Insight Focus

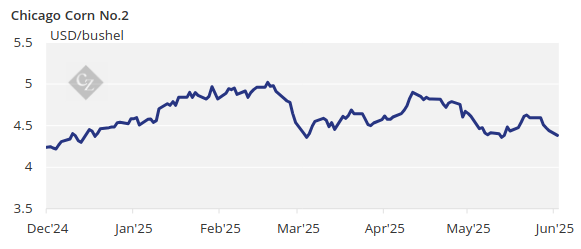

Corn and wheat fell globally on favourable rains. The market has priced in crops and shifted focus to June reports, expecting higher corn demand and lower stocks. We maintain our 2024/25 Chicago corn forecast at USD 4.55/bushel, with downside risk from the trade war.

There are no changes to our forecast for Chicago corn for the 2024/25 crop (September/August), expected to average USD 4.55/bushel with some downside risk depending on the trade war. The average price since September 1 is running at USD 4.48/bushel.

Corn and wheat fell in all geographies on favourable rains across most growing regions, alleviating dry areas, especially in Europe.

Grains Slide on Rain Relief

Corn and wheat declined on both sides of the Atlantic—European grains experienced bigger losses—following favourable rains in the US and Europe that reduced worries of dry weather, especially in northern Europe where many regions had the driest April in many years. China also had a very dry spell two weeks ago, now alleviated by ample rains.

The May MARS bulletin from the European Commission highlighted that large parts of northwestern Europe have experienced the driest spring since 1991, including key growing countries like France, Germany, Poland, and Sweden. However, it also highlighted that other areas have benefited from ample rains. They now project wheat yields to rise 8% year on year and corn yields 11% year on year, not really downgrading their projections yet.

US corn is 87% planted vs. 81% last year and 85% of the five-year average. The first condition report shows 68% of US corn is in good or excellent condition. In Argentina, corn harvesting is 40.5% complete. In Brazil, Safrinha (second) corn harvesting has started and is 0.9% complete vs. 2% last year.

French corn planting reached 97% vs. 84% last year and 95% of the five-year average, with conditions 85% good or excellent—down 2 points in the week and vs. 81% last year. Corn planting in Ukraine is 98% complete.

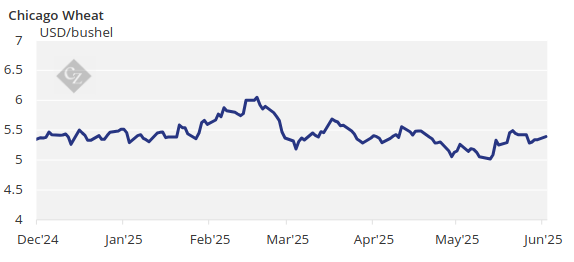

Wheat also fell last week along with corn, even as both US and European corn conditions declined slightly. But as we near the harvesting season, the size of the crop should be more or less secured.

French wheat condition was 70% good or excellent, down 1 point week on week and vs. 61% last year. US wheat condition was 50% good or excellent, down 2 points in the week and vs. 48% last year. US spring wheat is 87% planted vs. 87% last year and 80% of the five-year average.

BCR in Argentina projected wheat production for 2025/26 at 21.2 million tonnes, which would be the second largest crop on record.

Weather Volatility Impacts Market Ahead of June WASDE

On the weather front, the US is expected to have ample rains again and warm temperatures in the corn regions. Cold temperatures are expected in Argentina and southern Brazil, together with some rainfall in the centre-west of Brazil. Northwestern Europe will be warm, with some rainfall expected, as will the Black Sea area.

We had a slower planting pace in US corn last week, and ample rains forecast for this week could again slow planting. However, as we mentioned last week, planting is so far ahead of last year that a small delay should be no problem, thus neutral for the market.

European corn remains a concern in our opinion. We still have the whole summer ahead, but large portions of key producing countries suffered very dry weather during April and May. If rains return back to normal, it should be possible to recover soil moisture. But it is something to watch closely.

The market has now eliminated any risk premium due to dry weather in Europe, and the size of the wheat and corn crops in the northern hemisphere should be priced in.

The focus now turns to the June WASDE due next week, where we continue to expect higher corn demand for ethanol, and then the quarterly stock report on June 30, where we also expect lower-than-expected corn stocks. Expect weather volatility to continue, with more upside than downside risk during June.