Insight Focus

Currency fluctuations affect commodity competitiveness globally. Whether you are an importer or exporter, changes in currency rates directly impact the prices you pay or receive.

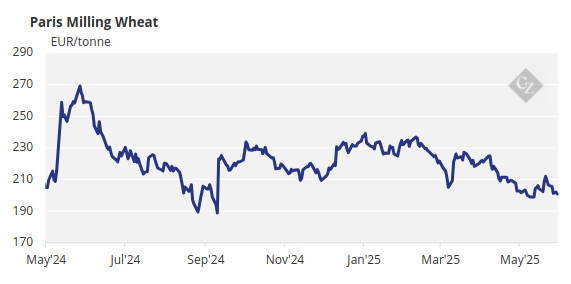

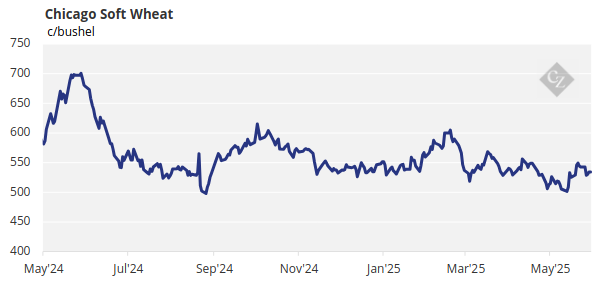

Prices Continue Volatility in 2025

Looking at wheat prices over the last 12 months, in the two charts below, we can see that volatility is a constant threat, and thus an understanding of price drivers is a must.

Although agricultural commodity prices are driven by many fundamental factors, such as weather and general supply versus demand elements, currency has its impact too.

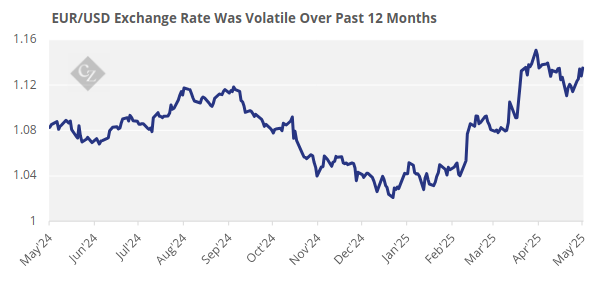

The chart below demonstrates the volatility in the exchange rate between the Euro and the US Dollar over the last year… and they are both relatively stable currencies!

How Currency Drives Commodity Prices

There are two distinct ways to view currency fluctuations when looking at an individual commodity:

As an Exporter

Good examples of commodity exporters are:

- Russian exporters of wheat (RUB)

- Brazilian exporters of soybeans (BRL)

- German exporters of milling wheat (EUR)

A stable global market in US dollars can still become a volatile market at home domestically, as the national currency fluctuates versus the US dollar.

Each exporter is buying their commodities from local farmers in their own national currency. The global export market is dominated by the US Dollar; hence, sales will often be made in dollars. An exporter will base their purchase price from the farmer on the sale price they can achieve with their buyer on the global market.

A stable global market in US Dollars can still become a volatile market domestically, as the national currency fluctuates versus the USD.

For Example…

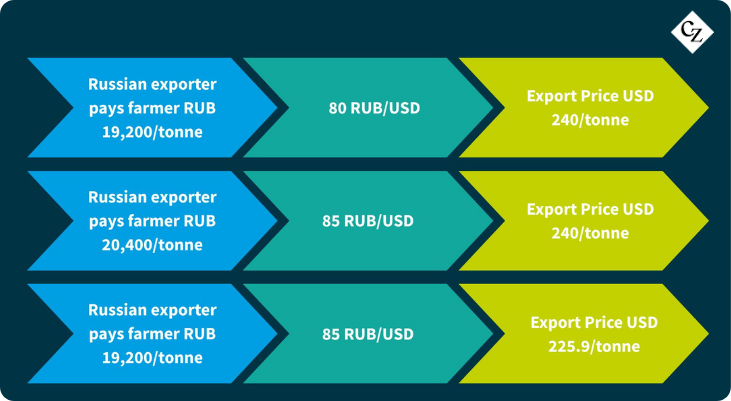

A Russian exporter buys wheat from a farmer at RUB 19,200/tonne, based on a price of USD 240/tonne with an exchange rate of 80 RUB/USD.

