Explainer Focus

- The UK’s Plastic Packaging Tax is set to become Europe’s first plastic tax in effect.

- It’ll come into force in April 2022 but packaging with more than 30% recycled content is exempt.

- It aims to prompt a switch from virgin to recycled plastic and create value recognition in waste plastic.

Background

The UK’s Plastic Packaging Tax (PPT) will come into force on tthe 1st April 2022 and will be charged at a rate of 200 GBP/mt.

The new landmark tax will apply to all plastic packaging components manufactured in, or imported into, the UK if they contain less than 30% recycled plastic.

Whilst other European nations, including Italy and Spain, have legislated for their own plastic taxes over the last couple of years, they’ve faced numerous delays to implementation in the wake of COVID-19.

As a result, the UK’s PPT will become the first plastic tax to come into effect in Europe.

The new tax aims to incentivise businesses to move away from virgin plastics and use greater amounts of recycled plastics in the manufacture of plastic packaging.

The UK government hopes greater demand for recycled plastic will not only stimulate increased levels of recycling of plastic waste but also reduce the amount of plastic waste being sent to landfill or incineration.

Who Will It Affect?

The PPT will primarily affect UK businesses that have manufactured or imported more than 10 tonnes of finished plastic packaging components within the preceding 12-month period.

Due to the possibility of secondary liability, it’ll also affect businesses across the supply chain.

All in all, the new tax should affect around 20,000 producers and importers of plastic across the UK.

What Type of Recycled Content Can Be Used?

As mentioned, the UK’s new PPT will apply to plastic packaging components manufactured in, or imported into, the UK if they contain less than 30% recycled plastic.

Plastic packaging containing 30% or more recycled plastic is exempt from the tax.

Recycled plastic is defined as plastic that’s been reprocessed from either pre-consumer plastic or post-consumer recovered material, using a chemical or mechanical process.

Recycled plastic can be used either for its original purpose or for other purposes, instead of new primary material.

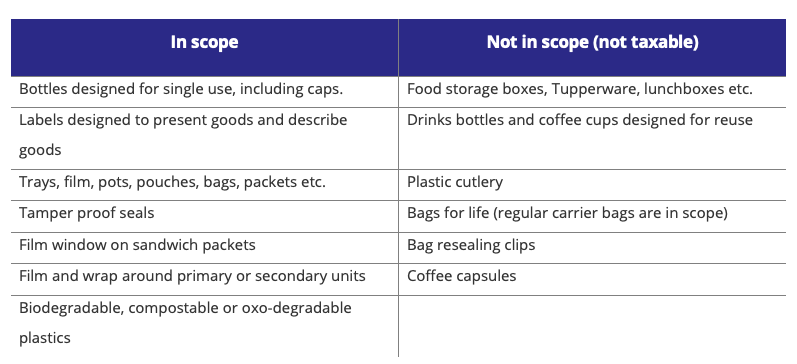

At present, there are no exemptions for biodegradable, compostable, or oxo-degradable polymers, all of which are considered plastics and liable for PPT.

When is Packaging Considered Plastic?

If a plastic packaging component is made from multiple materials but contains more plastic by weight than any other substance (including additives, which form part of the plastic), it’ll be classed as a plastic packaging component for the purposes of the tax.

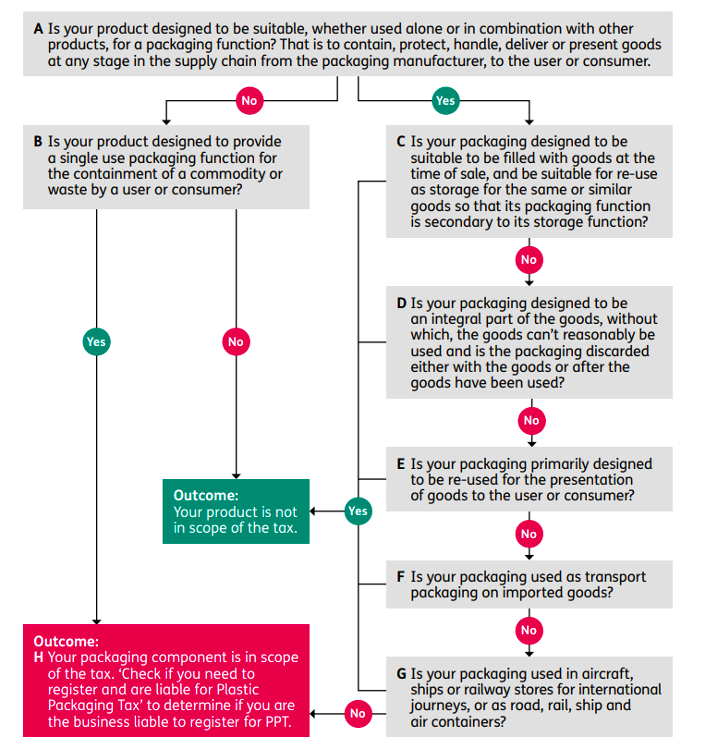

Under the tax, a packaging component is defined as a product designed to be suitable, whether on its own or in combination with other products, for single use by a consumer.

