Rate Hikes Used to Tame Inflation

Before we can explain interest rate hedging, we need to explain how interest rates are used by central banks. During times of economic growth, interest rates are kept low. This means more buying power for people and companies. This promotes spending and, consequently, economic growth.

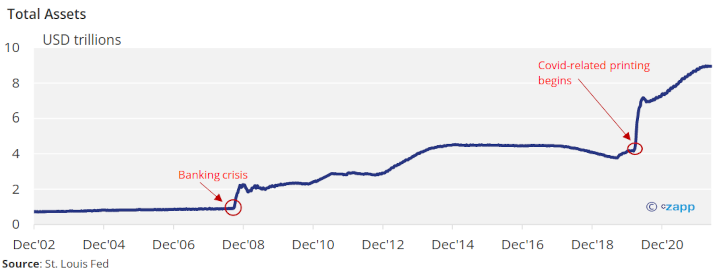

But when low interest rates are combined with high money supply, the economy can get too “hot”. Central banks have printed an enormous amount of money since 2020, creating too many dollars. This started during the banking crisis in 2008 and has slowly progressed.

Here’s what’s happened in the USA recently.

So, what is a “hot” economy? Well, printing extra money means more people can afford more things. This is great when fast growth is needed, such as during the COVID lockdowns in 2020.

However, over time, without an equivalent increase in goods and services supply, there is more demand but fewer products. This inherently pushes prices up because people are willing to pay more to get their hands on items.

In short, inflation is essentially a drop in the value of money. We all know that a burger and fries that cost USD1 in 1960 would now cost over USD 9 because of inflation.

A certain amount of inflation (somewhere between 2% and 3%) is thought to be healthy for the economy.

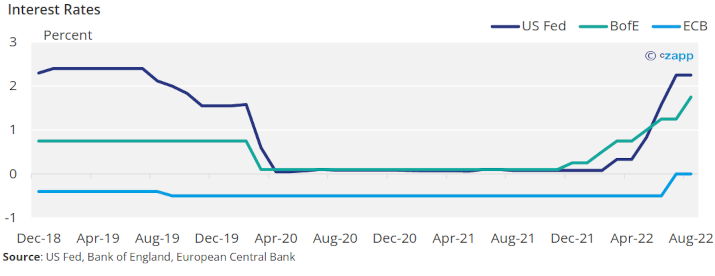

But in response to high inflation, central banks tend to raise interest rates. This generally makes products more expensive and disincentivise purchasing, therefore slowing inflation.

Companies Feel Financing Squeeze

So, what does this mean for business? When interest rates are low, borrowing is incentivised. A key reason why the housing markets in the US and UK have appreciated in value at various points in time is because very low rates have encouraged people to take out loans in the form of mortgages.

Likewise, as rates rise, borrowing is discouraged because it becomes more expensive. This helps to tame inflation with overall market demand reducing in response to the higher cost of funds.

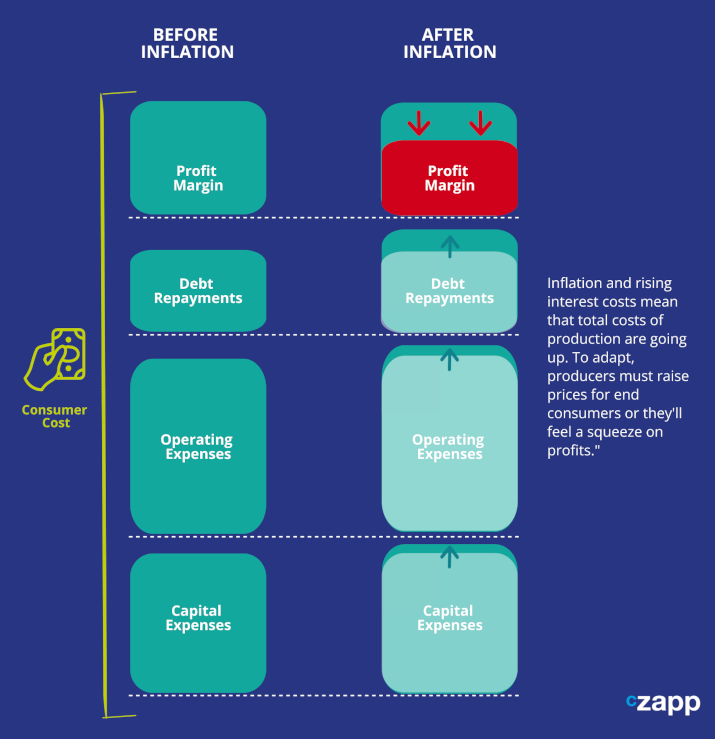

For large companies with significant amounts of debt, this can create cost volatility and prompt a complete reassessment of financing options.

Knock on Effects of Supply Chain

In high interest rate environments, banks and lenders tend to become more conservative and typically less finance is available. There are strict lending criteria linked to affordability. If rates rise too much, suddenly some companies may be deemed higher risk, so will have to pay more in interest as a form of insurance policy for the bank.

In some cases, companies may not be able to access debt at all because banks think the risk of missed payment or default may be too high.

This is also likely to push up the cost of goods. If suppliers are paying higher interest rates, they need to either pass on these additional costs or absorb them. This will either lead to higher prices or less efficiency within their supply chains.

Interest Rate Hedging Can Reduce Risk

This is where Cz comes in. Cz offers extended payment terms to consumers and prepayment terms to producers through an extensive range of financing partners. This allows companies to push out payments, giving them more breathing space amid tight margins.

The cost of this financing is linked directly to the Secured Overnight Financing Rate, or SOFR. As we have discussed, SOFR tends to rise as central banks try to fight inflation through monetary policy. This in turn increases the cost of finance.

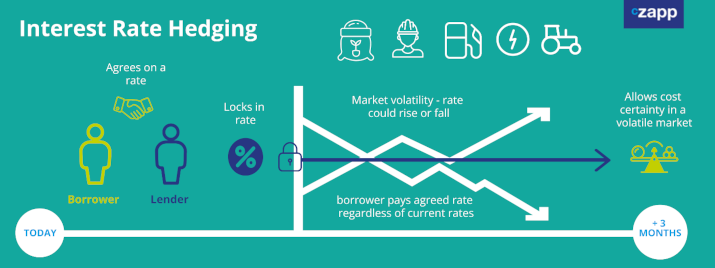

But companies do not necessarily need to swallow these continuously higher rates. Cz offers clients the ability to hedge interest rates. This locks in the SOFR component at a rate that the client deems affordable and removes the risk that the cost of financing continues to trade higher.

This kind of coverage locks down the finance cost component and allows cost certainty in an extremely volatile market.

Concluding Thoughts

- When interest rates are high, companies are burdened with high financing costs.

- Loan and bond issuance is also strained and there is a lower ability to access finance.

- There is an increased need for companies to mitigate interest rate risk.

- SOFR hedging allows companies to lock in rates during periods of volatility.

If you’d like to know more about how Czarnikow can help you manage your rate risk, please contact Maximilian Kirby on mkirby@czarnikow.com.