Insight Focus

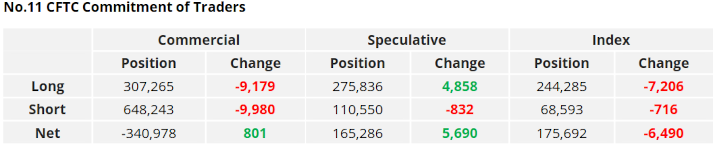

- Raw sugar futures continue to trade toward the top of the range.

- No.11 speculators added new long positions.

- Strengthening white premiums suggest refined sugar market tight later in 2023.

New York No.11 (Raw Sugar)

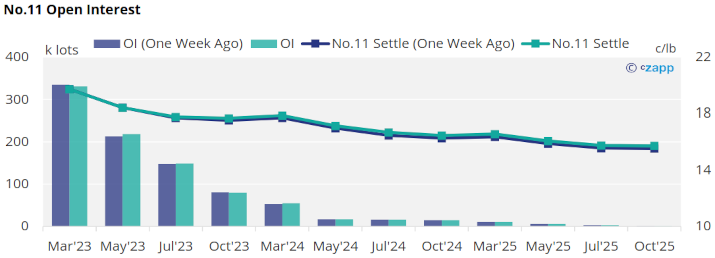

No.11 futures have traded sideways toward the upper end of the 18-20c/lb range, falling to 19.72c/lb by Friday close.

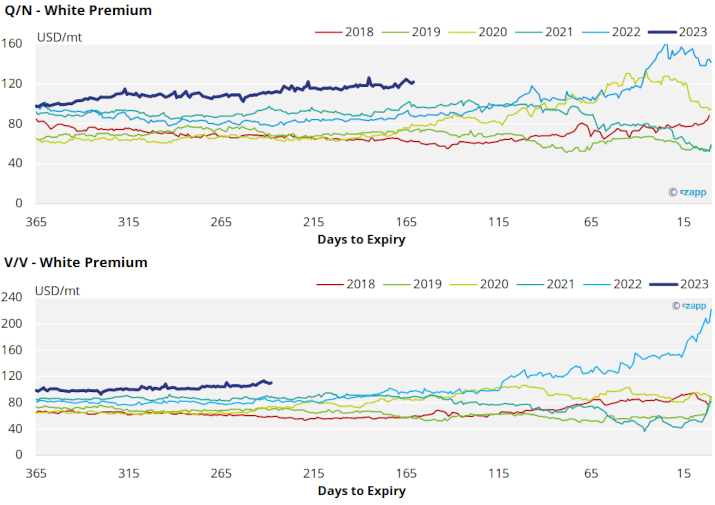

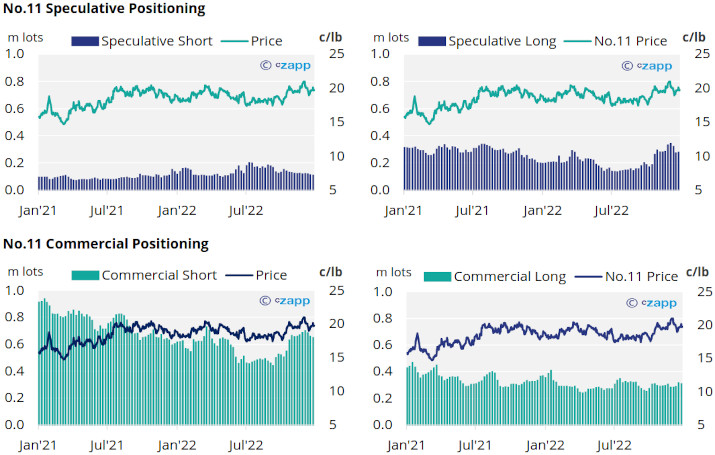

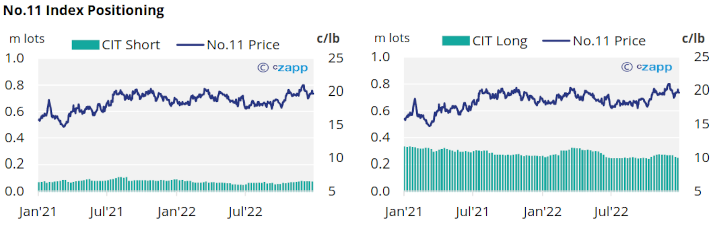

By the 17th of January (latest CoT CFTC), speculators added almost 5k new lots of long positions. Alongside this 1k lots of spec short positions were closed. With this, the spec short position now stands around 110k lots, the lowest since June 2022.

