Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

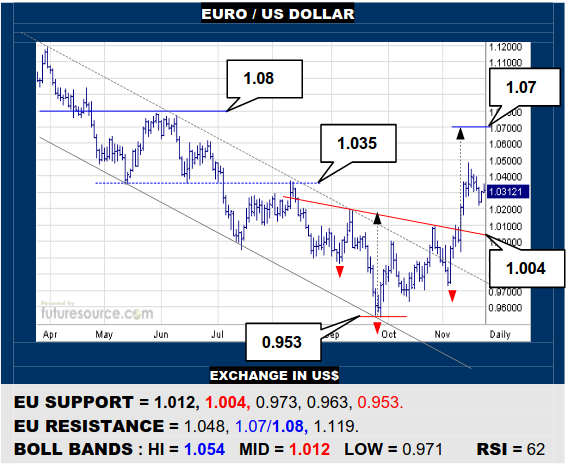

EURO / US DOLLAR

A nearby dip hasn’t troubled the mid band and the EU remains some way clear of its inverse H&S base (1.004) so the pattern looks solid and in with a chance for a flag if later able to pierce 1.048. Keeping sights on the 1.07 base projection then while only slipping back out of the 1’s would dissolve the base and turn focus back to 0.953.

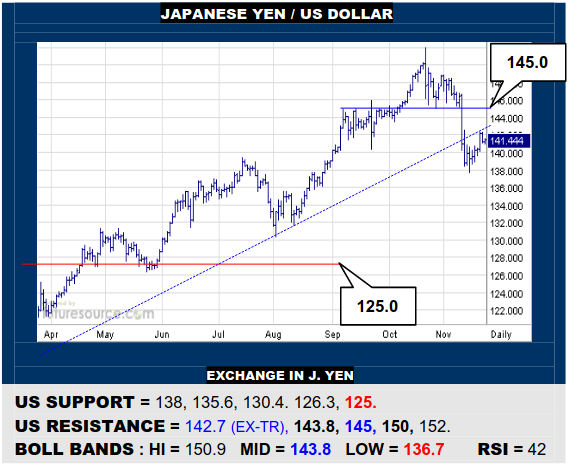

JAPANESE YEN / US DOLLAR

The US has taken a breath to jab at its previously broken uptrend (142.7). Even so, it must clamber back over this and the 145 rim of the new top to really make some persuasive repairs. Anything less would look corrective, leaving the underside vulnerable where a subsequent break of 138 would expand downside risk back to 125.

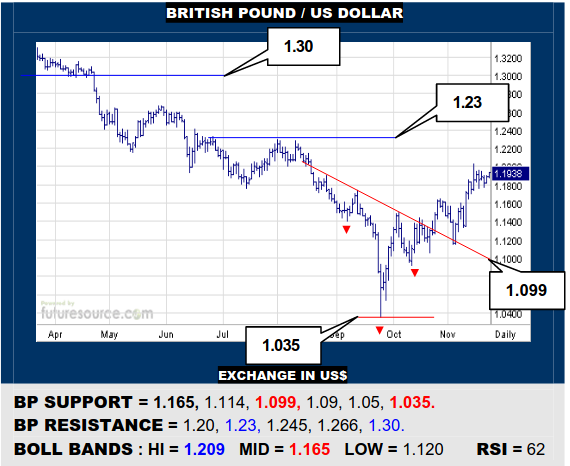

BRITISH POUND / US DOLLAR

A spell of congestion just shy of 1.20 has a flaggish vibe so the BP breaking into the 1.20’s would bode well for an ongoing defeat of 1.23 to reach the 1.26 vicinity. Meantime, only reeling through the mid band (1.165) would more seriously undercut recent efforts and threaten a delve back to the 1.12 area, if not to the inverse H&S neckline (1.099).

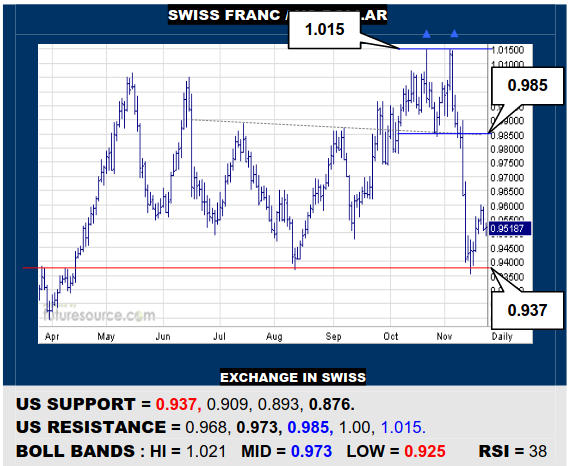

SWISS FRANC / US DOLLAR

The 0.937 shelf gave the US a boost back up but in the wake of the prior dive from 1.015, it initially just serves as a corrective gulp of air. Would have to at least see the mid band scaled (0.973) to give a more offensive gist that could endanger the 0.985 top rim. Meantime wary of another challenge to 0.937 and risk on down to 0.876 below.

