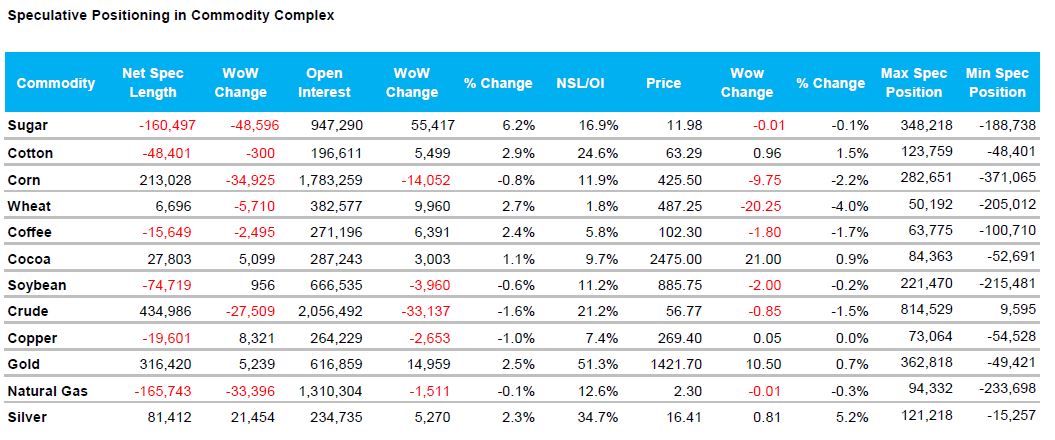

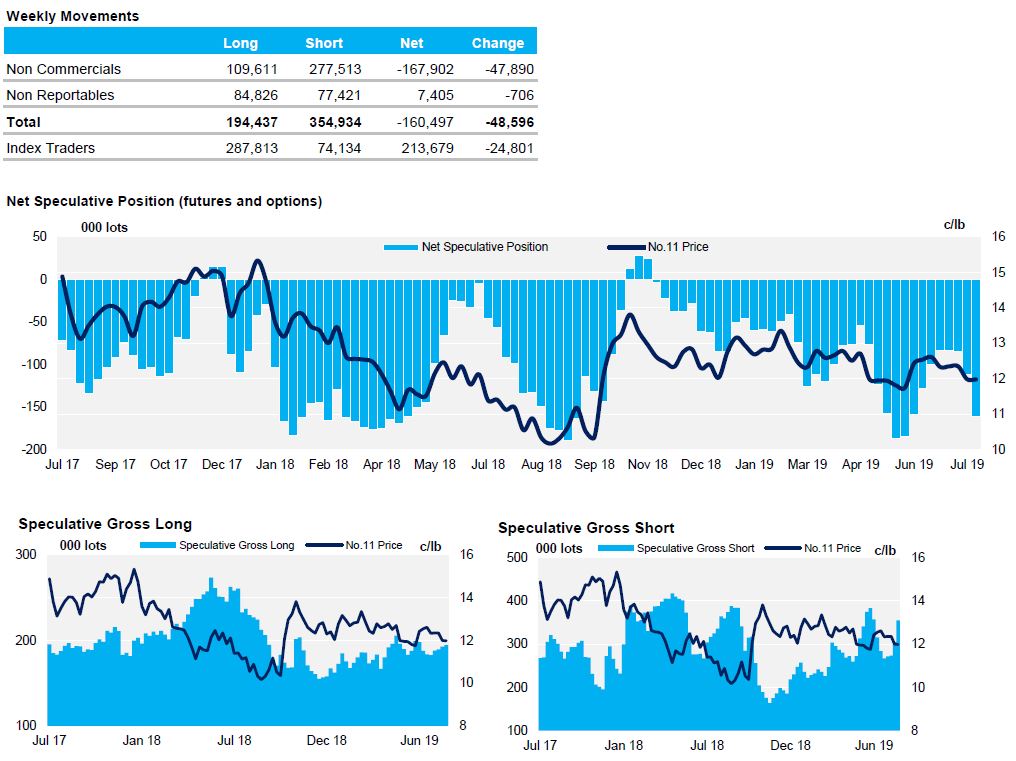

- As of last Tuesday the No.11 net spec position had reached close to a record short at 160k lots but this was unable to push the market beneath this year’s range.

- This failure has seen prices rebound back to 12c, presumably fuelled by short covering.