The five key activities used to determine whether a product is performing a packaging function include containment, protection, handling, delivery, or presentation.

However, a plastic packaging component is also only taxable once it is ‘finished’.

What Do We Mean by ‘Finished’ Packaging Component?

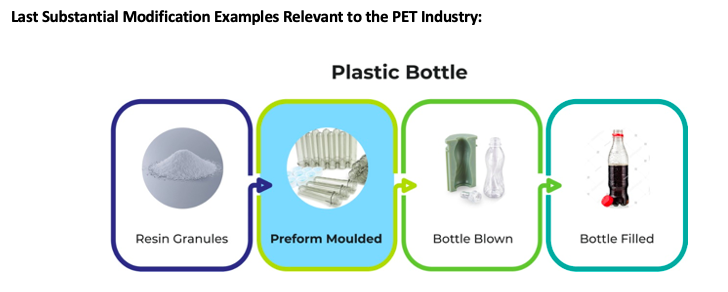

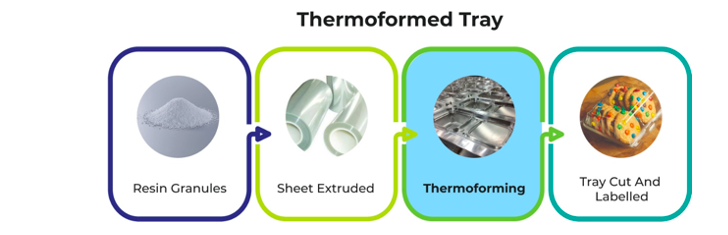

The HMRC defines a component as finished once it’s undergone its last substantial modification.

Any process that changes the shape, thickness, weight, or structure of a packaging component will be a substantial modification.

The UK business which performs the last substantial modification before the packing or filling process is the one which is liable to pay PPT.

A business that imports plastic packaging components which have already undergone their last substantial modification will also be liable for PPT.

Examples of substantial modifications include extrusion, moulding, layering and laminating, and forming (e.g. vacuum or thermoforming).

However, this doesn’t include blowing or forming a packaging component from a preform or cutting formed trays out of a larger sheet.

Further Exemptions

In terms of function, primary, secondary, and tertiary transit packaging manufactured in the UK would be liable for the tax.

It was initially planned that the tax would just have an exemption for recycled content, but further several exemptions are now factored in, including:

- Plastic is not the majority material by weight.

- The packaging is immediate packaging for human medicines e.g., blister packs.

- Transit packaging used to import goods/materials into the UK.

- It is not considered packaging under the definition of the tax.

Other specific use case exemptions exist, including silage wrap, and it’s possible the UK government will add other items to the exemption list in due course.

The below decision tree from HMRC outlines if a company’s product will be liable.

What Packaging is in Scope?

The below table offers some specific examples within the Food and Beverage space:

Market Implications and Our Opinion

One measure of success is already clear to see ahead of the tax coming into effect; demand for recycled plastics within the UK is soaring. Across the board, prices for recycled plastics are hitting record levels due to insufficient supply.

Whilst the EU Single-Use Plastics Directive, alongside global brand commitments, have been early drivers for the market, the introduction of the new PPT has accelerated the trend within the UK.

The PPT has forced all packaging manufacturers to consider their material choices, not just the larger multi-national brands with the biggest brand exposure, ahead of the EU’s 2025 timeframe.

The tax should also raise value awareness of waste plastics, driving collection and recycling rates. Value awareness will also compliment the planned introduction of bottle deposit return schemes across the UK, starting in Scotland, in 2023.

One potential limitation of the PPT may, however, be the level of the tax itself. Ideally, to incentivise a move away from virgin to recycled plastic, the tax should be set at a level that places virgin prices on par with recycled resin, at a minimum.

At present, the growing price differential between virgin and recycled PET (particularly food grade) could erase much of this economic incentive.

As a result, there’s an argument the tax should have been set at a more ambitious level, above 200 GBP/mt, and closer to 380 GBP/mt, like the planned Italian and Spanish plastic taxes (450 EUR/mt).

Other Explainers That May Be of Interest…