As such, the net spec position has extended to over 159k lots.

On the commercial side, both raw sugar producers and consumers have closed 10k and 9k lots, respectively. The current market strength could pressure raw sugar consumers to return to hand-to-mouth buying.

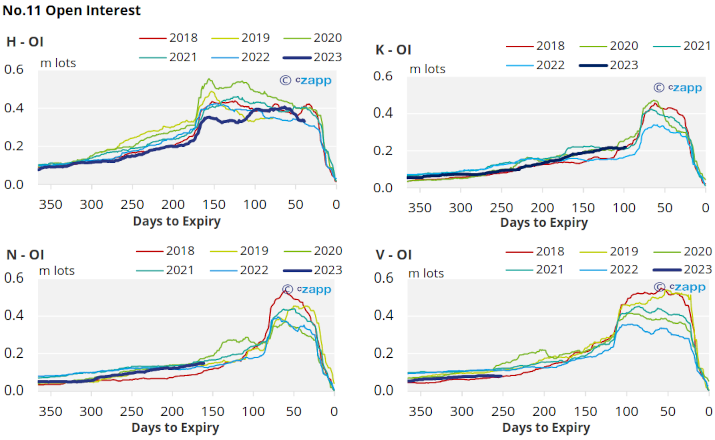

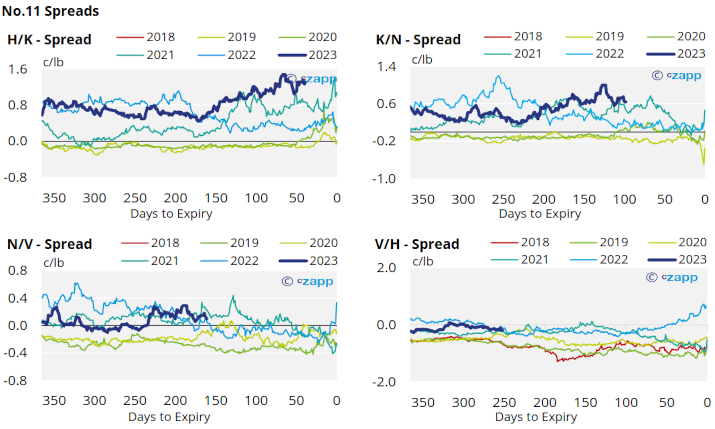

The No.11 forward curve remains inverted until Oct’23, moving into contango to Mar’24.

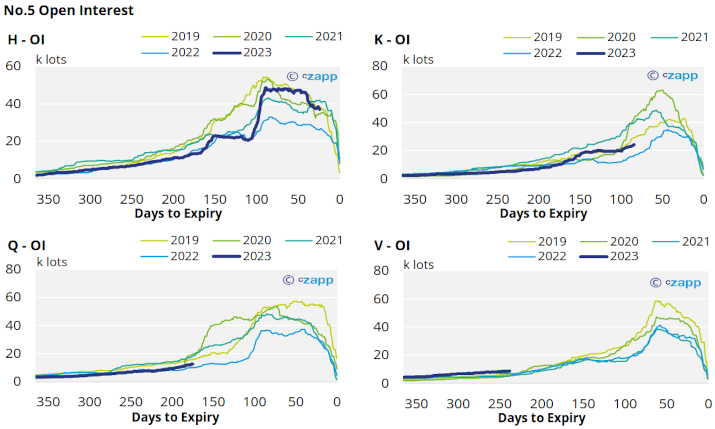

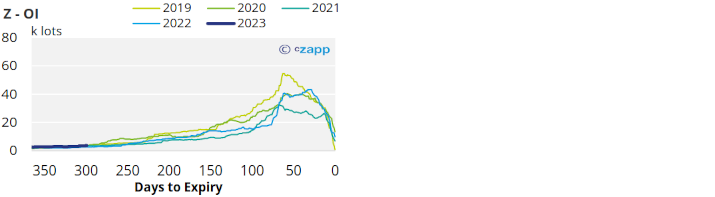

London No.5 (Refined Sugar)

