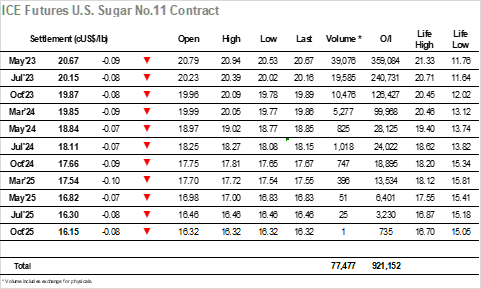

There was a new enthusiasm about the market this morning with yesterday’s recovery encouraging some of the specs to try and force the market back above 21c, with their efforts through the first hour bringing the market as high as 20.94. The smaller traders lack the depth of buying to maintain the gains however and so it was not long before the market was tracking back down into the range, finding support near to overnight level sand remaining in this area through into the Americas day. With the US markets opening so there was increasing struggle for equities and some commodities with the energy sector under pressure, and while the impact upon our own market was minimal it did serve to discourage buyers. Over the course of the afternoon the price retreated down through the range to 20.53, though volumes were light, and we remained within the confines of this week’s parameters The macro was performing increasingly poorly and so in the wider context of events todays performance was still reasonably robust. Prices pulled away for the lows during the later part of the session and so ended with only modest losses recorded, May’23 settling at 20.67, concluding a quiet day which serves only to suggest we are likely to see more of the same when we resume on Monday.

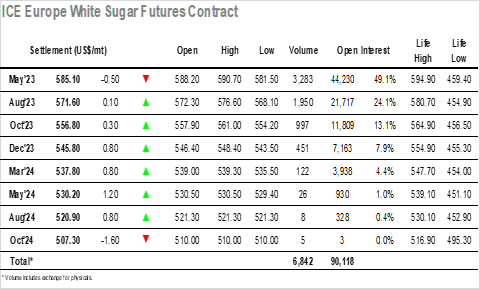

A burst of buying for the opening put the market back onto the front foot, and early trading took the market as high as $590.70 before retreating against some long liquidation. This early strength had seen the May/May’23 white premium nudging towards $130.00 though that strength proved to be short-lived with the low volumes seen on the screen showing that very little actually traded in this area. Having fallen back volume remained incredibly light with few people interested in trading within the range, recent events showing how most participants are attracted by the opportunities provided on wider moves to either direction. With the macro picture weakening there was a move back down into the lower $580’s as the afternoon progressed, though it had only a limited pull upon sugar which remained relatively stable while the funds are content to maintain their longs. By late afternoon the price had pulled away from the lows and was sitting back to the centre of the range, ultimately ending the day at $585.10 with the near term likely to see continuing calm consolidation.