Insight Focus

Market volatility from US tariffs remains high with wild daily swinging in upstream prices. Chinese PET resin export prices have firmed as raw material pricing bottoms out. Asian PET prices should remain volatile with the forward curve flat through to Jan’25.

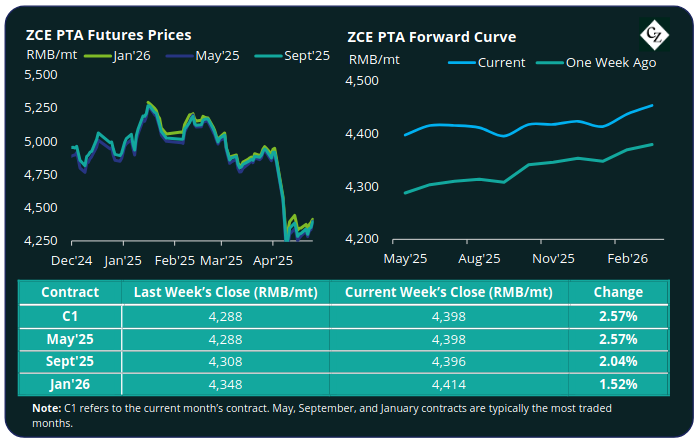

PTA Futures and Forward Curve

PTA Futures continued to move higher with global commodity prices last week after their tumultuous fall earlier in the month. By Friday, main months contracts were up between 2-2.5%.

Oil prices ended the week with a decline following reports that OPEC+ may increase output and due to positive developments regarding the situation in Ukraine. Other geopolitical factors, including Iran’s openness to nuclear negotiations, also influenced the oil market’s bearish trend. At time of writing, Brent crude prices were at USD 65.72/bbl.

The PX-N CFR average weekly spread narrowed by around USD 10/tonne pushing PX producers into losses; whilst the PTA-PX CFR spread narrowed to average of USD 78/tonne last week, down USD 2/tonne on the previous week near break-even line.

However, with poor PTA profitability producers are increasingly turning to plant maintenance, in turn helping to alleviate high PTA stocks. Destocking is expected to continue through May and June supported from demand driven by high polyester operating rates.

The PTA forward curve remains relatively flat and stagnant; Sept’25 contract is on par with the current month, and Jan’26 holds just a RMB 16/tonne premium over May’25.

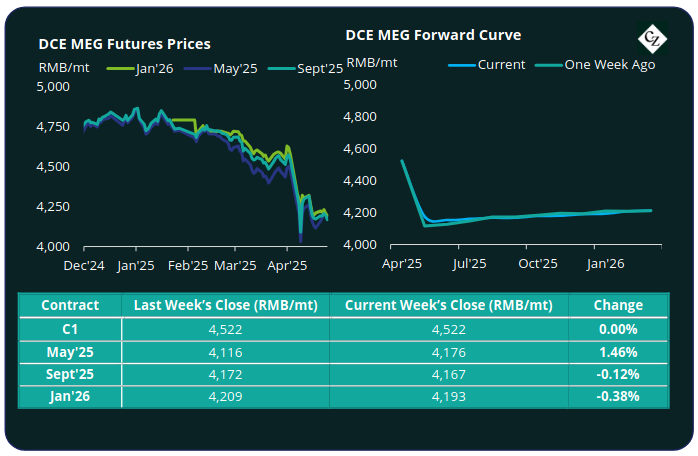

MEG Futures and Forward Curve

MEG Futures contracts also remained volatile, with the May’25 contract increasing nearly 1.5%, whilst further out contracts kept flat and stagnant.

East China main port inventories decreased by 1.8% to around 707k tonnes following reduced import arrivals and a rebound in offtake after the previous wave of imports.

US tariff uncertainty continues to cloud the outlook for the downstream textile industry weighing on MEG market sentiment. However, demand is for the time being supported by higher-than-expected polyester operating rates.

Beyond the current month’s contract that is ending, the MEG Futures forward curve remains relatively flat; Sept’25 contract at a RMB 9/tonne discount over May’25 and the Jan’26 holding a RMB 17/tonne premium.

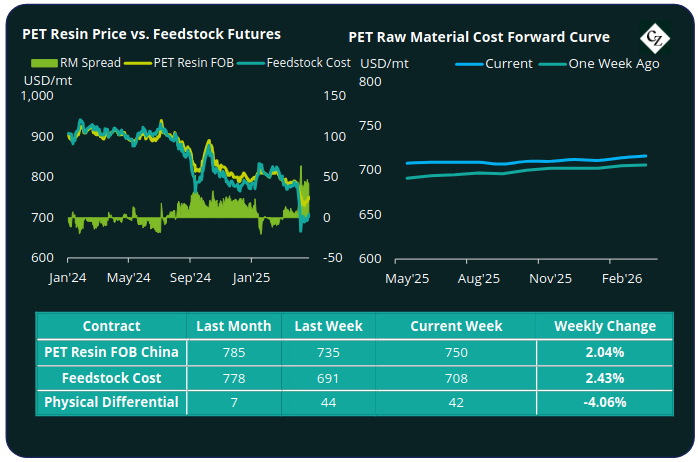

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices firmed to an average of USD 750/tonne FOB China by Friday, up USD 15/tonne on the previous week, as buyers chased low prices and producers were quick to respond to increased demand.

The average weekly PET resin physical differential against raw material future costs increased marginally to a weekly average of positive USD 44/tonne last week, up USD 2/tonne. By Friday, the daily differential was positive USD 42/tonne.

The raw material cost forward curve remains relatively flat, with Sept’25 at a USD 1/tonne discount over May’25, and Jan’25 holding just a USD 3/tonne premium over May’’25.

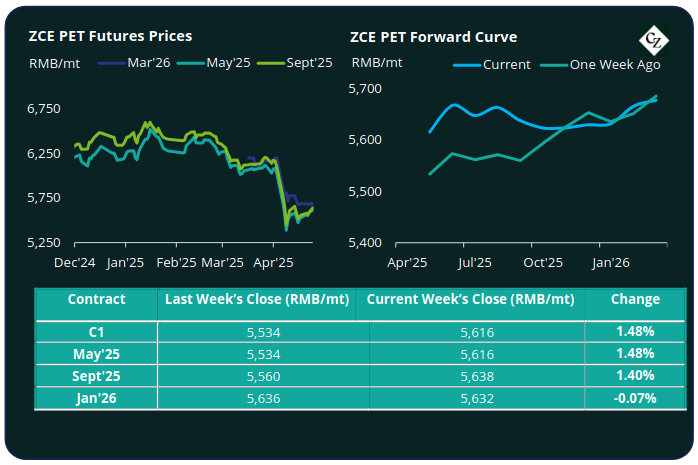

PET Resin Futures and Forward Curve

PET Resin Futures also floated upwards with rest of the market, with main contract months recovering by around 1.4% on the week.

May’25, the current main month with the highest liquidity increased 1.4% to RMB 5616/tonne (USD 770/tonne), up around USD 10/tonne since bottoming out pre-Easter.

The average weekly premium of the May’25 PET Futures over May’25 Raw Material Futures increased to USD 33/tonne, up just USD 1/tonne. By Thursday, the daily premium was USD 30/tonne.

The PET Resin Futures forward curve lost all forward premium, flattening entirely across main contract months; Sept’25 held just a RMB 22/tonne (USD 3/tonne) premium over May’25, and Jan’25 had just RMB 16/tonne (USD 2/tonne) premium over May’25.

Concluding Thoughts

The PET resin physical differential over future raw material costs has expanded substantially over the last month. With upstream costs falling rapidly, Chinese producers have been able to sell spot resin at an increased premium over futures.

As a result, PET resin producers have continued to increase operating rates to maximise returns, with some producers announcing certain grades to be sold-out for May.

With raw material prices looking to have bottomed out, PET producers will likely seize upon any upward momentum to increase prices further.

However, geopolitical tensions remain extremely volatile, and future crude fundamentals may be determined by the next OPEC+ meeting on 5 May. PET resin and PTA futures remain flat through to 2026, in part due to the current market uncertainty.

Close attention should also be paid to changes in ocean freight rates.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.