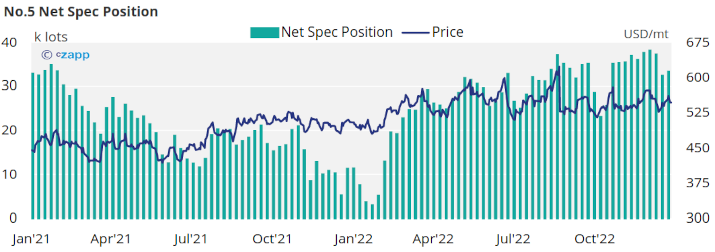

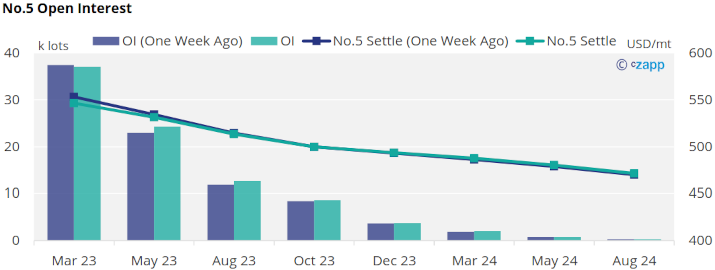

No.5 refined sugar futures fell toward the end of last week, closing at 546USD/mt by Friday.

By the 17th of January (latest CoT CFTC), the net spec position increased to over 33k lots. Thus despite it weakening at the start of the year, specs remain significantly long in refined sugar.

The No.5 forward curve flattened slightly in the nearby contracts; the H/K spread now trades at a 15USD/mt premium. Overall, the curve remains backwardated into 2024.

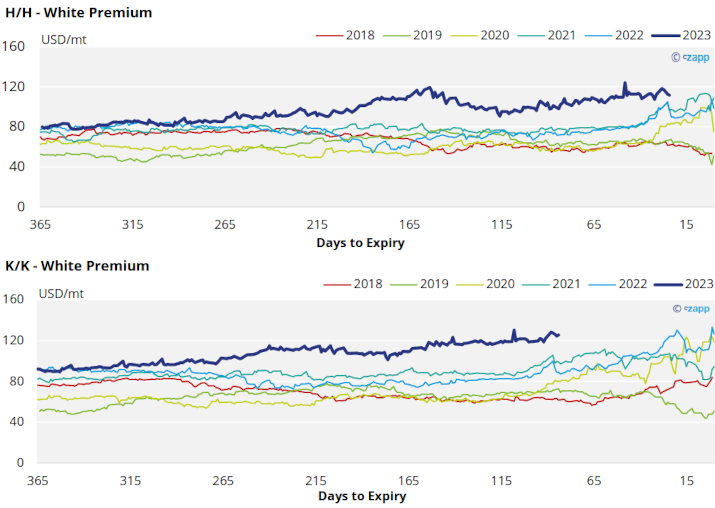

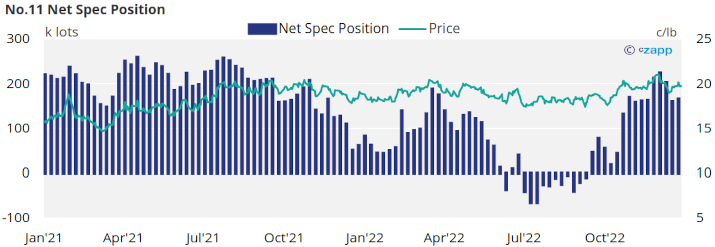

White Premium (Arbitrage)

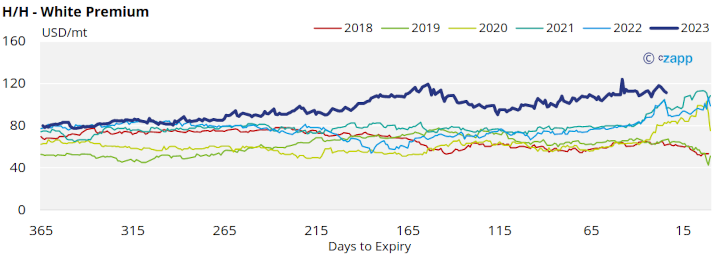

The H/H sugar white premium has been moving within 110-120USD/mt, falling to the lower end of this range by the end of last week.

We think re-exports refiners need around 115-125USD/mt above the No.11 to profitably produce refined sugar which hasn’t been the norm throughout the H/H period, therefore physical values are necessary to bridge this gap.

Comparatively stronger K/K and Q/N white premiums both strengthening above 120USD/mt suggest the refined sugar market is likely to be slightly undersupplied for most of 2023.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix