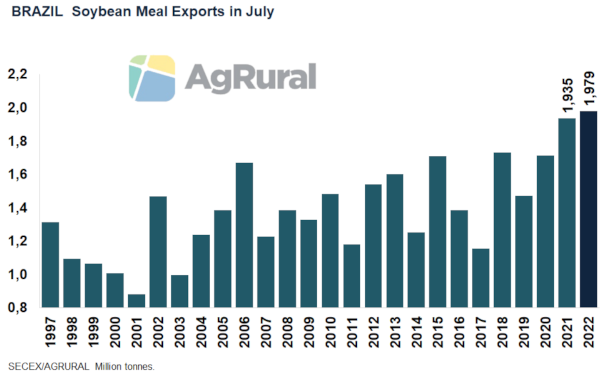

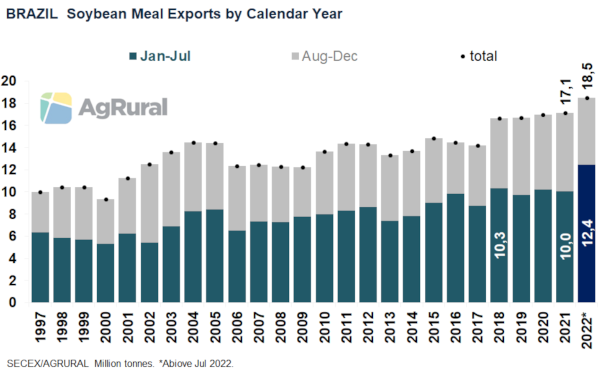

“A new month, a new record” has been the rule for Brazilian soymeal exports so far in 2022 despite the severe failure of the 2021/22 soybean crop. Data released last week by the Ministry of Economy show that Brazil shipped 1.979m tonnes of soybean meal in July, slightly more than the 1.935m exported a year earlier and, albeit by a whisker, a new high for the month. From January to July, Brazilian exports totalled 12.4m tonnes, up 24% year on year and beating the previous record for the period, set in 2018, by 20%.

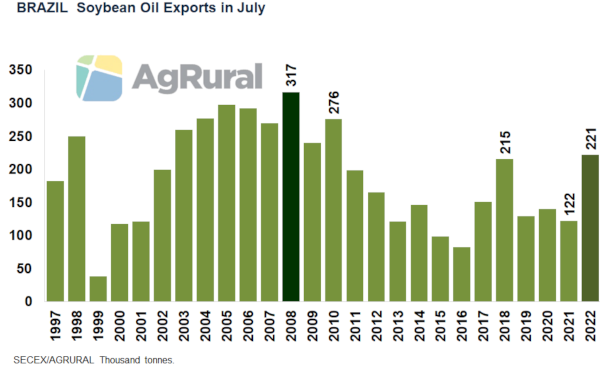

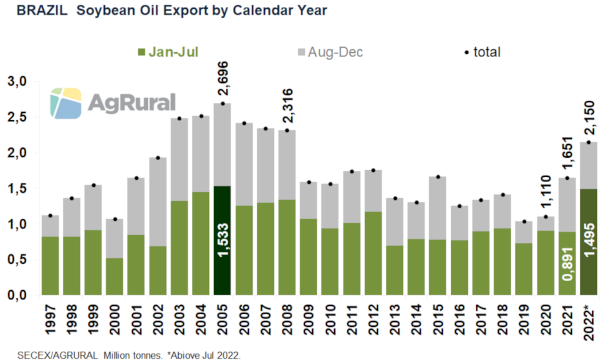

Soybean oil exports came to 221k tonnes in July and, despite not establishing a new record, were the highest for the month since 2010. That took January-July exports to 1.495m tonnes, the largest since 2005, when Brazil started producing biodiesel, which resulted in a gradual decline in soybean oil exports until the blending mandate was cut in 2020.

I have already written a few times about the reasons of the strong pace of Brazilian soybean meal and oil exports in 2022, which are, in short: smaller shipments from other exporters, such as the US, Ukraine, Indonesia and Argentina; higher prices in Chicago and stronger export premiums in Brazil, driven by the switch in international demand; higher crushing margins in Brazil; a drop in soybean exports, due to smaller Chinese purchases; and a decrease in Brazilian domestic consumption due to the biodiesel mandate being cut and a slowdown in meat demand. In addition, Walter Cronin has explained the uptrend in Chicago soybean prices and how this is linked to tight US supply, creating even more room for Brazilian exports.

But the robust performance of Brazilian soybean meal and oil exports in 2022 has raised some questions. Here are the most important:

1. Is the increase in Brazilian meal and oil exports part of a national plan to expand crushing and reduce soybean shipments, adding value to Brazilian agricultural exports?

No, it is not. The strong increase is only temporary and can be explained by the factors mentioned above. Neither the government, the crushing industry nor the soy producers have made a coordinated move to increase production and export of by-products. So much so, that installed Brazilian soybean crushing capacity hasn’t really changed over the past few years. The larger crush this year has been possible due to the use of idled capacity.

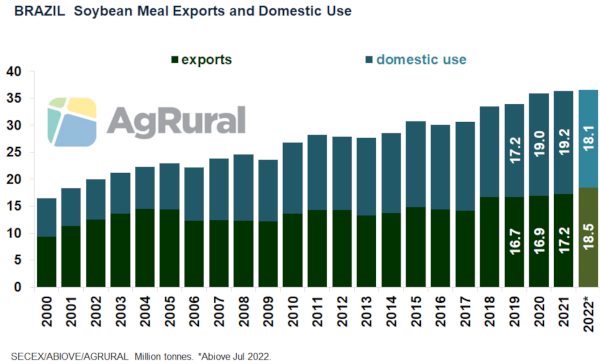

The increase in crush expected in 2022, by the way, is of mere 500k tonnes, or 1%, which is only possible, in a year marked by a drought-related crop failure, by a reduction in soybean exports. With such small growth in crushing, soybean oil production is likely to grow by only 1.7% in 2022, while soybean meal production is projected to rise by 0.6%, according to Abiove, the Brazilian Association of Vegetable Oil Industries.