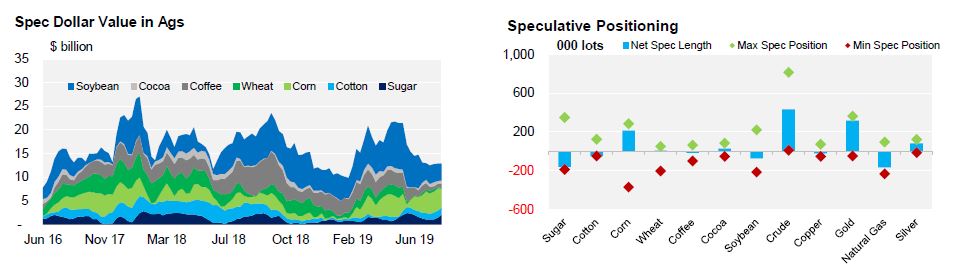

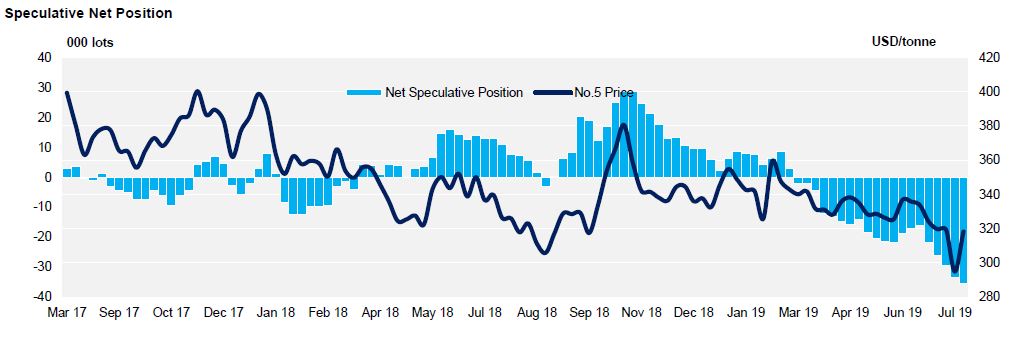

- The No.5 net spec position is now almost triple the record set in 2018 before the most recent spec push lower and sits at 36k lots short.

ICE No.11 Futures Speculative Positioning (values as of 23rd July 2019)

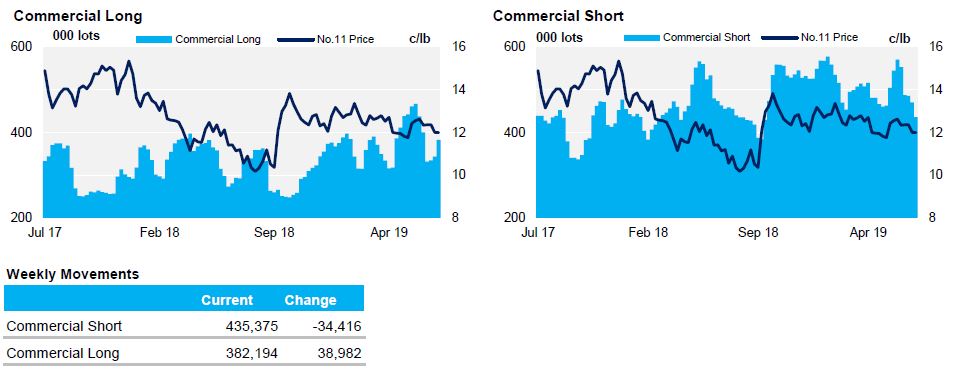

ICE No.11 Futures Commerical Positioning (values as of 23rd July 2019)

