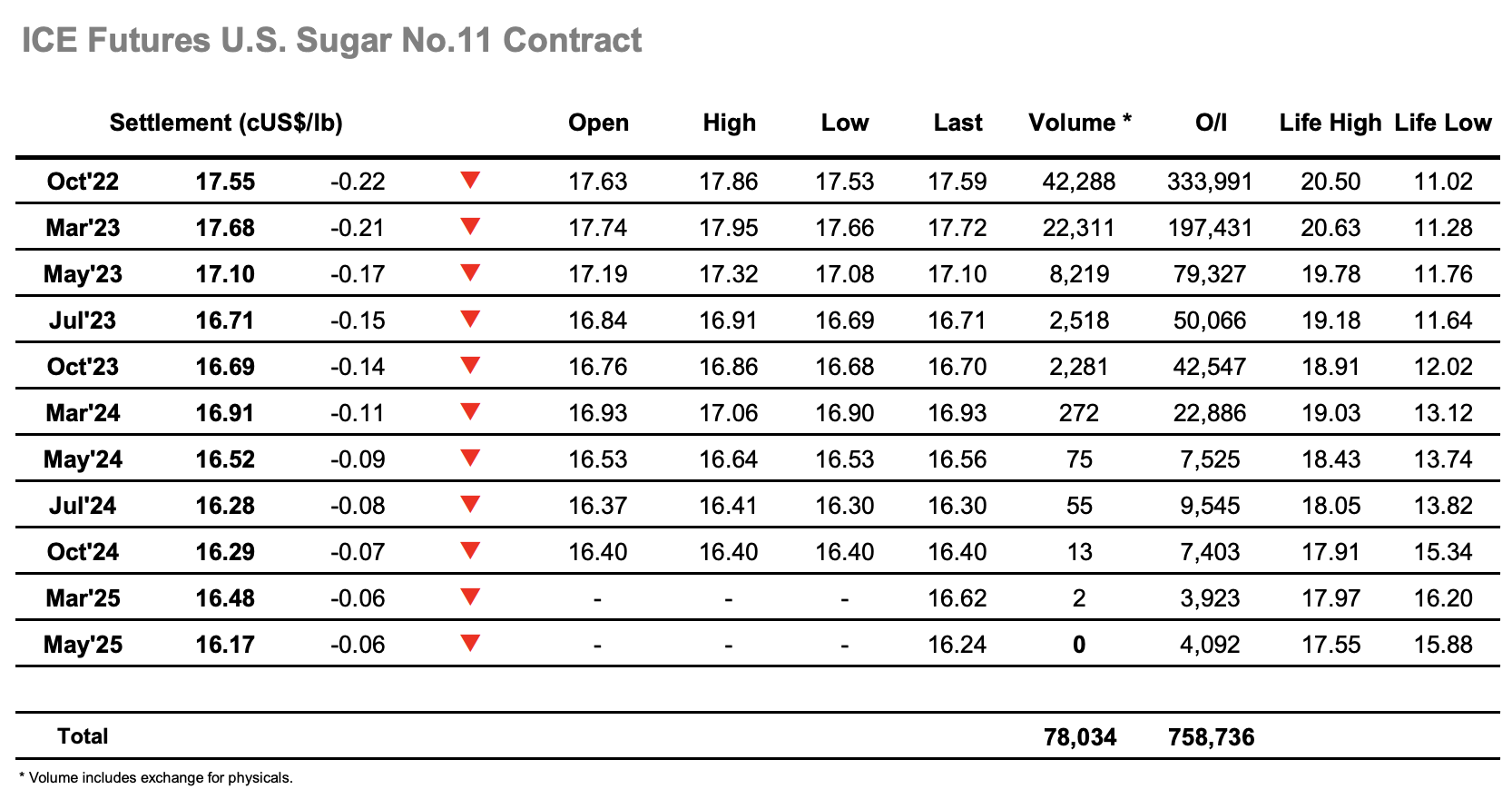

A lower opening was quickly picked up, and though there was little impetus to push higher during the morning the market was content to hold just beneath overnight levels and continue the attempts at rebuilding. The macro picture was rather mixed with gains for softs/ags offset by another poor showing from crude/energy, and while we have shown scant regard for these movements of late the lack of anything other than spec interest of late means they remain keenly viewed. No.11 meanwhile maintained the recent pattern and looked to work higher again as the Americas day got underway, however there was less momentum than seen yesterday which led the move to top out at 17.86 and return to sit in the 17.70’s. For no other reason than the upside move had failed there was then a look lower which led Oct’22 down to 17.55, but again the action was driven by day traders and so another return into the range had a sense of inevitability when positions were covered back. Little changed as the day petered out quietly, marginal new lows on the close ensuring that Oct’22 settled negatively at 17.55 though still firmly with recent 17.20/18c parameters.

