Insight Focus

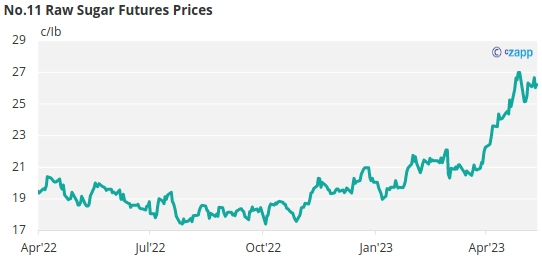

- Raw sugar futures traded sideways over the past week, hovering around 26c/Ib.

- Likewise, refined sugar futures also traded sideways, trading around 715USD/tonne,

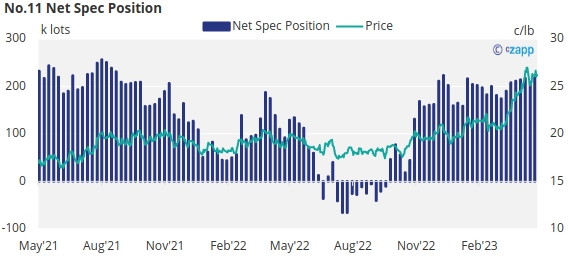

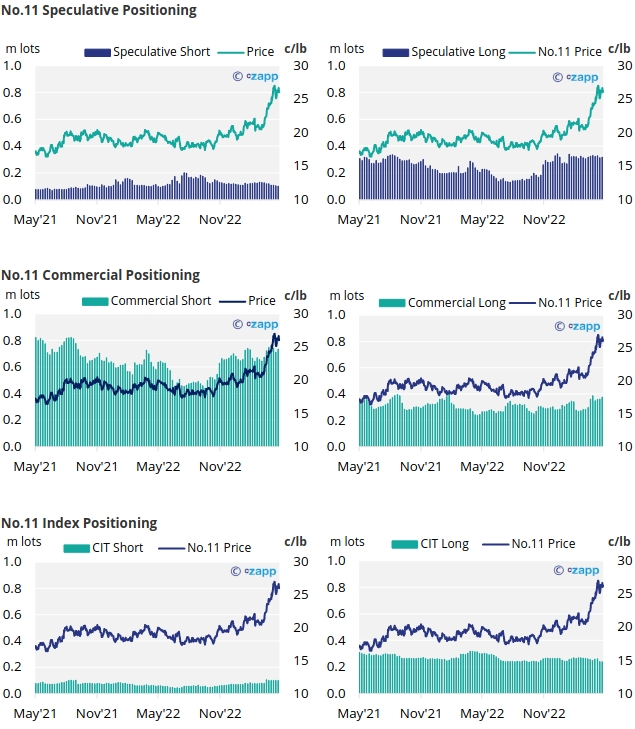

- The net speculative position has recovered slightly since last week’s update.

New York No.11 Raw Sugar Futures

The No.11 raw sugar futures traded sideways over the past week, hovering around the 26c/Ib mark before closing at 26.22c/Ib last Friday.

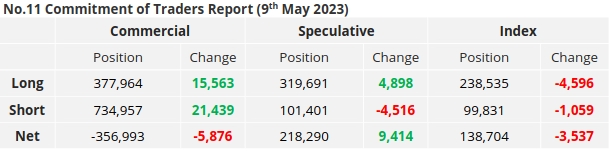

By the 9th of May (latest CoT CFTC report), both raw sugar producers and consumers had added new hedges, 21k and 15k lots respectively. Producers are likely profiting from the price increase, while consumers hand-to-mouth buy.

Over the same timeframe, raw sugar speculators opened approximately 5k lots of new long positions and cut around 4.5k short positions. As such the net spec position has extended by around 9.4k lots to 218k lots long.