On a different day, the same Russian exporter buys wheat from the farmer based on the same USD 240/tonne, but with an exchange rate of 85 RUB/USD, giving the farmer a price of RUB 20,400/tonne. Paying the farmer the same amount as previously—RUB 19,200/tonne—would thus equate to a cheaper export price of USD 225.90/tonne.

This creates a scenario where a devaluation of the exporter’s national currency, as shown above, either allows the farmer to be paid more, or enables the exporter to pay the farmer the same and become a cheaper, more competitive seller on the world market.

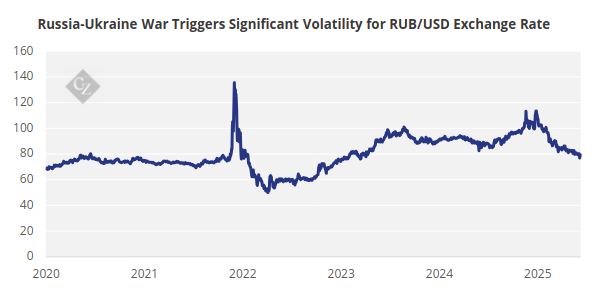

The Russian ruble—with Russia being the largest wheat exporter in the world—is a great example of how currency fluctuations can impact price.

The chart below shows the enormous volatility between the Ruble and the Dollar over the last five years, particularly since the all-out Russian invasion of Ukraine.

The significant devaluation of the ruble has enabled Russian exporters to be very aggressive—and, relatively speaking, cheap—sellers on the international market, while maintaining acceptable prices in rubles for their farmers at home.

As an Importer

Good examples of importers are:

- Egypt as a wheat buyer (EGP)

- China as a soybean buyer (CNY)

- Mexico as a corn buyer (MXN)

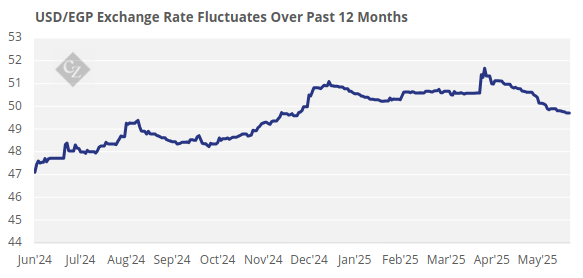

In contrast to the exporter example above, an importer will see a devaluation of their national currency increase the cost of imports, while a strengthening of the national currency reduces the cost of imports.

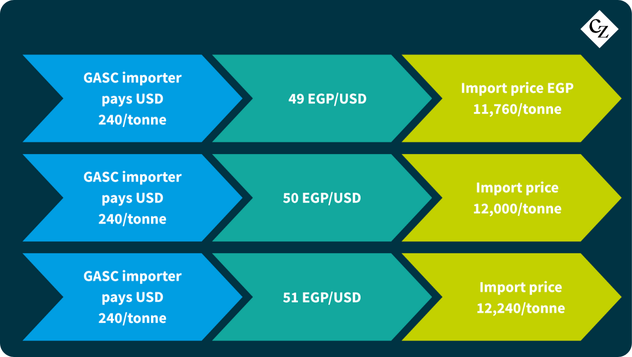

For Example…

The Egyptian GASC (General Authority for Supply of Commodities) imports wheat.

The Currency Dynamic

The examples above demonstrate the impact of currency fluctuations on domestic prices.

The Russian ruble has been extraordinarily volatile since Russia’s invasion of Ukraine, experiencing near collapse and general weakness since February 2022. This has enabled Russia to maintain a virtually constant position as a cheap seller of wheat.

Many of the major agricultural commodity players have seen instability in their currencies over the years, leading to fluctuations in domestic prices—whether they are importers or exporters.

The ebb and flow of who sells what and who buys what is very much influenced by currency in short-term commodity trading.

Although the macro fundamentals of supply and demand remain important, currency will always be a key talking point in the trade as regional prices swing up and down.

As a buyer or a seller, ignore currency at your peril… you have been warned!