Insight Focus

- China among world’s top raw sugar importers, CS Brazil’s biggest buyer.

- Chinese government pushing for sugar self-sufficiency.

- Does this mean CS Brazil could lose its best customer?

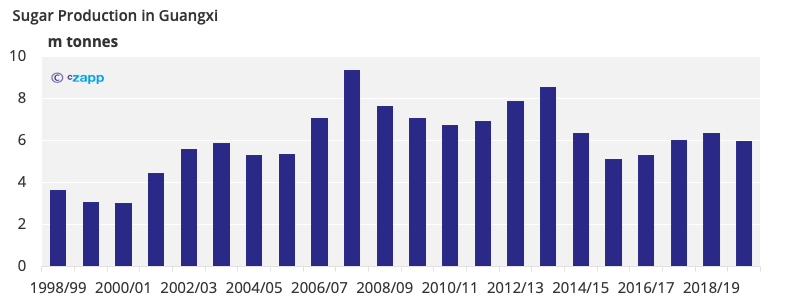

China is striving for sugar self-sufficiency, and with global sugar prices increasing, it may be tempted to expand its production. But is this possible? Production peaked in 2007 and has been falling ever since. Of course, though, if its output does increase, CS Brazil could lose its main customer.

China’s Push for Sugar Self-Sufficiency

Global sugar production has barely grown in the last decade. Meanwhile, consumption has been growing at around 1% per year. The world therefore needs 14m tonnes more sugar than it did 10 years ago.

So far, we’ve discussed the feasibility of cane and beet expansion in some of the world’s largest sugar growing regions: India, Brazil, Thailand, and Europe.

Here, we talk about China, which produces over 10m tonnes of sugar a year but consumes around 16m tonnes, making it one of the world’s largest sugar importers.

In recent years, China’s provincial governments have put a tremendous effort into securing sugar supply, but with global prices rallying, is there a greater opportunity for China’s own industry to expand?

China Could Invest in Higher-Yielding Cane Varieties

China has been subsidising farmers to try new cane varieties since 2015. This has bolstered both agricultural and sucrose yields. Agricultural yields climbed to almost 85 mt/ha in 2020 from just over 70 mt/ha in 2014, whilst sucrose yields jumped from 11% in 2016 to 13% last year.

While some progress has been made, it’s much less than that achieved by India during the same time frame, perhaps due to China’s less favourable weather and soil conditions.

China Could Increase Milling Efficiency

In 2008, Chinese sugar production hit a record high, but behind the scenes, running costs were high and competition between the mills was intense.

The country’s provincial governments have therefore been encouraging mill consolidation since 2010 and their efforts seem to have paid off, with sugar production in Guangxi increasing by around 0.71 tonnes between 2016 and 2020.

The Cost of Cane Planting is an Obstacle, Though

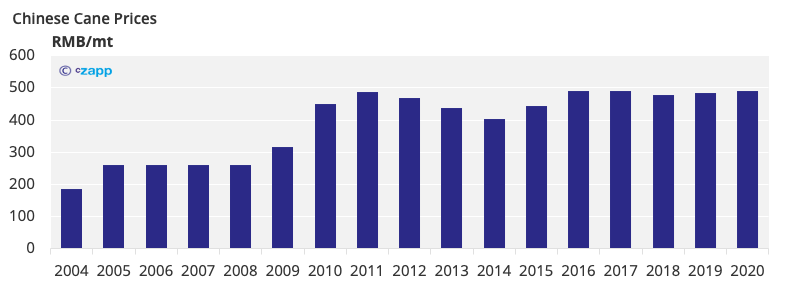

China’s cane prices have been stable in recent years due to various subsidies and price floors set by the government. Any decrease in the cane price would likely deter farmers from planting sugarcane, but we suspect prices will hold firm for the foreseeable future.

