Insight Focus

- Thai ethanol consumption is falling.

- The local ethanol industry has overcapacity.

- Dissolution of parliament leads to regulatory freeze.

Thai Government Ethanol Policy Change

The Thai government has made a major policy shift away from ethanol.

In 2022 it stopped using its Oil Fund to support biofuels. It will now support electric vehicle adoption instead as part of its “30@30” policy, where 30% of new vehicles will be zero emissions by 2030.

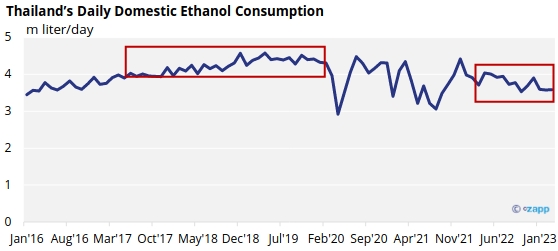

This puts the Thai ethanol industry in a difficult position. Domestic ethanol consumption has dropped from highs close to 4.5m litres per day pre-COVID to around 3.5m litres per day.

The industry now has significant overcapacity. It is able to produce 6.5m litres per day with a further 0.7m litres per day due to be commissioned.

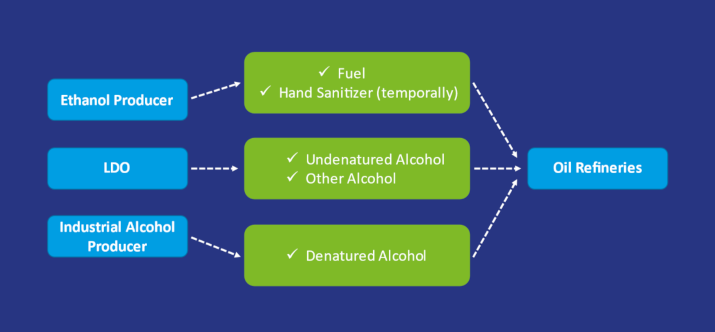

Worse, Thai ethanol producers are only allowed to sell their product to oil refiners for blending into gasoline. A temporary exemption also allows them to make pharmaceutical grade hand sanitizer.

By contrast, the state-owned Liquor Distillery Organisation has a monopoly on selling undenatured alcohol and other alcohol products. Other industrial alcohol producers are only permitted to sell denatured alcohol. Neither the LDO nor the industrial alcohol producers want more competition from Thai ethanol producers.

Possible Solutions

One possible solution is to allow the Thai ethanol producers to export their surplus products. However, export values are below their cost of production.

Another solution is to allocate the markets differently: LDO could supply government and state-owned markets, industrial alcohol producers could supply existing industrial markets and ethanol producers could be allowed access to new markets like bioplastics or biojet fuel.

However, these new markets are not mature and changes to ethanol regulations would require cabinet approval. Parliament is currently dissolved and the cabinet is suspended. A new cabinet isn’t expected to be formed until August 2023 at the earliest. Ethanol producers have been struggling with oversupply for months already.

As a result, Thai ethanol producers are searching for short-term actions they can take. One is to persuade the Oil Fund to change fuel pricing so that motorists are encouraged to use more E20 and less E10. Another is to prepare for access to bioplastics market by seeking sustainability certification for Thai ethanol, which might open access to other global green industries. However, until a new cabinet forms the industry will remain in a difficult position.