Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

ICE BRENT CRUDE OIL SPOT

Foiled shy of a key 89 hurdle, Brent doubled back through the Opec gap and has delved close to the prior 70 trough. If it could mop up here and rebound over 80.5, suspicions of a big double bottom evolving would build. By no means secure yet though and gouging below 70 would point to a full Fibonacci retracement at 63 before trying the brake again.

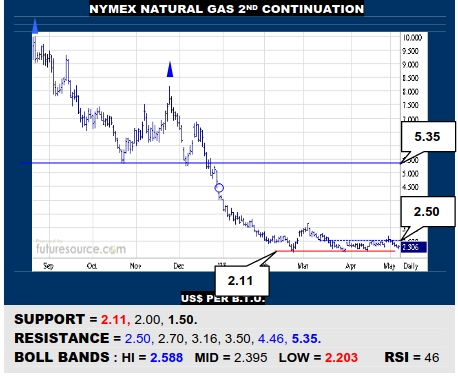

NYMEX NATURAL GAS 2ND CONTINUATION

A preliminary base escape over 2.50 was promptly smothered so Nat Gas has one false start to its name but would stay on watch for any next 2.50 break still delivering more pep and a next foray to 3.16, a gateway on to the low 4’s. It would still take a clean snap of 2.11 to dispel basing impressions and pose a new threat down to 1.50.

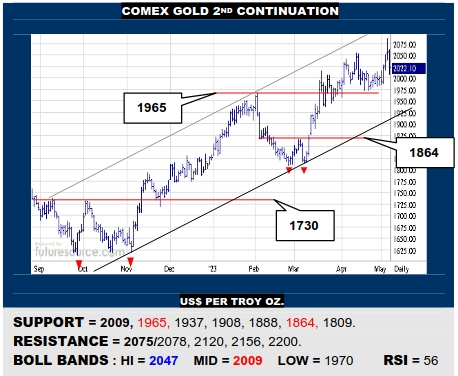

COMEX GOLD 2ND CONTINUATION

An early May flurry glimpsed through the 2075/2079 monthly peaks but RSI divergence and a quick backlash have swiveled focus onto the mid band (2009). Hold here and a breakout to new ground over the 2070’s could yet be seen, compounding if the $ index left the 100’s. If the mid band gave way though, beware loss of 1965 tripping a dive to 1864.

LME COPPER 3-MONTHS

The 8440 ledge has resiliently buffered a derailment from the uptrend to deny a large 6-month H&S absolute confirmation. That remains a risk of course and would then open the way down to first 7850 and later 7340. Gritting the teeth for now though and grafting back across the 8700’s would dispute the toppy shape and suggest restoring a better foothold.

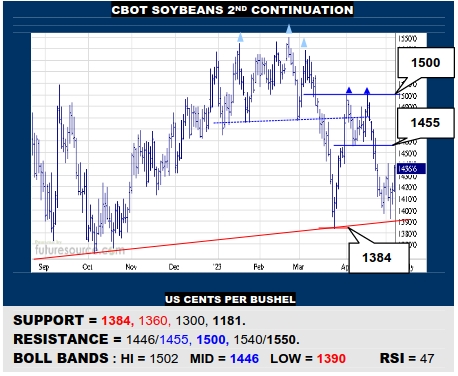

CBOT SOYBEANS 2ND CONTINUATION

Beans held clear of a key 1384 pivot to a much broader top. Must still watch that point as a tripwire for a far deeper delve therefore to 1181 and maybe even the 950’s. Meanwhile though there may be a chance for a reprieve if the mid band (1446) and then 1455 were pierced in quick succession, in that case targeting 1500 as a double bottom exit.

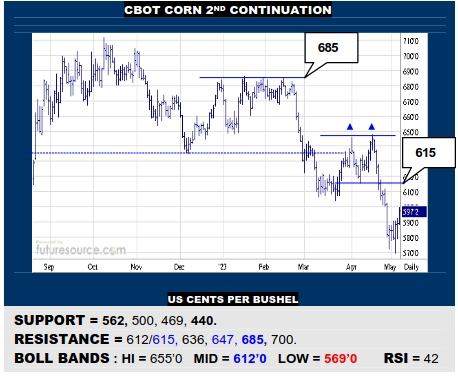

CBOT CORN 2ND CONTINUATION

Similarly, Corn grabbed on just clear of a much larger top tripwire at 562 to avert further hefty losses back to better defined monthly support in the 440’s. Even so, to make longer lasting repairs will demand vaulting the mid band (612) and recent double top border at 615, only then regaining a firmer feel to create scope up to 647 and even 685.

