A mixed opening led the market into another very quiet morning with prices confined to a narrow range on low volume. As ever it was only the Americas based spec traders who brought any impetus to proceedings and in the least surprising news of the day, they pushed from the long side to take March’23 up to 20.07. A small period of stability followed as the market tried to consolidate just below 20.00 however with the specs not having the volume to keep pressing the market now that the long position has grown so some liquidation appeared and sent values back to opening lows. While there was no sign that the market would collapse the final couple of hours did see the range extend a touch lower, a further sign that there is less capacity for the longs to keep pushing right now. March/May’23 dropped back to 1.09 points as the nearby prompts remained in deficit, with new session lows recorded late on at 19.68 ahead of a settlement at 19.74. There is little fresh news available, and the evidence of the week so far suggest that tomorrow is likely to see a continuation of the low volume, rangebound activity ahead of the Thanksgiving holiday.

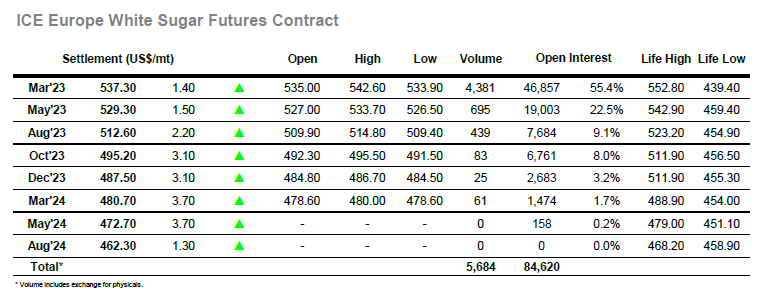

A lower opening was quickly forgotten as light but dynamic buying appeared into the market and too March’23 back up towards $540.00, showing the desire to continue protecting longs in the current environment. Having extended to $541.00 the picture calmed a little to leave prices holding within the range, though some mixed buying was noted ahead of unchanged levels to ensure that prices remained net positive. Some volatility was noted from the US specs around 1pm with a retreat being followed by a push to new daily highs at $542.60, though the volumes were minor and so movement was not sustained in either direction. One feature of the general stability today was to bring the white premium values back up through their own recent range, March/March’23 pivoting back up through $100 and reaching beyond $102.00 intra-day. The flat price saw a slow decline over the rest of the afternoon to be showing only token gains as the close approached, though the premium remained firm and was approaching $103.00 during the final hour. There was little change to this on the call with March’23 ending the day at $537.30 and leaving the wider picture unchanged.