Insight Focus

Corn fell in Chicago on strong planting and record production. US wheat and European grains closed the week positive. Weather and demand factors support sideways trading with some volatility ahead.

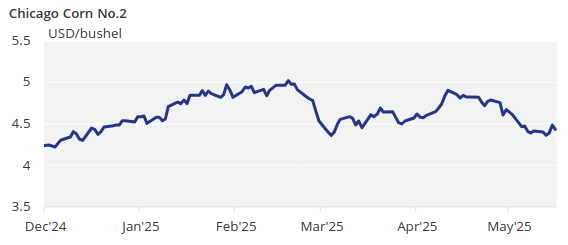

There are no changes to our forecast for Chicago corn for the 2024/25 crop (September/August), expected to average USD 4.55/bushel with some downside risk depending on the trade war. The average price since September 1 is running at USD 4.47/bushel.

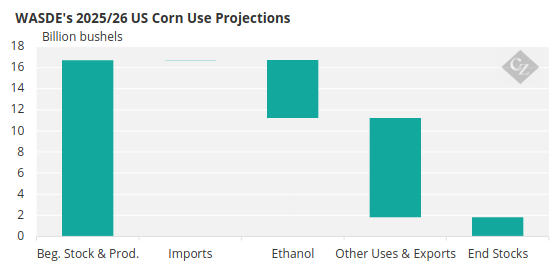

The May WASDE report left US corn demand for ethanol unchanged at 5.5 billion bushels for the old crop, but we continue to think this should be more in the 5.65 billion bushel region. 2024/25 ethanol production year to date is up 3.2% year on year, while the WASDE shows only a marginal increase in corn usage for ethanol of just 0.4%.

Source: USDA

We think sooner rather than later this will be reflected in upcoming WASDE reports and will be reflected in the next quarterly stock report, which would take old crop ending stocks below 1.3 billion bushels and the stock-to-use down to 8.2%. The lower old crop stocks would go down to 1.65 billion bushels versus the 1.8 billion bushels recorded in last week’s WASDE.

Corn Falls on Record Planting

Corn fell again in Chicago on strong planting progress and record new crop production as per the May WASDE.

The start of last week was dominated by the publication of the May WASDE last Monday and a huge increase in corn planting, surpassing by far last year’s pace and the five-year average.

The May WASDE reduced US corn old crop stocks by 50 million bushels, all coming from higher exports, leaving the stock-to-use ratio at 9.3% versus 9.6% before.

The USDA published its first estimate for 2025/26 using the number of acres from the prospective planting report released in March and a trend yield of 181 bushels per acre. This results in production of 15.82 billion bushels, up from 14.87 billion bushels for the old crop. Demand is forecast at 12.79 billion bushels versus 12.6 billion bushels for the old crop, with exports at 2.68 billion bushels versus 2.6 billion bushels last crop.

This all results in ending stocks of 1.8 billion bushels, significantly up from 1.4 billion for the old crop. Stock-to-use also rises to 11.6% versus 9.3% for the old crop.

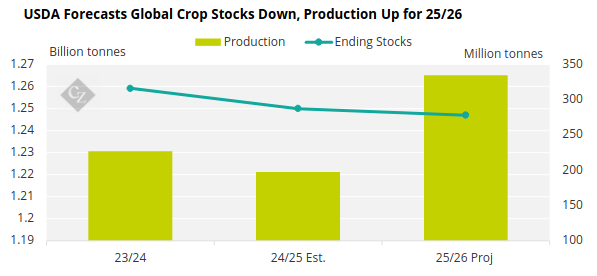

Global ending stocks for the new 2025/26 world crop were projected at 277.8 million tonnes, down from the 287.3 million tonnes of ending stocks projected in 2024/25. World production was projected at 1.26 billion tonnes, up from 1.22 billion tonnes in 2024/25.

Source: USDA

US corn is 62% planted versus 47% last year and the five-year average of 56%. In Argentina, corn harvesting is 37.2% complete, with 80% of the area in normal to good condition, unchanged week on week.

Both BAGE and BCR left their production estimates unchanged at 49 million tonnes and 48 million tonnes, respectively. In Brazil, Conab increased its production estimate to 126.87 million tonnes, up by 2 million tonnes and compared with USDA estimates of 130 million tonnes. Summer corn harvesting is 77.6% complete.

French corn planting reached 90%, compared with 70% last year and the five-year average of 87%. Corn planting in Ukraine is 87% complete. Corn planting in Russia is 66.2% complete.

Wheat Stocks Rise Despite Demand

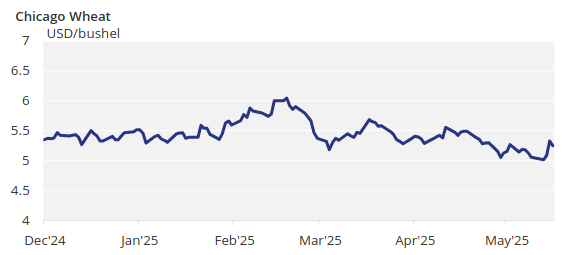

US wheat and European grains closed the week positive.

The May WASDE reduced old crop US wheat stocks by 5 million bushels, all coming from higher demand for food. The first estimate for the new 2025/26 crop showed a yearly stock build of 82 million bushels, a combination of 80 million bushels of lower supply coming from lower production and fewer imports, and 18 million bushels of lower demand, almost entirely from fewer exports.

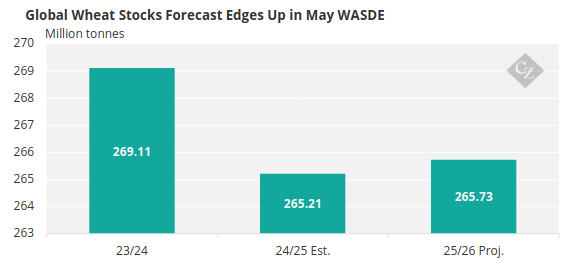

Global ending stocks for the 2025/26 crop were projected at 265.7 million tonnes, marginally higher than the 265.2 million tonnes of 2024/25 ending stocks.

Source: USDA

French wheat condition was 73% good or excellent, down 1 point week on week and compared with 64% last year.

US wheat condition was 54% good or excellent, up 4 points in the week and compared with 50% last year. Spring wheat planting is 66% complete versus 59% last year and the five-year average of 49%.

US Rains Could Slow Corn Planting

The US is expected to experience ample rains for a third week in a row. Brazil’s centre-south is expected to remain dry, which is normal for this time of year, while Argentina is expected to receive ample rains. Northwest Europe is expected to remain warm and dry, similar to the Black Sea regions, which will also see some showers.

We could see a slowdown in US corn planting this week as ample rains may have impacted planting pace, but we are so far ahead of last year and the five-year average that there is enough buffer for a couple of slower weeks without impacting prices.

With last week’s WASDE and a full week for the market to price in the record corn production of the new crop, all the bearishness should have been priced in. Good weather and planting progress in the US should keep any upside capped. Dry weather in Europe impacting corn yields and higher US demand for ethanol usage — not yet reflected in the WASDE — are supportive elements for the coming months. Expect some sideways trading with some volatility coming from weather.