This report was published on the 26th of November originally only in Portuguese. It has since been translated to English and its data updated.

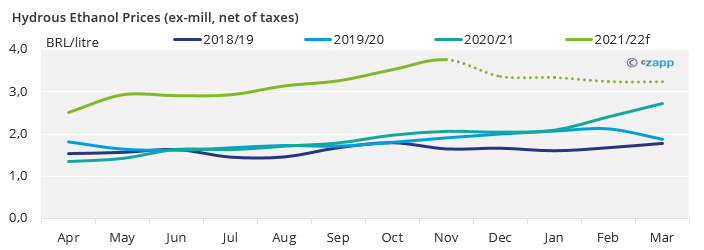

- In the past month, ethanol prices in Centre South Brazil have been falling.

- Fuel demand has been impacted by high prices at the gas stations.

- Prices are expected to remain under pressure in the upcoming months.

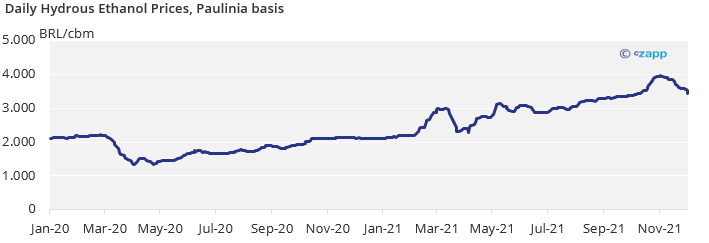

Hydrous Ethanol Prices are Retreating

- After climbing since late July, hydrous ethanol prices are now falling back.

- The Esalq Paulinia daily index has fallen 8% over the past 10 days, closing last Friday at around BRL 3424.5/cbm.

- We also heard from mills that hydrous sales prices in a fortnight fell by around BRL0.4/litre.

- But what about the upcoming months? What downside and upside risks for ethanol prices we see on the horizon?

Bearish Factors

Demand Retraction

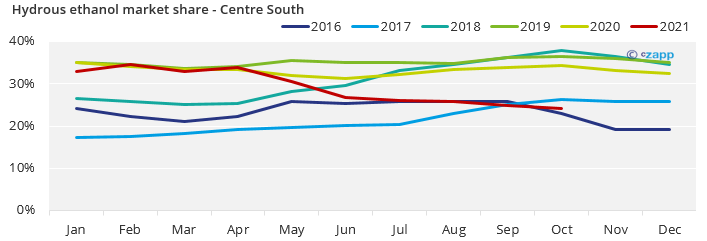

- Fuel hydrous sales in October dropped once again, taking the biofuel market share to 24% (Center South) – the lowest since 2016.

- So far, cumulative sales are at around 13bi billion liters (CS region), 22% down yoy – just a reminder that last year was marked by the pandemic and fuel consumption decline.

- This trend is expected to remain, with hydrous ethanol market share staying below 25% over the next few months.

- Such a change in consumption behaviour, with the demand migrating to gasoline, is due to the loss of ethanol competitiveness against gasoline.

- Since May, ethanol/gasoline parity has been above 70%, and today it finds itself around 81% –São Paulo state average, the largest consumer market.

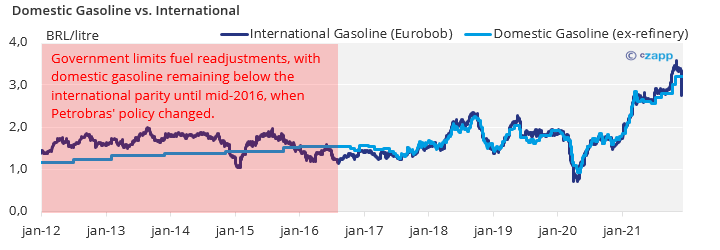

- Gasoline at the refinery has risen 73% since January, and this has been reflected in a 50% increase in gasoline for the final consumer – on average according to ANP data (National Oil Agency).

- Obviously, high prices are not ideal – even more on the eve of Presidential election year.

- This topic has turned into campaign agenda for many politicians, with discussions advancing so far as of creating a bill that would change the way Petrobras ‘ readjustments could be made.

- The main agenda at the moment is to prevent Petrobras from using international price parity as a benchmark for adjustments.

- That is, any increase in crude oil or currency devaluation, gasoline and diesel prices would not be impacted.

- The result of this strategy we witnessed from 2012 to 2016, resulting in limiting the upside for ethanol prices.

- This is one of the main bearish risks for ethanol prices in the upcoming months.

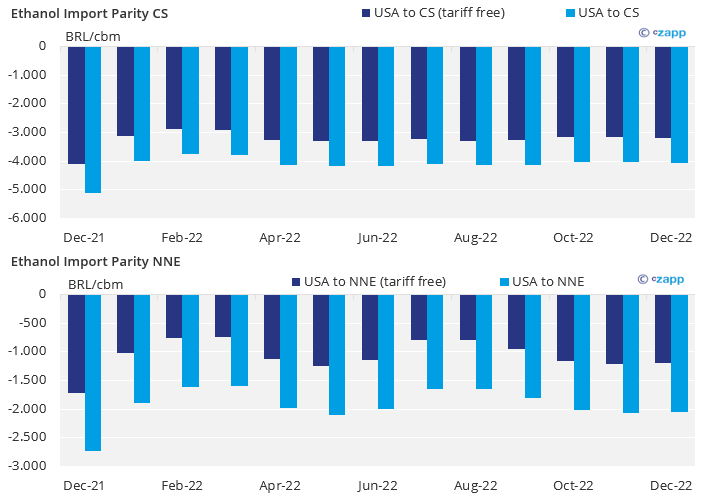

- Elimination of Ethanol Import Tariff

- The demand migration to gasoline has led to an increase in anhydrous ethanol demand.