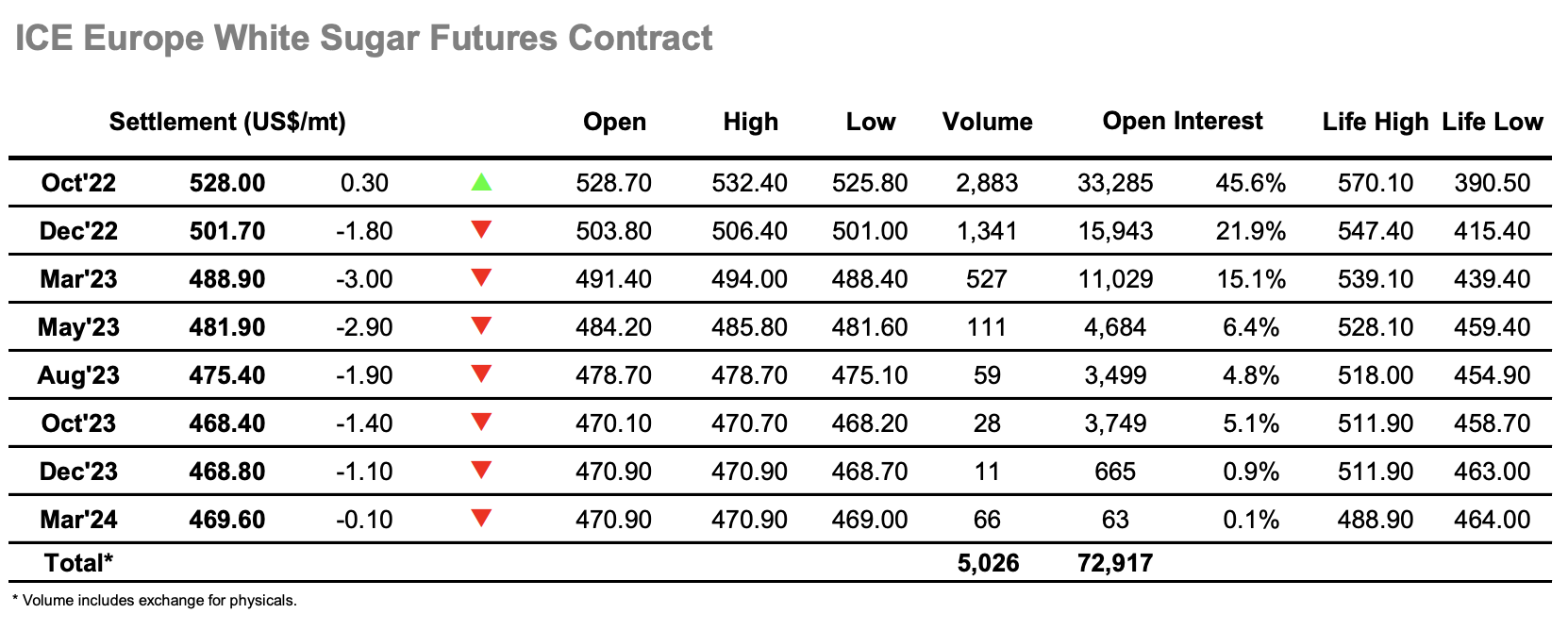

The new day had a familiar feel as the market chopped around during the morning with a slight negative bias, though volumes were so light that it really didn’t mean much in the wider context. There are increasingly few resting orders to both sides of the market within recent parameters which enabled light spec buying to take prices upward once again as the Americas day drew closer, reaching to $532.40 but topping out quickly as again there was no buying in place once the specs stood back. Though the flat price then eased back down through the range there was supportive action for the Oct’22 spreads which enabled the Oct/Dec’22 to move back out to $26.00 as the afternoon progressed, while the Oct’22 white premium nudged through selling in the upper $130’s to sit just below $140.00. The final couple of hours played out to the lower end of the range with Oct’22 settling at $528.00, though positivity remained from the white premiums with Oct/Oct’22 approaching $141.00 and March/March23 trading at $99.00.