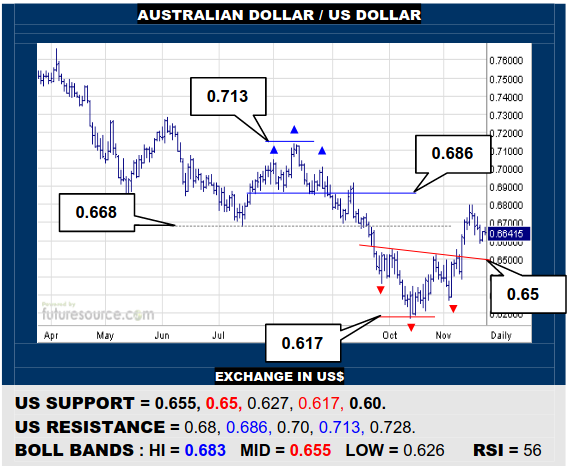

AUSTRALIAN DOLLAR / US DOLLAR

The AD base escape came up shy of the prior H&S above 0.686 and it has taken a corrective swerve lower. This isn’t chiming any alarm bells as yet though with the mid band and base neckline presenting good buffering in the 0.65’s. Only falling back under 0.65 would look truly damaging then while otherwise seeking a further rally to 0.713.

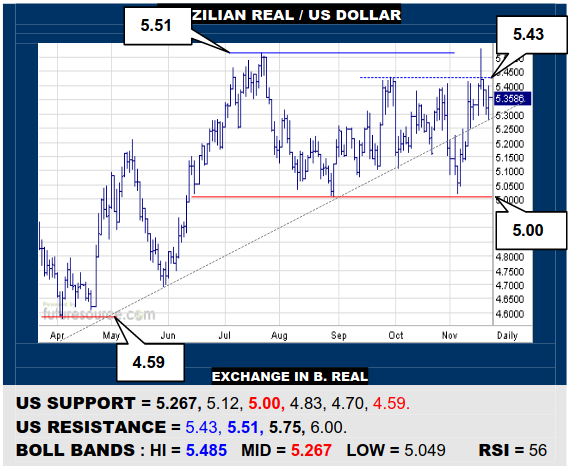

BRAZILIAN REAL / US DOLLAR

The US stabbed over 5.43 to tag the 5.51 Jly peak but promptly fell back below again. This now puts the responsibility on the mid band (5.267) to gather up if another try for 5.51 is to occur. If instead the mid band succumbed, be prepared to tumble back towards the 5 figure once more, where a substantial double top could be formed.

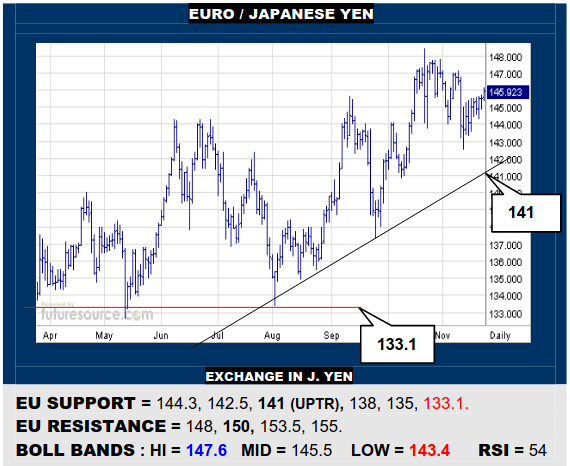

EURO / JAPANESE YEN

The EU retrieved a dip without troubling its overall ’22 uptrend (141) but must secure the mid band break (145.5) to hint at a large flag-like event that imply scope up across 148 towards 153. Not exactly rapid progress of late though so watch a 144.3 pivot to warn of fumbling this revival, in which case fearing a new swipe lower to the trend itself.

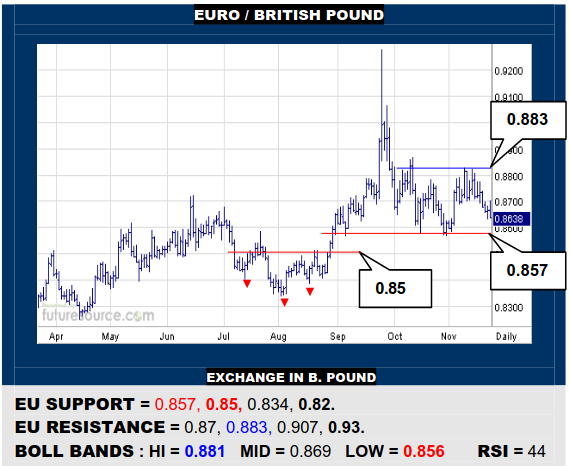

EURO / BRITISH POUND

Q4 had base-like undertones but the EU has slipped through its mid band from a micro-sized Nov H&S and now looks prone to testing the 0.85’s defenses again. If able to dig in at 0.857 again, the basing effort could be revived. Alas, loss of 0.857 would tilt more towards a broader top that would be confirmed if 0.85 later gave way.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.