Therefore, the substantial increase in exports of both by-products has only increased because of lower domestic consumption.

2. Brazil has recently become the world’s largest soybean exporter, surpassing the US. Is the South-American country set to also become the top soybean meal exporter, replacing Argentina?

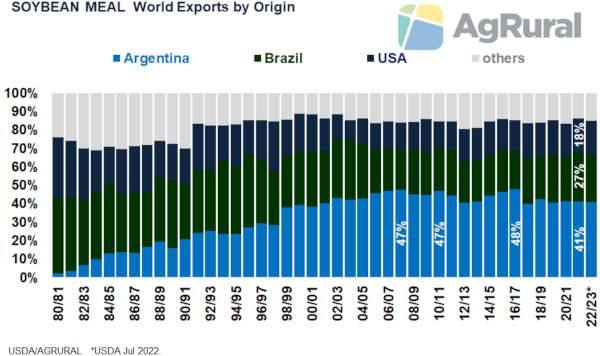

No, or at least not anytime soon. In the current 2021/22 season, according to the USDA, Argentina accounts for 41% of world soybean meal exports, followed by Brazil (27%) and the US (18%). In the 1980s, Brazil’s share of world soybean meal exports hit 35-40%, but it gradually decreased from the 1990s due to changes in tax policies (with state tax exemptions for soybean exports, but not for by-products) and the increase in domestic consumption to supply its thriving meat production. In the following years, the strong growth in China’s demand for soybeans was also decisive for soy crushing losing steam in Brazil.

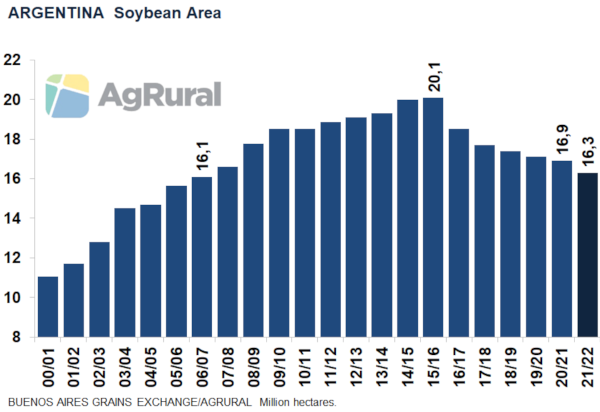

In Argentina, on the other hand, tax policies traditionally favoured soybean meal and oil exports until recently, when their export tax was raised to 33% from 30%, the same as soybeans. That increase has already slowed pace of Argentine crushing over the past few months and may result in a further drop in the soybean planted area.

In the 2021/22 crop, Argentina planted its smallest soybean area in 15 years, pressured by competition from corn, a product that currently has an export tax of 12% and which was exempt from the tax during much of Mauricio Macri’s presidency (2015-19). With the planted area shrinking, soybean production has decreased in Argentina, with a knock-on effect on soybean meal exports. In 2016-17, Argentina’s share in world exports was 48%; now, it’s 41%.

Even so, it is unlikely that Brazil will overtake Argentina in the short term as the world’s largest soybean meal exporter. Although the increase in Brazilian soybean production projected for the coming years will force the country to look for alternatives on the demand front, and although, as a result, Brazilian soybean meal exports will tend to grow, it is more likely that the meat sector will absorb a significant part of the expected surplus.

In addition, the US may also increase its share in world’s soybean meal exports in the coming years, to drain the oversupply that might result from the greater use of soybean oil for renewable diesel production. Thus, what could happen in the next few years is a more competitive environment, with Brazil and the US exporting more soybean meal, but with Argentina remaining the world’s top exporter.

3. And what about soybean oil exports? Is Brazil threatening Argentina’s position?

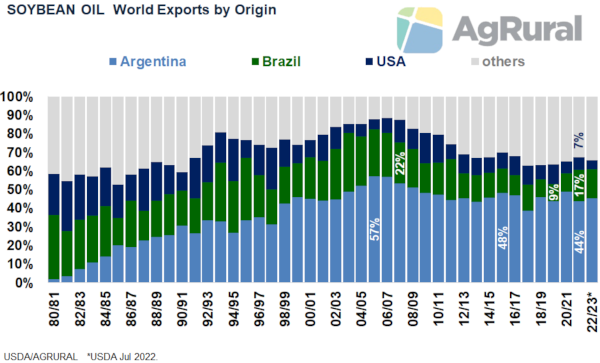

Not at all. Brazil is exporting more soybean soy oil in 2022 (as it already did last year) because the biodiesel blending mandate is at 10%, down from what was originally projected for 2021 (13%) and 2022 (14%). The reduction in biodiesel blending and production has created a soybean oil surplus that, thankfully, has been absorbed by the world’s main importers, especially India.

If there is a return to a gradual increase in biodiesel blending, as expected, and if Brazil follows the US and starts producing renewable diesel, Brazilian soybean oil exports will fall, as was the case until 2020 due to the biodiesel mandate. With Brazil and the US focused on meeting their domestic biofuel demand, Argentina is likely to increase its share of global soybean oil exports, which was once 57% and currently stands at 44%.

In short, Argentina will continue to dominate soybean meal and oil exports in the coming years, unless its government keeps creating difficulties for soybean production and crushing.

Other Insights that may be of interest...