Insight Focus

- Both raw and refined sugar futures prices strengthened over the last week.

- The CFTC is still affected by an earlier cyber-attack, hindering access to up-to-date trading data.

- Despite this, we still think speculators hold a large long position in raw sugar.

New York No.11 Raw Sugar Futures

No.11 raw sugar futures slowly strengthened back above 21c/lb over the last week of trading.

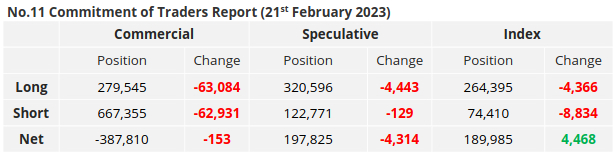

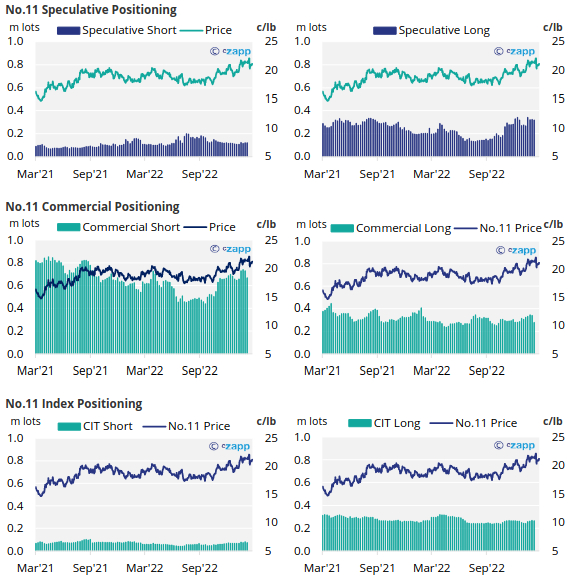

The CFTC is slowly recovering from a cyber-attack earlier in the year, releasing trading data up to the 21st of February on Friday, this is still a few weeks behind the usual schedule:

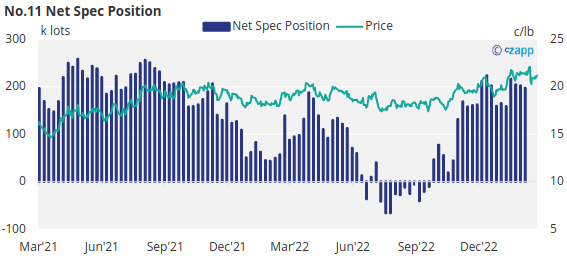

This in mind, whilst we still don’t have access to current data we think that raw sugar speculators still hold a large long position given the continued market strength so far in 2023. For reference, by the 21st of February the net spec position stood at just under 200k lots long.

Stronger prices should also mean raw sugar producers have been offered plenty of opportunity to hedge too, for reference, by the 21st of February the commercial short position accounted for over 60% of total open interest in raw sugar.

Raw sugar consumers had been hedging closer to 18c/lb in 2022, with the market 300 points above this now we think it is likely that buying will have been hand-to-mouth.