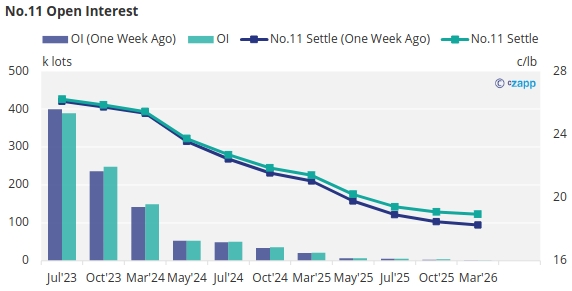

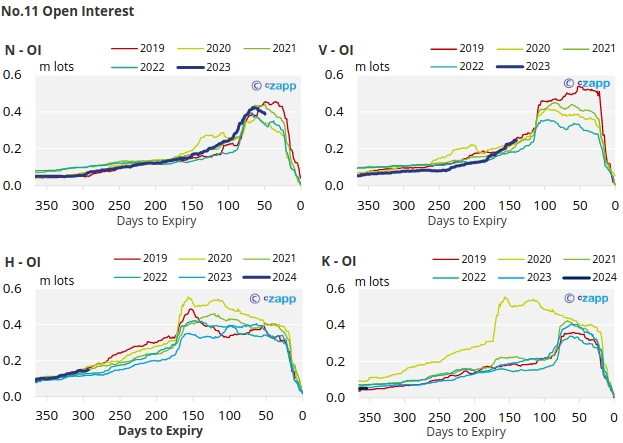

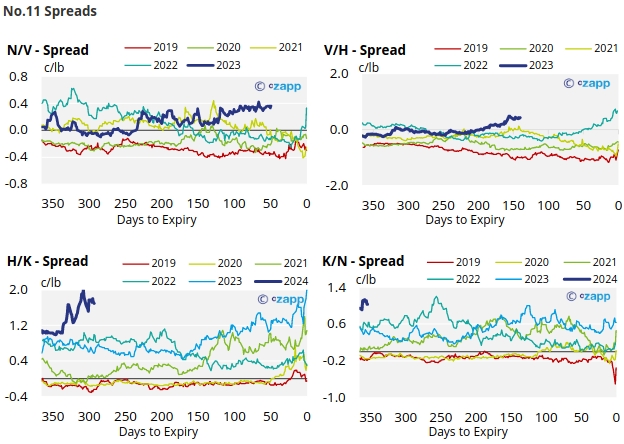

The No.11 forward curve has become increasingly backwardated over the last week, particularly in the nearby contracts, reflecting the tightness in the raw sugar market.

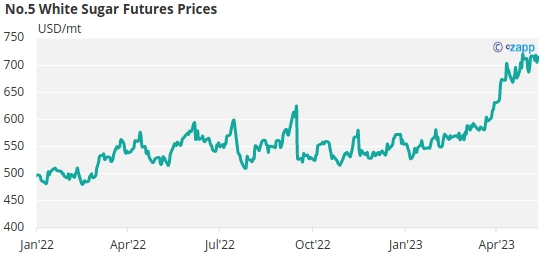

London No.5 Refined Sugar Futures

The No. 5 refined sugar futures, which also traded sideways last week, closed at 715 USD/mt on Friday.

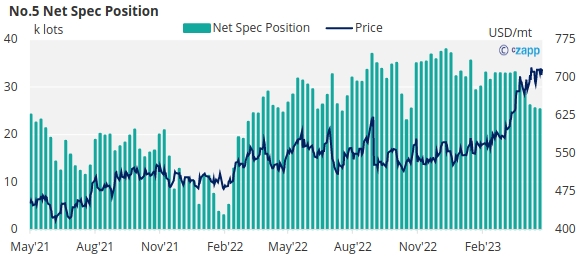

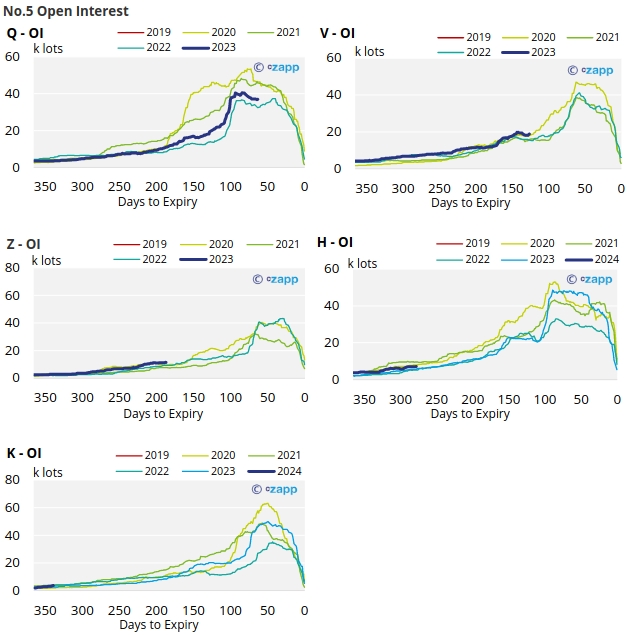

By the 15th of May (latest CoT report) the refined sugar net spec position weakened slightly, now standing at 25k lots, similar to where it was this time last year.