- Although anhydrous ethanol supply reached 10.3bi litres as of 1H November (record), strong demand left inventories tight with worrisome off-season forecasts

- There were even rumours about a possible reduction in the ethanol blend from the current 27% to 18%.

In face of this risk some groups decided to import ethanol (even at a loss)

- Now there are other rumours: requests for eliminating the 20% import tariff on ethanol.

- This is a downside risk for prices, because if approved, we believe that the tariff could remain exempt during the next crop – once it is withdrawn, to be reinstituted is not an easy affair.

- Even with the exempt tariff, imports would be made at a loss.

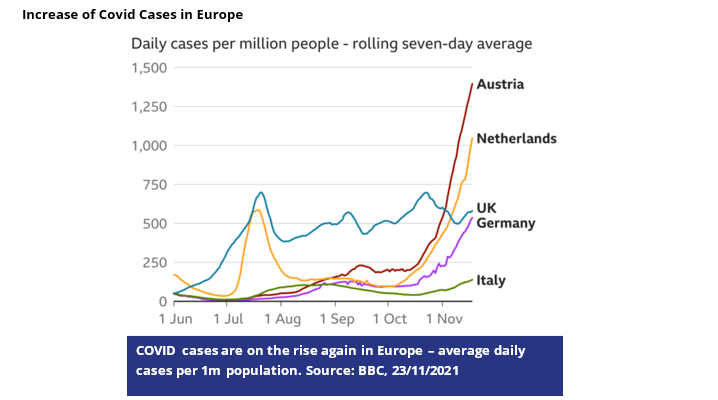

- Despite advances in vaccination, another wave saw COVID cases increasing in Europe.

- In some countries the rising rate is so expressive that some sort of lockdown had to be instated as a measure to combat the advancement of the disease.

- The result is a negative effect on fuel demand, which results in pressure on oil and gasoline prices.

Bullish Factors

- Despite the bearish view given above, there are still some factors that could be beneficial or at least maintain the price level for ethanol in Brazil.

End of the Year Seasonality

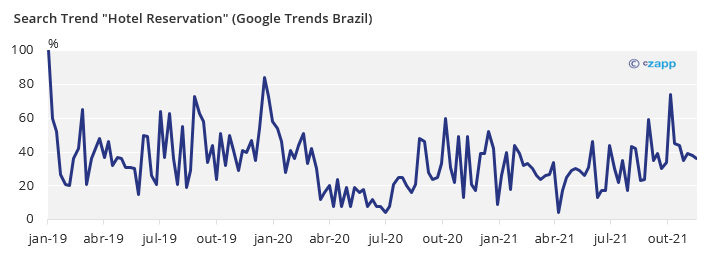

- With the weak BRL, there is an expectation for domestic tourism to increase this year.

- HoteisRIO reported that the hotel occupation for New Year’s has already reached 78% in the city of Rio de Janeiro, level above the one recorded in 2019.

- Additionally, the BLTA (Brazilian Luxury Travel Association) recently said that the occupancy rate of its associated hotels not only surpasses the 2019 highs but are in fact record.

- Increase in internal tourism this year means more people travelling by car, impacting on higher expected fuel demand in December and January.

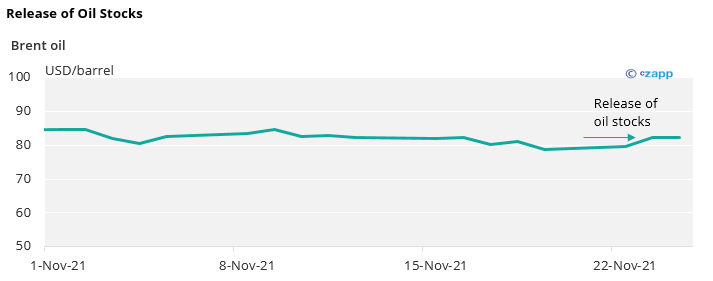

- On the 23rd of November, the US announced the release of 50m barrel of oil from SPR (Strategic Petroleum Reserves), in a coordinated move with other countries – India, Japan, China, the United Kingdom and South Korea.

- In contrast, OPEC+ said that if these countries continued to release their reserves, they would review the policy of gradually increasing oil production.

- As a result, instead of the release of inventories having the desired effect by the US of reducing prices, Brent ended up rising.

- This counteracts the increase in covid cases mentioned earlier. If demand declines, OPEC appears to signal that it should continue to regulate production to keep prices above $75/barrel.

Note: since this report was written, OPEC+ has met and decided to keep the production increase that was on their strategy, but with the addendum that could revisit the decision if fuel demand is impacted more than anticipated – this was brought on due to the uncertainties of the Omicron variant.

Conclusion

- Despite tight off-season stocks, the reduction in demand for hydrous ethanol (akin to demand destruction) should limit the upward movement.

Other Insights that may be of interest

- Brazil: Ethanol Imports at a Loss to Save the Blend

- Brazil: Risk of a Fuel Shortage

- Brent Oil is Down; What About Brazilian Ethanol Parity?

Interactive Data Reports that may be of interest …