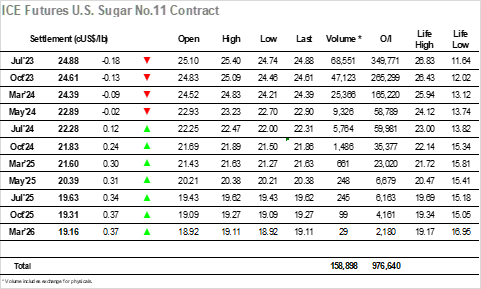

Today No.11 market opened at 25.10, 4 points above yesterday’s settlement. Just after the opening, market pushed fast trading near 25.30. From 9am till 1h30pm, market traded sideways in the 25.22-25.40 range (daily high at 1h30 pm). It was then near the Americas opening when sellers started acting continuously bringing the market down until 3h30pm, when the daily low was reached at 24.74. At 4pm, market drafted a recovery to the 25.00s but was able to reach only 24.98. During the final 1h30 of trading, prices retraced to the 24.90 level, keeping closed in that range until closing at 24.88. No.11 N3 settled at 24.88, -0.72% below yesterday’s settlement, a -0.18 pts change. NV spread went down 5 points, closing valued at 0.27. The traded volume was 69k lots.

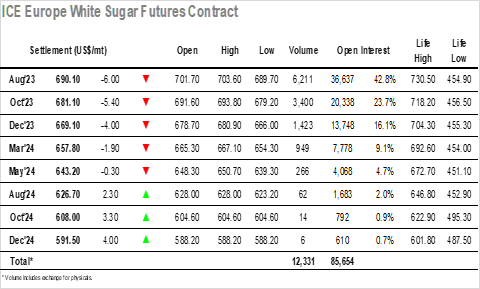

Today Whites Aug’23 opened at $701.7, $5.6/mt below yesterday’s settlement. Just after the opening, market went up and was trading sideways near $701.5. In the meantime, daily high was reached at $703.6 at 12am. This dynamic remained until 1h30pm, at that time onwards, following No.11, market continuously went down until 4pm, when the daily low was reached, with Aug’23 at $689.7. Recovery was tested just after daily low, but market could just make it until the $695.0s at 4h30pm. Another retracement was seen afterwards and Aug’23 closed valued at $690.4. Settlement price was $690.1, a -$6.0 change from yesterday’s settlement (-0.86% change). Aug’ 23 registered 6.2K lots of volume, and the Q23/V23 spread closed at $9.0.