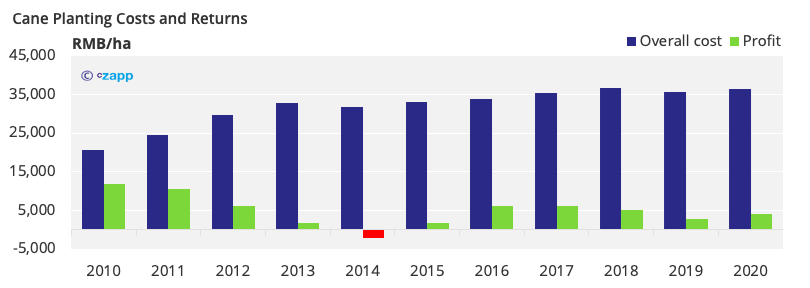

However, the cost of producing cane tripled between 2004 and 2020.

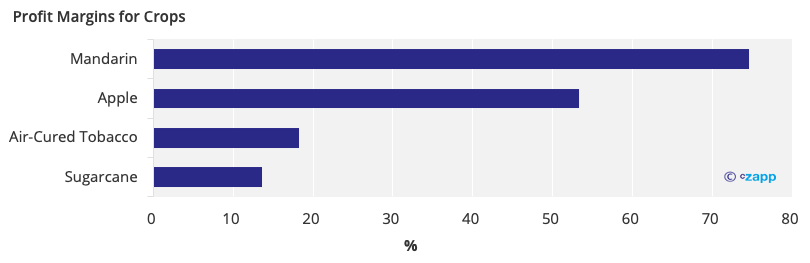

This means that, even with stable revenues, farmers’ earnings are poorer now than they were in the early 2010s, making other crops such as fruit and tobacco more appealing.

To keep cane farmers on board, though, the governments in Guangxi and Yunnan provinces have offered funds to help improve irrigation networks. They’re also paying farmers to lease their cane fields to cooperatives.

Agricultural Limitations Are a Trickier Obstacle

Despite the government efforts to keep cane farmers happy, difficult terrain and poor soil fertility ultimately limit cane expansion in China. Over 90% of the country’s cane is grown in Guangxi, Yunnan and Guangdong, and expansion in cities or on hilly terrain would be near impossible.

This is complicated further by the fact that China’s food security policy requires that flat, fertile land is reserved for the cultivation of staple foods, such as rice and wheat.

If you’re wondering whether sugar beet could save the day, it’s unlikely. Sugar beet accounts for just 10% of China’s production and the government is doing little to push expansion here.

Concluding Thoughts

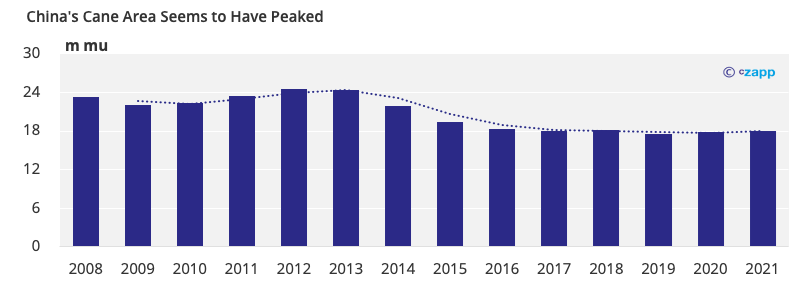

- China’s cane and sugar production seemed to peak in 2008.

- Acreage shouldn’t decline any further, though, as the Central Government pushes for sugar self-sufficiency.

- Cane’s agricultural and sucrose yields should remain where they are too as new varieties prove themselves to be marginally effective, and China’s weather and soil conditions are unlikely to change

- China will therefore remain one of the world’s largest raw sugar importers and CS Brazil’s top buyer.

Other Insights That May Be of Interest…

The World Needs More Sugar…Who Can Help?

India’s Unknown Climate Heroes

Explainers That May Be of Interest…