Insight Focus

India announced a 1.5 million tonne urea tender closing June 12. Chinese products are likely excluded due to government restrictions on fertilizer exports to India. Phosphate prices rise amid tight supply, while potash markets await tender results and ammonia remains bearish after a discounted Mosaic sale.

EU Sanctions Disrupt Urea Trade

The international urea market is fragmented and still trying to find its way forward due to the EU rubber-stamping anti-dumping measures against Russia and Belarus, in addition to the introduction of urea exports from China.

Obviously, Russian producers will have to look elsewhere to sell their products. This situation could open up avenues for other producers to enter the European markets—notably urea producers in Algeria and Nigeria—while Russian producers will most likely focus on Brazil, Argentina and the US markets.

Finally, after months of speculation and deliberation by the Chinese government, urea exports will now commence, with the first shipments expected to reach markets sometime in July due to the time-consuming CIQ processes, which can take up to 60 days. Another peculiar issue is that it appears Chinese products will be prohibited from participating in Indian urea tenders.

The first test of this measure will come with the NFL of India announcing a 1.5-million-tonne West Coast only import tender closing on June 12, with shipments required on or before July 31. Another caveat of the Chinese export program is that prilled urea cannot be exported below USD 360/tonne FOB, and the price floor for granular urea is set at USD 370/tonne FOB. Time will tell whether these two measures will be adhered to or if changes will be announced in due course.

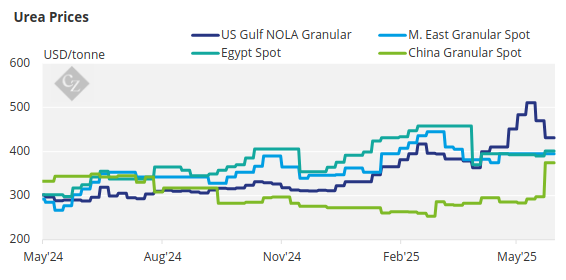

On the trading side this week, it was interesting to note that SABIC of Saudi Arabia, in a classic pre-India tender move, sold a granular urea cargo at USD 385/tonne FOB—USD 5/tonne higher than the previous sale—while the market price was in the USD 370s/tonne FOB.

Egyptian operating rates are returning to normal after being affected by natural gas supply limitations. Producers are offering products at USD 405/tonne FOB, with limited buyer interest. Brazil has yet to enter the buying season in earnest, with non-sanctioned urea offered at around USD 395/tonne FOB. However, it is reported that large volumes of Iranian urea are being shipped to Brazil, following successful sales tenders at USD 335–338/tonne FOB Iran, which should give CFR prices well below the USD 395/tonne CFR levels currently offered.

US/NOLA prices are edging lower toward the end of the major application season, with prices around USD 420/short ton, equivalent to USD 413/tonne CFR.

Indonesia’s Gresik prilled urea tender was scrapped, with the highest bid at USD 350/tonne FOB, while the floor prices were just over USD 20/tonne higher. However, Pupuk Indonesia is reported to have sold a granular urea cargo for June shipment at USD 380/tonne FOB Bontang.

Thailand, being one of the global import markets for granular urea, saw January–April imports at 827,000 tonnes versus 947,000 tonnes year over year and 601,000 tonnes in the same period of 2023. Saudi Arabia was the largest exporter, accounting for 405,000 tonnes, followed by Malaysia and Qatar with 165,000 tonnes each.

The outlook for urea prices will be heavily reliant on India and China’s positions—either participating in or adhering to current government instructions. The question remains: where will China export its allocated 2 million tonnes if India does not receive a share?

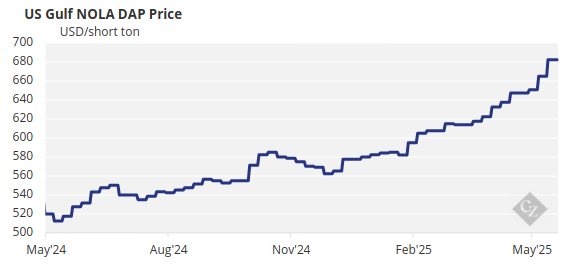

Tight Supply Lifts Phosphate

The processed phosphate market remains tight due to the absence of China. Jordan DAP has reportedly been sold in the upper USD 730/tonne CFR region to India. The lack of Chinese supply is the key driver behind the tight global availability, with the country’s January–April DAP/MAP exports down to a 23-year low at 155,128 tonnes—an 82% decrease from January–April 2024. This compares to 2.33 million tonnes in 2021 and 1.64 million tonnes in the same period of 2023.

China is rejoining the global market with an export quota allocation of around 3–3.5 million tonnes for DAP+MAP from May to September—about half of last year’s export quota of 6.5 million tonnes. Still, local sources suggest that more quotas may be released after September if domestic supply is sufficient and prices remain acceptably low.