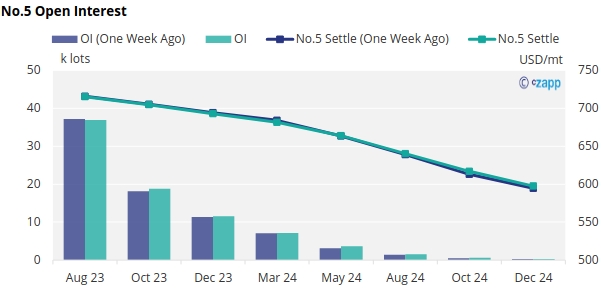

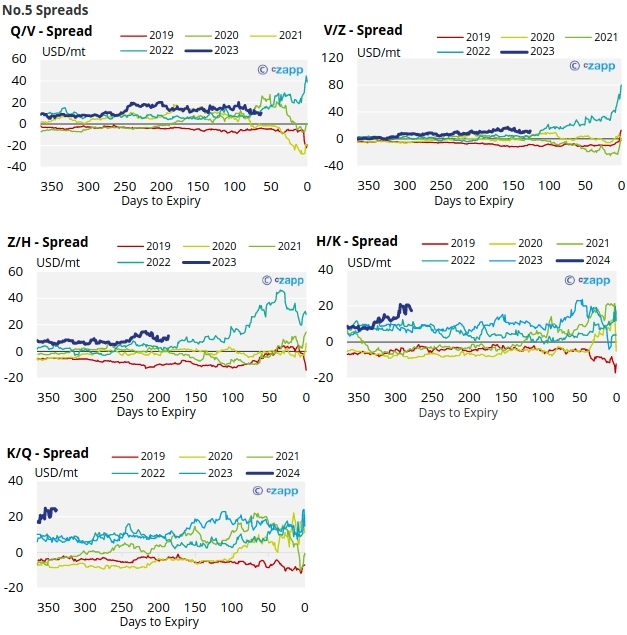

The No.5 forward curve remains strongly backwardated as far ahead as Dec’24.

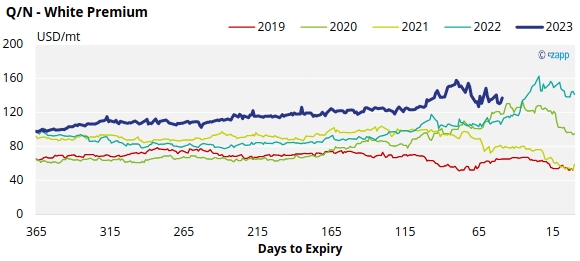

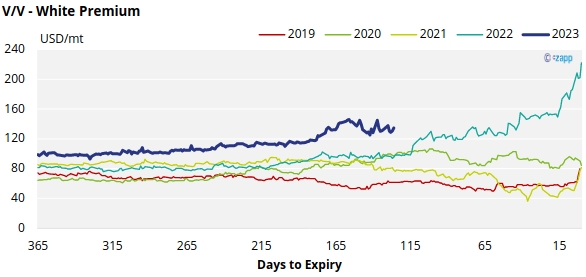

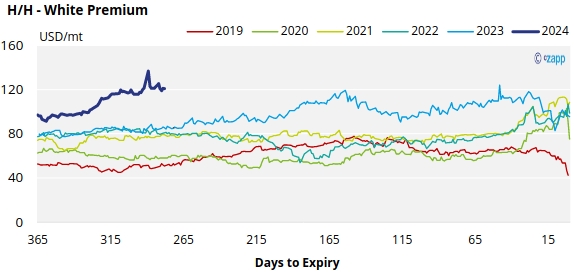

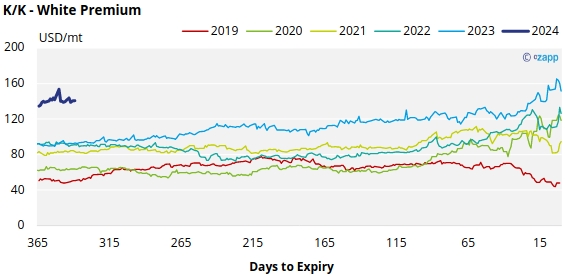

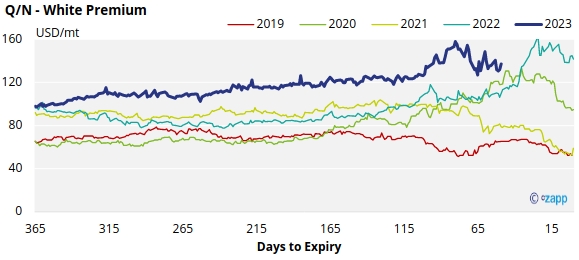

White Premium (Arbitrage)

The Q/N sugar white premium increased slightly over the past week, now trading at 137USD/mt.

The refined sugar market is expected to be slightly undersupplied for the majority of 2023, as evidenced by comparatively strong V/V and H/H white premiums, which have also been rising and now approach 135USD/mt and 121UD/mt, respectively.

With global energy prices falling, we believe re-exports refiners require around 120-135 USD/mt above the No.11 to produce refined sugar profitably.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix