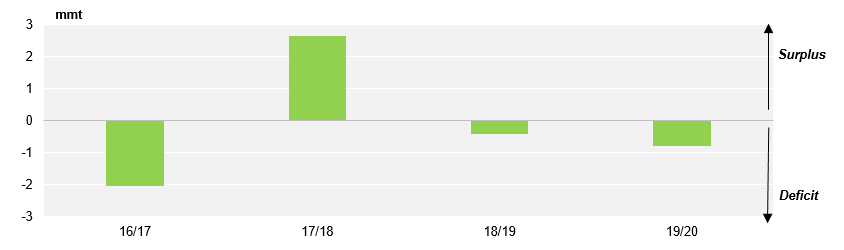

- We expect the EU to remain tight through 19/20 with consumption greater than production.

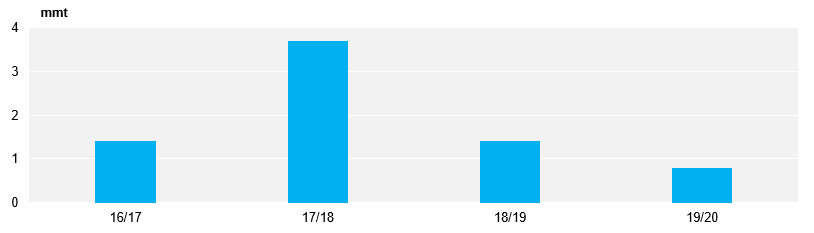

- Due to the sustained high EU prices, we see exports reducing YoY.

- Despite 19/20 crop uncertainty it is unlikely that there won’t be a drop off in exports.

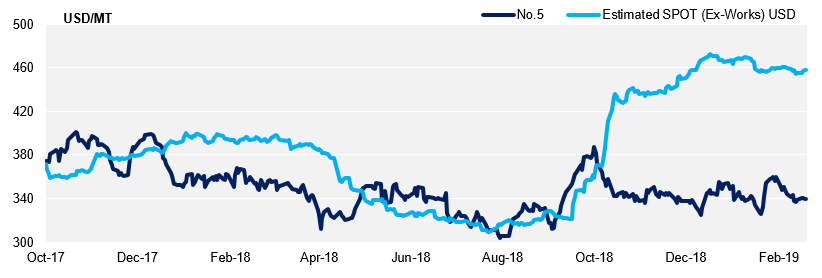

European premium to world market remains high

- For 19/20, we forecast production to be about 800 kmt below consumption, the second year in a row where the EU is in deficit.

EU Production less Consumption

- Therefore, we believe that 19/20 exports will reduce YoY due to tighter stocks and the unattractive return for world market exports.

- Exports should be lower than 18/19 as a significant volume of 18/19 exports were forward booked when the return was much more attractive.

- We now forecast just 800 kmt of exports for 19/20, compared to the 1.4m tonnes we are expecting for 18/19.

EU Exports

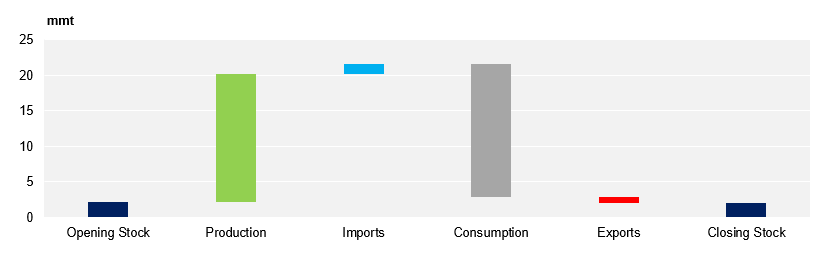

- This leads to a 200 kmt reduction in EU closing stock at the end of the 19/20 season, meaning we do not expect EU prices to come under downward pressure in the short to medium term.

EU Waterfall Chart

19/20 Production Uncertainty

19/20 Production Uncertainty

- Whilst there is significant uncertainty in the 19/20 crop due to the neonicotinoid ban (which has been overturned in some countries) and the area planted, we only see a

small possibility of a crop of 18.6m tonnes (consumption volume) or greater. - Therefore it is unlikely that there will be a need for exports.

- The neonicotinoid ban remains in place in France, Germany, Italy, Netherlands and the UK which make up 2 thirds of total EU production.

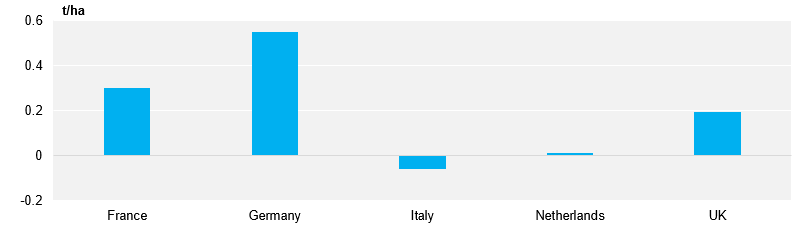

- Despite this, in 4 out of these 5 countries, we expect yields to be the same or higher than in 18/19 (assuming a 5% yield loss due to disease) as 18/19 yields were consideaably below average due to the warm dry weather at the start of the season.

Forecasted Yield change 18/19 to 19/20

· Due to the mild

European winter supporting higher aphid populations (virus that affects sugar

beet), the latest disease forecast suggests that the sugar beet crops are at

high risk of infection this summer given no use of the neonicotinoids that

prevent them.

· It is worth noting that

for each 1 percent extra yield lost in these 5 countries, about 150k tonnes

less sugar will be produced, which could reduce exports further.

· We are predicting a

fall in area planted of around 5% across the board due to relatively low sugar

beet returns.

EU crop Return Estimates

· When combined with the

yields this leads to a small reduction in production YoY in France, Germany,

United Kingdom, Poland and Europe.

Top 5 EU producers by Season

This

takes our estimated EU production for 19/20 to 17.9m tonnes, 300 kmt below

18/19

EU Production