering took place. Despite the earlier failure to challenge 14.84 there was no effort to push on however and once the covering was concluded the market turned back down into the 14.90’s while the May/Jul’21 pushed in to just 0.06 points premium to continue its own weaker slant. A mixed close saw May’21 settle unchanged at 14.92 leaving the negative technical bias in tact for another day.

Sugar #5 May’21

Following on from the strong conclusion to yesterday’s session we saw early buying take May’21 up to $434.50 during the early stages though once the initial flurry was concluded the price soon eased back towards overnight levels. Volume was sparse for the outright prompts during the morning but the same could not be said for the spreads where May/Aug’21 was attracting some strong selling. The differential had touched a high at $7.90 during the early part of the session however with funds looking to continue rolling forward their longs ahead of the forthcoming May’21 contract expiry the stream of selling led it all the way in to a narrowest $4.70. The spec pressure on the spread forced May’21 down to record another new recent low for the move at $428.00 but with little selling hitting the flat price it was able to stabilise again as we moved into mid-afternoon, climbing back up through the range and into positive ground once more. With the outright movements being generated by some light spec flip-flopping there was a final decline back into the upper 420’s during the final hour before a generally quiet day ended lower at $429.80.

White premium values struggled today as the May’21 spread weakness rippled through. May/May’21 closed off of its lows at $101.00, Aug/Jul’21 end at $96.75 with Oct/Oct’21 at $89.75

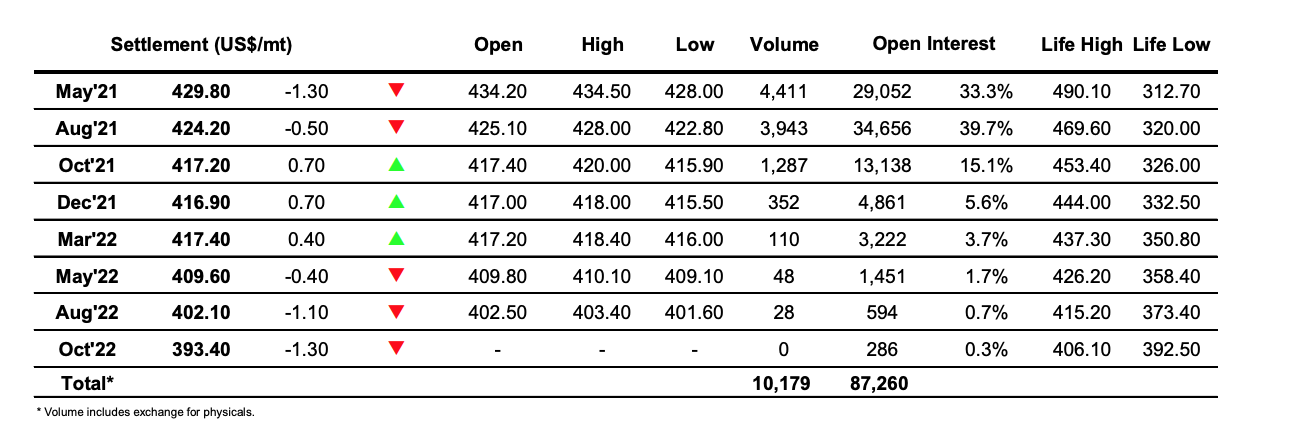

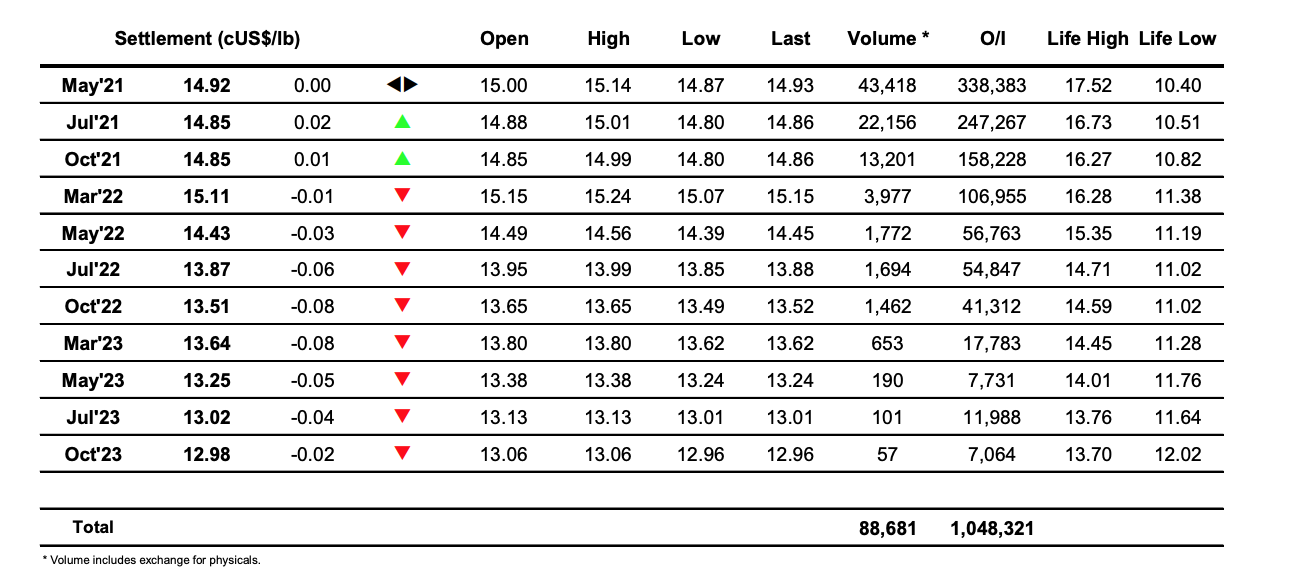

ICE Futures U.S. Sugar No.11 Contract

ICE Europe Whites Sugar Futures Contract