Acceptance of export inspection certificates for DAP/MAP began on 24 May and will continue until October 15. Current sales of DAP for export from China are priced around USD 700–720/tonne FOB, while producers are aiming to increase to USD 730–750/tonne FOB. Current sales of DAP for export from China are priced around USD 700-720/tonne FOB, while producers are aiming to increase to USD 730-750/tonne FOB.

China’s export policy continued to keep market players on their toes, with news that export inspections were being halted for NP/NPKs, while the approval time for export inspections for TSP and SSP was reportedly being extended. China’s exports of SSP and NP have surged significantly since the start of 2024, as considered in recent analysis, with Brazil emerging as the primary destination.

No new DAP/MAP deals have been reported in the key import markets of Brazil and India, though price assessments have increased, with previous low-end offers no longer available.

Prices are expected to rise further over the coming weeks as demand picks up and supply remains exceptionally tight. Although affordability concerns persist, buyers have limited options. A reversal in market direction now seems unlikely before Q3 and will depend on improved supply and increased buyer confidence.

India, China Delay Potash Deals

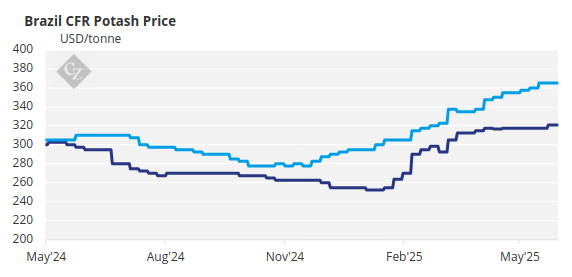

The potash market remains relatively quiet as attention shifts to the imminent contract settlements from India and China. All eyes were on India this week amid rumours of a settlement between IPL, BPC and other overseas producers.

Although not officially completed, prices are widely expected to be around USD 349/tonne CFR, which producers consider fair. A USD 5–10/tonne price difference between suppliers still exists, potentially delaying progress. The timeline remains unclear, with expectations ranging from this weekend to the following week.

Although India initially waited for China to settle first, its port stocks have been steadily depleting and are now down to around 170,000 tonnes. With the Kharif planting season approaching and the early arrival of the southeast monsoon prompting early land preparation, urgency to finalise the settlement has grown.

The China contract remains under negotiation, with no fresh updates this week. China is in no rush to settle, as the high-demand spring application season has ended. The next major season, corn application, does not require heavy potash use, and the autumn application will not begin before July.

In recent months, China faced pressure to settle contracts as domestic prices spiked amid tight supply and strong demand. The government responded by releasing 1.1 million tonnes of MOP through a tendering process that ended on April 15. Although inventories have since declined, this release helped stabilise prices. China will eventually need to replenish these stocks but has sufficient time and is under no immediate pressure.

Meanwhile, the Southeast Asian MOP market remains quiet pending contract settlements. It is widely believed that BPC was the only respondent to the Pupuk Indonesia tender but secured significantly less volume than initially requested. Although the accepted prices were USD 360/tonne CFR—the lowest offer in the tender process—this has done little to stimulate demand or push prices higher.

Standard MOP regional prices remain at an average of USD 345/tonne CFR. In Brazil, prices held steady at USD 360–365/tonne CFR, with July offers at USD 360–370/tonne CFR. However, no sales have occurred at USD 370/tonne CFR. Farmers remain hesitant, with inland prices still USD 10–20/tonne lower than CFR equivalents. Purchasing activity has paused, as both buyers and suppliers are in no rush to transact for July onwards. The Safra season is already well covered compared with last year.

Market participants await the India contract settlement, expected imminently, which could support sentiment amid the recent slowdown in momentum.

Ammonia Prices Remain Under Pressure

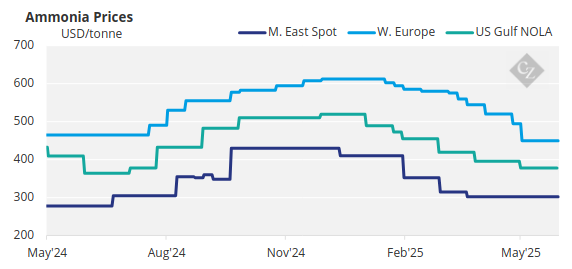

On the ammonia side, Tampa was the main talking point, unusually making headlines this week due to a spot purchase rather than the contract settlement. Mosaic’s 25,000-tonne purchase at USD 370/tonne CFR appears to have complicated negotiations for next month’s term cargoes. That sale by Trammo represented a USD 45/tonne discount to the May settlement and was also notable for involving material sourced from the Middle East.

The supposed netback from that cargo triggered talk of a sharp drop in spot ranges in the Arabian Gulf, though the trader is widely believed to have secured favourable freight rates for the lengthy voyage.

That deal was one of several CFR cargoes sold in the West, with spot shipments now en route to buyers in Morocco, France and the Netherlands.

Ammonia prices remain under pressure, and the bearish tone continues.