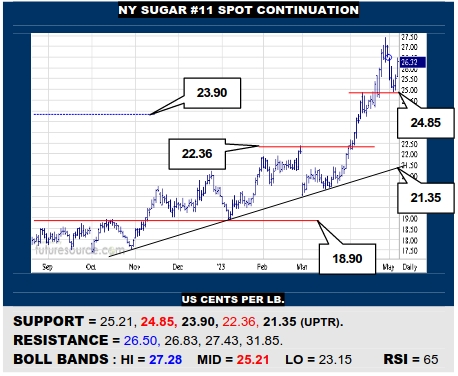

NY SUGAR #11 SPOT CONTINUATION

The mid band intercepted Sugars’ May-Jly hand-off dip and has chased it back up to a prior tiny 26.48-26.50 spot gap. Break this and close over 26.83 and a further significant leg higher to 31.85 would look viable. Fail near 26.50 and the Jly flinch could resume, then on red alert as a break of 24.85 could prompt a setback to 22.36, if not the uptrend (21.35).

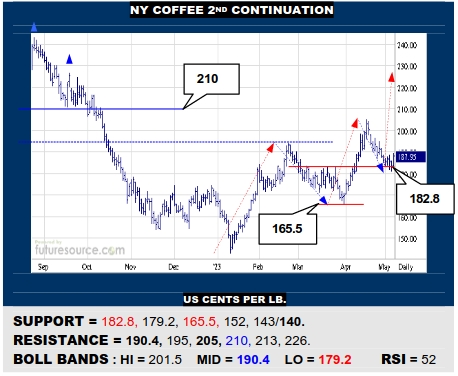

NY COFFEE 2ND CONTINUATION

Absolute precision no but Coffee generally found buffering in the 182’s and nudged back up towards its mid band Friday (190.4). Bust loose beyond and it would end a correction and suggest readiness for a fifth (Elliot) wave higher that could well pop 205 to reach the 220’s. Beware a weaker outcome if the mid band kept the lid on early next week.

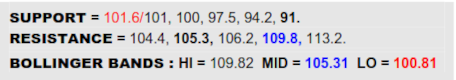

BLOOMBERG COMMODITY INDEX

A second half of April dive in Crude saw the B-Berg swept back down to stab at the prior 101.6 lows this week but Thursdays’ inside day offered a glimmer of hope and sparked an initial reflex over 102.75 Friday. If this can be secured early next week and especially if the Dollar broke below 100.8, it would signal a successful defence of the 101’s here and crack the window for a reaction towards the mid band (105.3), needing a break beyond that to give greater fortification and to bring the main 109.8 resistance back into consideration again. On the other hand, a clean break of the 101’s would mark a next major step down, exposing a slope stretching on towards 91.

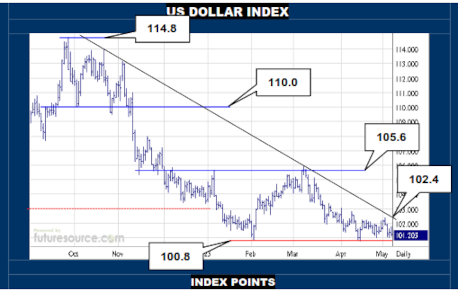

US DOLLAR INDEX

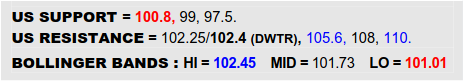

Certainly not much bicep flexing from the Dollar lately and thus far another incremental rise in the Fed rate has failed to impress so that the 100.8 troughs remain very much in play as the mid term downtrend squeezes closer (102.4). If this led to a decisive snap from triple digits, it would clarify the two ’23 gouges through a 103 monthly base rim as a bona fide overthrowing of that base, opening passage down to the next main buffering at 93 and potentially giving the B-Berg a crucial boost out of its own predicament. Not toppled yet however and thus watching the trend closely, a rip free from it opening the lid back towards 105.6, whereby the B-Berg could be in serious peril.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.