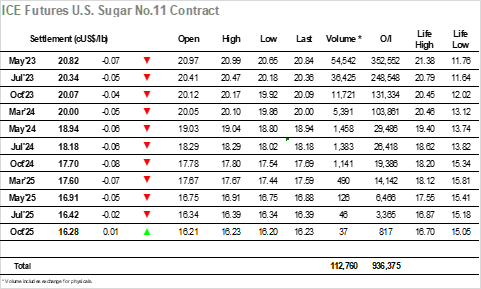

Having cooled from contract highs the market was calm initially today, consolidating near to unchanged levels on low volumes. Progressing through the morning a little more selling started to filter into the environment which accrued losses, the movement being driven by some long liquidation while specs/day traders played from the short side in reaction to macro weakness across equities and energy. Buying was limited though interest did pick up in the 20.60’s with a low establishing at 20.65 as the Americas day got underway. For a period, the market struggled to find any traction to pull away from the 20.60’s however some determined interest did finally see the market work away from the lows with short covering adding to the momentum as we reached 20.91. With half of the screen volume having originated from the spreads the market was still lacking the necessary impetus to make a meaningful move either way and so the afternoon wore on tediously within the range. A couple of efforts were made to reduce the losses which eventually resulted in just single digit losses and a settlement at 20.82, ending the week calmly with the recent 21.38/20.35 parameters likely to maintain as we move towards the end of the month.

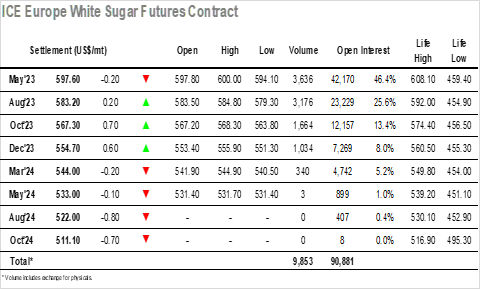

The day started calmly with May’23 moving either side of unchanged, with outright volume still low and the market lacking direction having fallen back from the highs yesterday. There was some slightly better spread volume being seen for May/Aug’23 between $14 and $15 as rolling starts to pick up with just three weeks remaining until May’23 goes off the board, however the flat price remained quiet despite a fall in prices which saw a morning low at $594.10. Relatively the market was performing well as despite sitting on the lows for an extended period the white premium remained firmer with May/May’23 above $139.00 and Aug/Jul’23 touching $136.00. Once into the afternoon some buying helped the nearby prompts to pull away from the lows, and some momentum duly gathered to move through the thin environment and record new daily highs at $600.00 before easing back to the range. Activity continued at the upper end of the modest range through the final part of the afternoon, maintaining white premium gains, before settling as $597.60 basis May’23 following some pre-weekend position squaring.