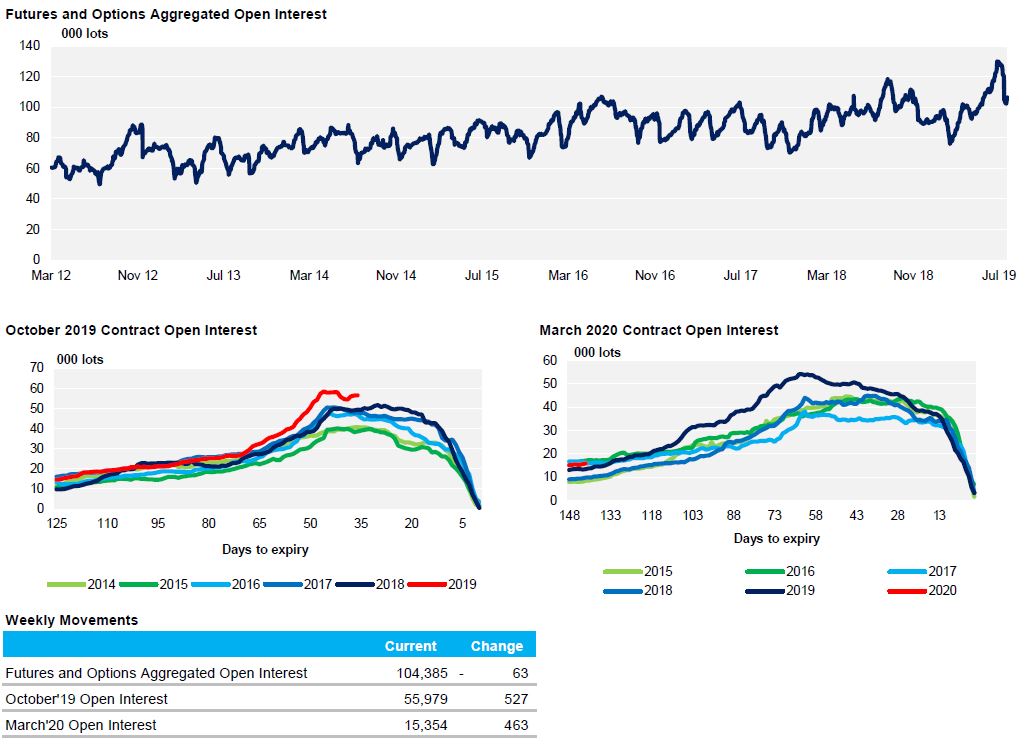

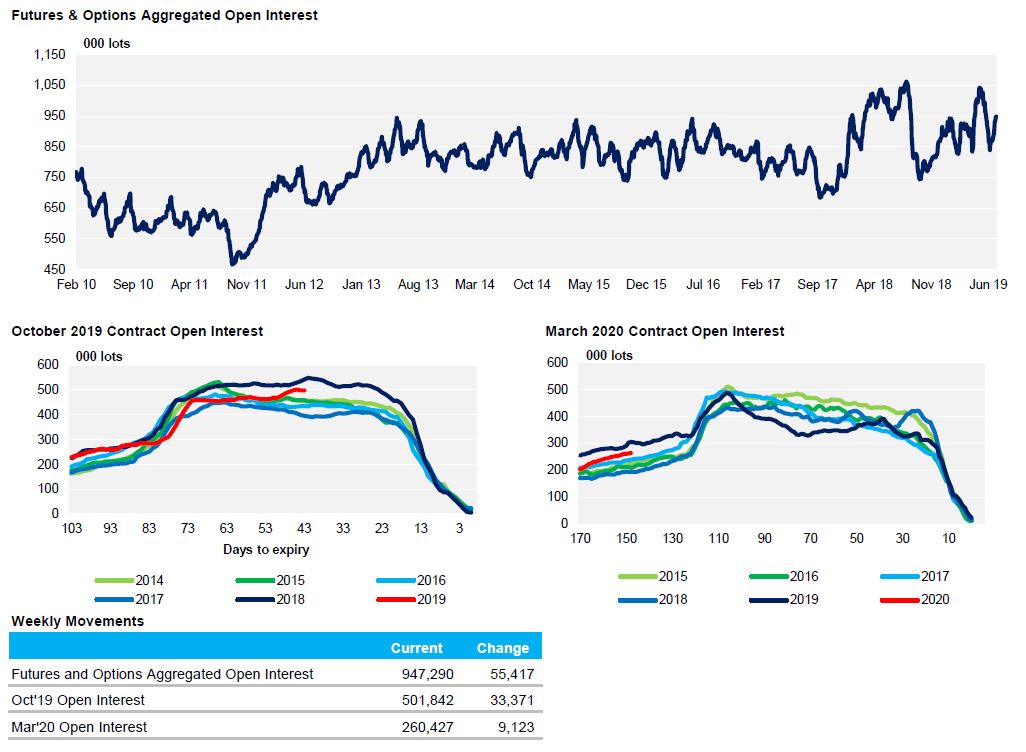

ICE No.11 Futures Open Interest (values as of 23rd July 2019)

ICE Futures Europe (No.5) Speculative Positioning (values as of 23rd July 2019)

ICE Futures Europe Open Interest (values as of 23rd July 2019)