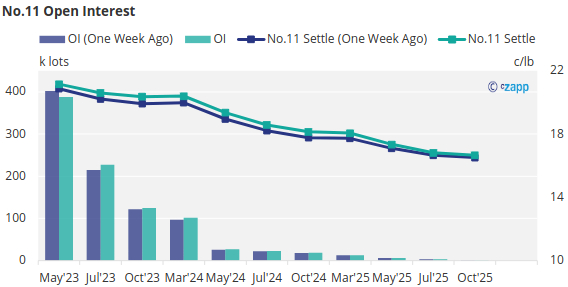

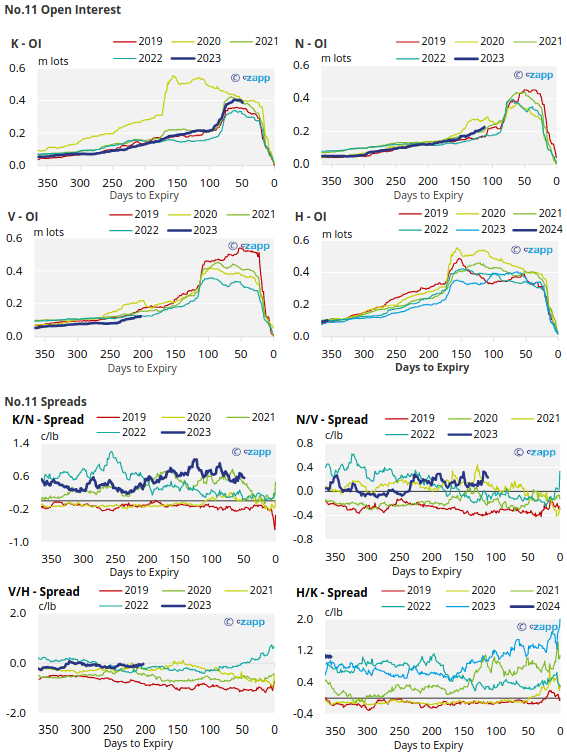

The No.11 forward curve remains backwardated throughout 2023, the May/July spread has narrowed slightly over the last week, closing at a 56-point premium by last Friday.

London No.5 Refined Sugar Futures

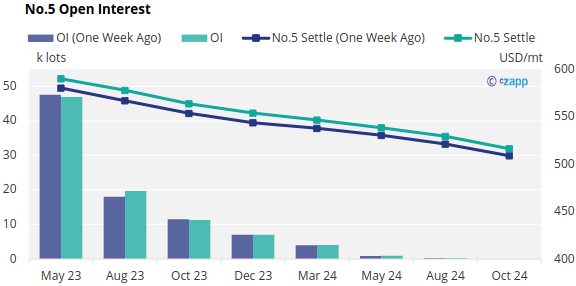

No.5 refined sugar futures have strengthened toward 590USD/mt over the last week, the first time since before the Oct’22 expiry last year.

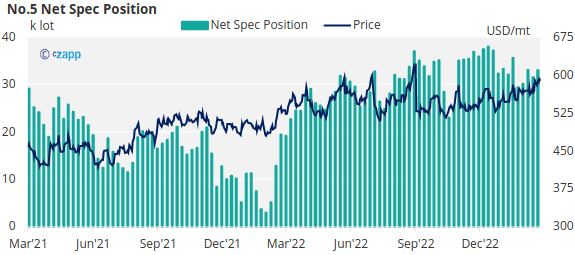

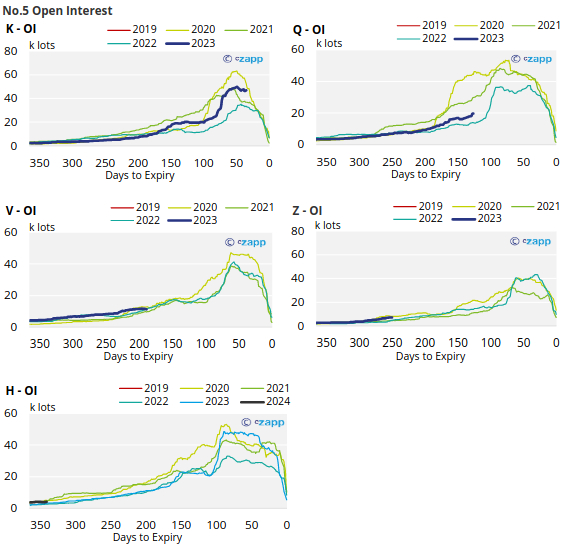

No.5 CoT data has been unaffected by the recent cyber-attack, as of the 7th of March the refined sugar net spec position increased back toward 33k lots long, an increase of around 1.5k lots from the previous week.

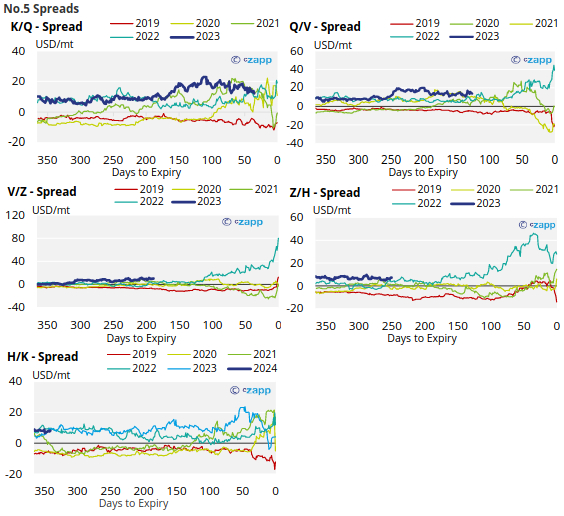

Whilst contracts down the board have lifted over the last week, the No.5 forward curve remains backwardated into 2024.

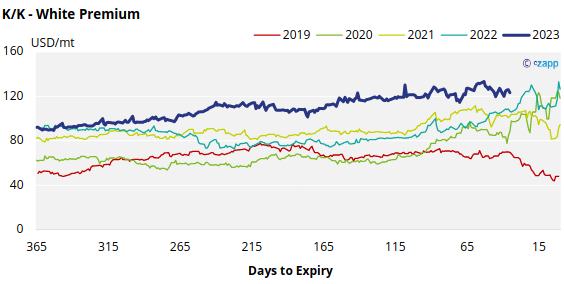

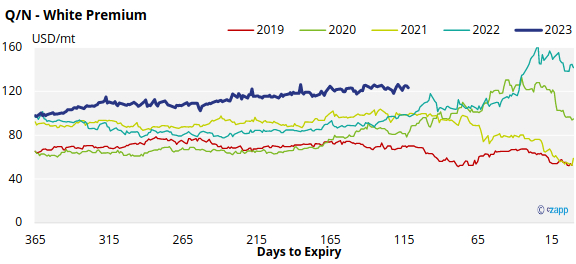

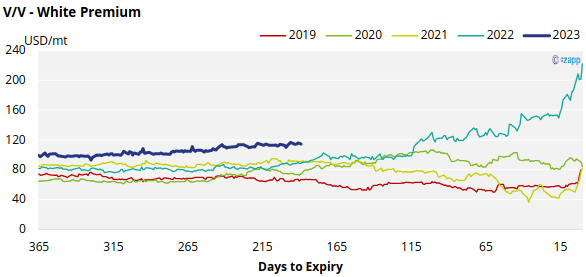

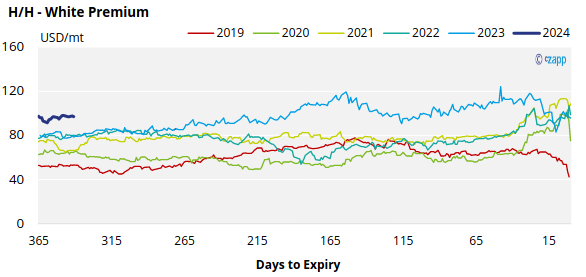

White Premium (Arbitrage)

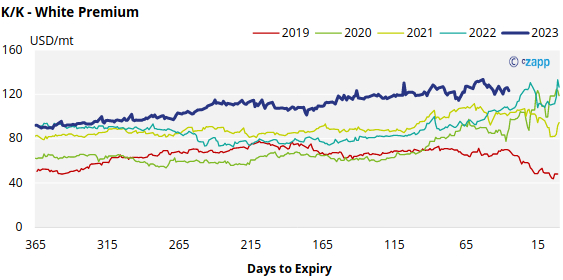

The K/K sugar white premium still trades above 120USD/mt. With world energy prices falling, we think re-exports refiners need around 115-125USD/mt above the No.11 to profitably produce refined sugar.

This has fallen noticeably from the 140USD/mt margin we thought necessary earlier in 2022.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix