Insight Focus

Ethanol production remains strong despite global trade policy challenges. Blending rates have surged, and exports continue to set records across multiple markets. Future growth depends on increased EPA renewable volume obligations and continued international demand.

Ethanol Industry Holds Steady

Despite the Trump administration’s awkward tariff battles with the world, which threaten to disrupt the global economy, the outlook for ethanol production and use remains strong, according to market watchers. In addition, the ethanol industry—led by the US and Brazil—is steadily expanding to meet growing demand.

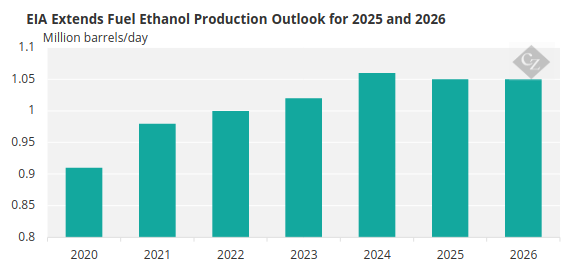

In the April Short-Term Energy Outlook released by the US Energy Information Administration (EIA), the agency extended its 2025 and 2026 estimates for fuel ethanol production to average 1.05 million barrels per day. On a quarterly basis, fuel ethanol production is expected to average 1.03 million barrels per day during the second and third quarters of 2025, rising to 1.05 million barrels per day in the fourth quarter.

Source: EIA

For 2026, the agency expects fuel ethanol production to average 1.06 million barrels per day in the first quarter, 1.04 million barrels per day in the second quarter, 1.03 million barrels per day in the third quarter, and 1.06 million barrels per day in the fourth quarter.

While the EIA conservatively estimates steady ethanol production and use, ethanol blending is on the rise. According to the agency’s Weekly Petroleum Status Report, ethanol blending in gasoline jumped 30,000 barrels per day during the week ending April 11, reaching 902,000 barrels per day. That pushed the blending estimate up by more than 3.4% for the week, marking the highest rate since December.

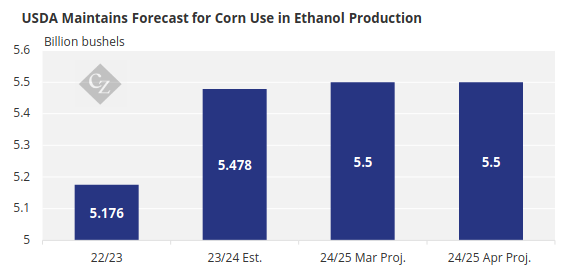

Meanwhile, in April, the USDA the USDA maintained its forecast for 2024-25 corn use in ethanol production at 5.5 billion bushels. Corn use for ethanol was 5.478 billion bushels for 2023–24 and 5.176 billion bushels for 2022–23.

Source: USDA

Ethanol Markets Expected to Grow

While there are plenty of sceptics who claim the ethanol industry is stagnant, there are just as many ethanol proponents who believe the market is on the verge of expansion.

In the state of Minnesota, for example, Minnesota Bio-Fuels Association Executive Director Brian Werner told news sources that new data from the Department of Commerce shows more than 140 million gallons of Unleaded 88 were sold during the past calendar year. “And more importantly, at a 17-cent price spread from regular unleaded,” he added. “That number of gallons sold actually saved Minnesota consumers USD 24.2 million at the pump.”

According to Brownfield, it was also a record year nationally. “Nationwide, last year we reached a record of 1.24 billion gallons, which was an increase of 11% over 2023.” Werner said he’s hopeful that 2025 will be an even bigger year for Unleaded 88 sales in both Minnesota and the US.

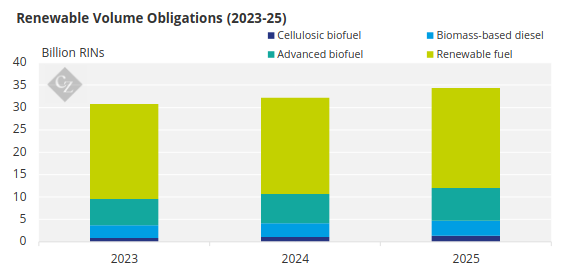

For robust market growth, the EPA needs to cooperate by increasing renewable volume obligation (RVO) levels. In April, four Midwestern governors sent a letter to the EPA urging it to promote more renewable fuel production by doing exactly that. The governors are seeking standards of 15 billion gallons for conventional ethanol. Current standards have remained unchanged for more than three years.

Source: EPA

“If you don’t have growth in the renewable volume obligation, you’re not going to see growth within the renewable fuel industry. So, in South Dakota, for example, you may not see an ethanol plant expand,” said Troy Bredenkamp, Senior Vice President for Public Affairs at the Renewable Fuels Association. Bredenkamp added that while producers are currently comfortable with the existing ethanol standard, they expect to see growth in future years.

Ethanol Exports Poised to Drive Industry Growth

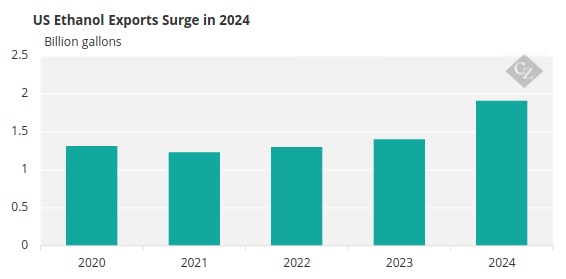

Increasing ethanol exports will also spur growth for the ethanol industry.

The US Grains Council (USGC) believes biofuels such as ethanol are vital to international transportation decarbonisation efforts and is dedicated to helping countries meet their global climate commitments as they fuel forward to a net-zero world. The USGC stated that ethanol offers an immediate solution to decarbonise road transportation, with long-term potential to reduce emissions in long-haul trucking, aviation and maritime transport.

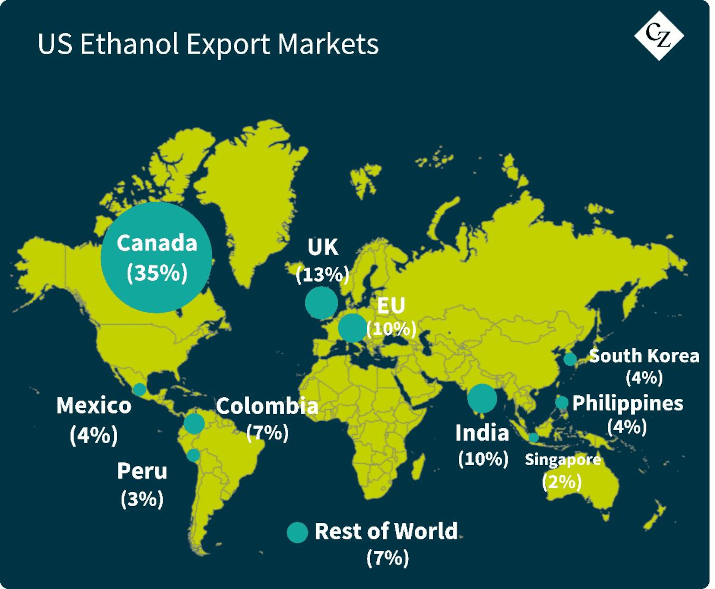

US ethanol exports expanded in 2024, propelled by record shipments to multiple markets. Canada retained its position as the top destination for the 45th consecutive month, with exports rising 10% to 62.8 million gallons, primarily of denatured ethanol.

Source: RFA

The EU saw a 49% surge to a record 35.4 million gallons, driven by record exports to the Netherlands, while shipments to the UK rose 48% to an eight-month high of 27.1 million gallons. Mexico also set a record at 11.1 million gallons, up 36%.

When the dust from the Trump tariff battles settles, exports are expected by market watchers to continue growing.

Sales of electric vehicles (EVs), once thought to threaten the future of ethanol, have begun to level off. As research and development into alternative power sources—such as hydrogen engines—continues, it is foreseeable that EVs may prove to be merely a pause in the broader march toward environmentally sustainable transportation.