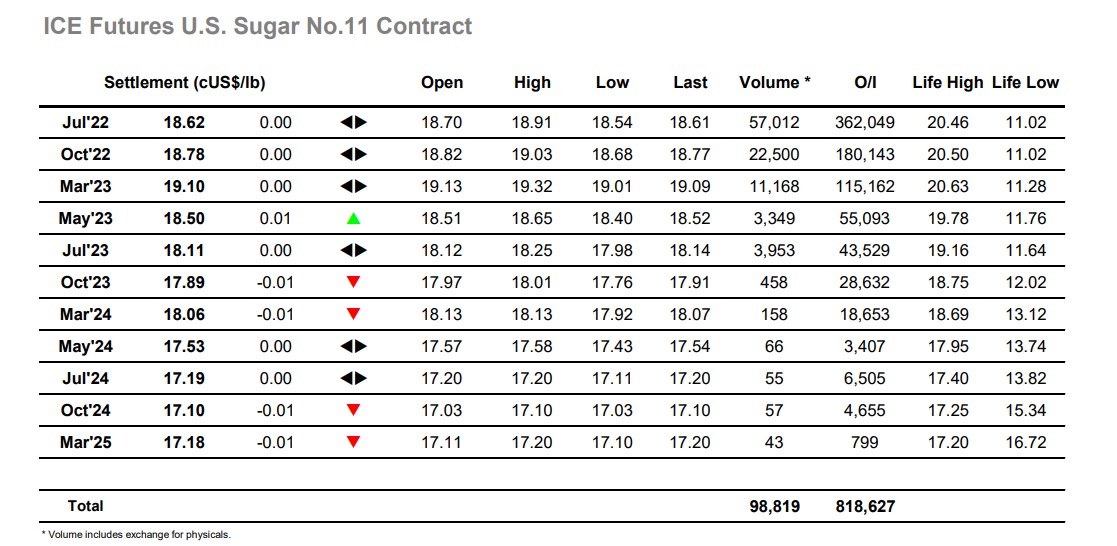

A quiet opening saw nearby values trading a few points higher, and with positive movements being seen across the wider macro some supportive buying followed it to take Jul’22 up to 18.80. Quiet consolidation followed within a tight band for the rest of the morning, and while unspectacular it did provide some encouragement to longs that the market may be looking to build a bottom. Specs were suitably encouraged to use this platform to push upward as the Americas day got underway and took Jul’22 to an intra-day high at 18.91, however with no other buying following behind the move soon topped out. The struggles soon resumed as the afternoon saw a slide back down to the yesterday’s lows and extended through the scale buying to a new recent low mark at 18.55, suggesting that the physical picture remains dominant for the time being with the fall contrasting with the still firmer macro. Some short covering from day traders pulled values back into the 18.60’s and prices continued in this rea through a slow final hour to settle little changed at 18.62.