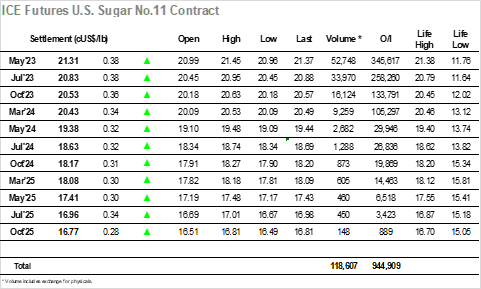

The day began positively with the market kicking straight back over 21c but lacking the spark to push on which left May’23 holding a tight range between 21.02/21.11 for the next few hours. By early afternoon what had been a mixed macro picture had begun to swing to the positive, but despite a small nudge to 21.18 the May’23 was remaining decidedly quiet with volume at very low levels once again as spreads too showed little activity. Talk of a prompt conclusion to the Indian crop which will eliminate the any prospect of additional exports had been well absorbed, however the specs may have just been digesting the news as an afternoon push emerged to send prices surging back towards last week’s contract highs. Suddenly there was the first signs of more significant interest as volumes increased above 21.30, with a new high mark set at 21.44 soon afterwards before pausing against some profit taking. Nearby spreads were only marginally firmer despite the push (maybe a sign that any light fund interest is starting to look towards the Jul’23 contract ahead of the roll) with May/Jul’23 reaching 0.52 points while Jul/Oct’23 saw a widest 0.32 points. The final hour of so played out comfortably just beneath these new highs until some pre-close position squaring sent values back a little though settlement remained constructive at 21.31.

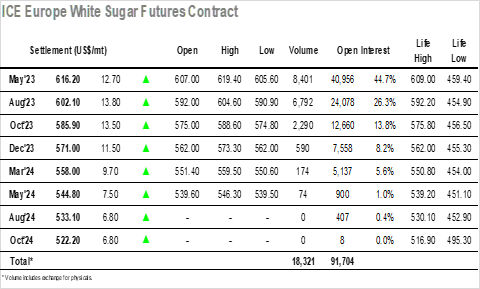

Determination remains amongst the specs to continue to pursue the technical strength as the new day started with another push to fresh contract highs before pausing to consolidate the $609.00 area through to the later morning. Volume was steady though this was primarily due to an increasing level of May/Aug’23 interest as the expiry draws closer, the flat price seeing more limited interest with only some moderate scale interest above the market keeping things in check. Though we saw marginal new highs recorded all remained reasonably calm through the early afternoon, and it was not until a mid afternoon shove which triggered a few buy stops that the market looked to breakout once again. The scale selling was filled comfortably as the move extended towards $615.00, in the process extending the white premium values yet further with May/May’23 approaching $148.00 and Aug/Jul’23 near to $143.00. The flat price then proceeded to work further ahead to $619.30 before seeing a small correction, though by now the No.11 was climbing and the premiums had slipped from their highs. There was some closing volatility as smaller traders chopped back out of positions though it remained another incredibly strong showing as May’23 settled a long way above the former contract highs at $616.20.