Insight Focus

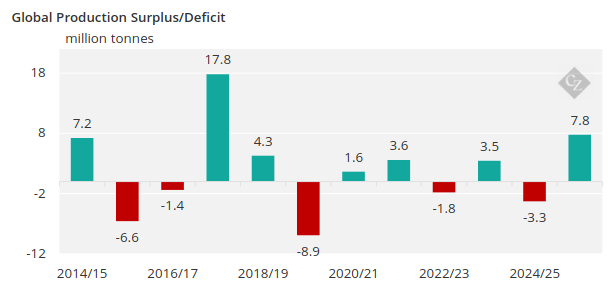

We retain our view that the 2025/26 season will bring a global sugar stock rebuild. We think production will exceed consumption by a little less than 8m tonnes. We think a major point of difference between us and the rest of the market is that we forecast stagnant consumption growth.

2025/26 at a Glance…

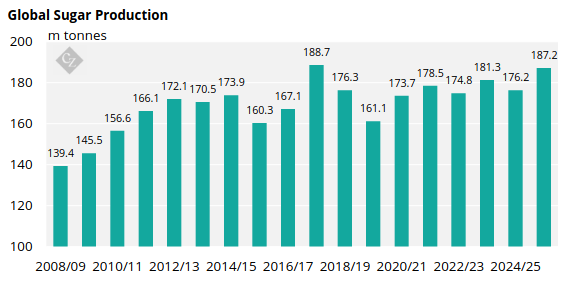

Global Sugar Production

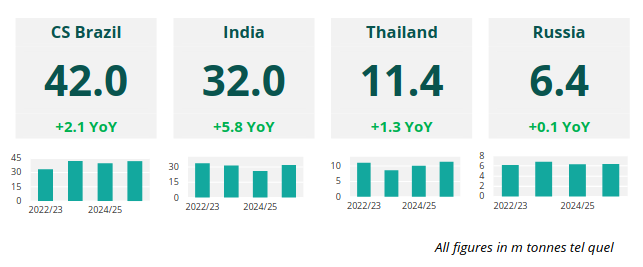

Our estimate for global sugar production in 2025/26 is 187.2m tonnes. If achieved, this would be the second-highest sugar production on record, after the 2017/18 season. This follows higher cane area in countries like India and Thailand, area which would have led to higher production in 2024/25 had the weather been normal.

Much of the weather that’s important for our 2025/26 projection is yet to happen. Major northern hemisphere regions are about to enter the phase where cane grows the strongest and the water requirement is highest. Therefore, we’ll need to monitor moisture levels in the coming months. For northern hemisphere beet, this is also an important time as beet seedlings emerge and mature. We are aware of late frosts in Russia which could require farmers to replant some beet areas, and have downgraded our crop forecast accordingly.

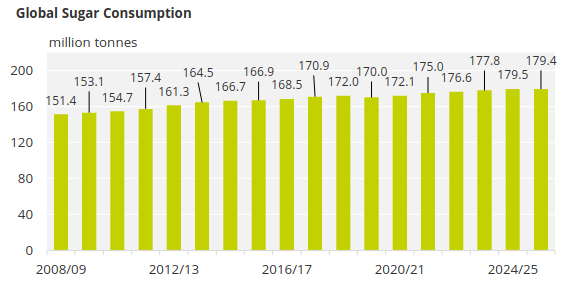

Global Sugar Consumption

We do not expect to see any meaningful growth in sugar consumption in 2025/26, due to food price inflation, increased awareness of sugar consumption and GLP-1 drugs.

We are concerned that the emergence of GLP-1 receptor agonist drugs like Ozempic and Zepbound will undermine sugar consumption globally. In 2025 and 2026 this is likely to occur only in the world’s wealthiest countries, where many consumers can afford these drugs.

However, semaglutide (Ozempic) comes off patent in many countries in 2026. At this point, drug manufacturers will be able to release cheaper biosimilars, increasing availability. This should lead to greater uptake in other less-wealthy countries too.

To account for these drugs, we have factored in a gradual decline in sugar consumption for the USA from 2024, extending to most G20 countries in 2025 and 2026.

Production Surplus in 2025/26

We forecast a production surplus of 7.8m tonnes in 2025/26. If achieved, this would be the second largest production surplus in the last 10 years and would help to rebuild some of the stock drawdown that’s happened globally since 2020. A full breakdown of our production surplus can be found here.

Production Update: EU-27+UK

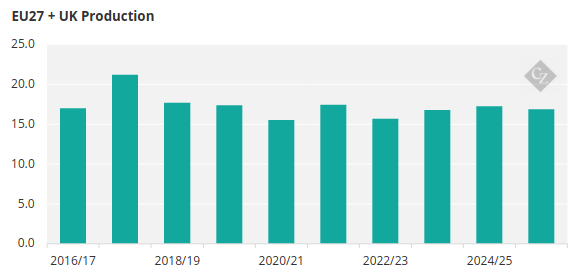

We estimate that the EU and UK will have a combined production of 16.9m tonnes in the 2025/26 season.

Dry weather in Europe has aided with early beet sowings, but normal rainfall will be needed for the beet to develop well and so far, the weather has been dry in North West Europe — we will continue to monitor this. We further expect EU+UK beet area to decline this season by around 5-7%, from 1.61m ha to 1.51m ha. But if yields are better year-on-year it could help offset some of the area loss.

Other Sugar Producers at a Glance…