Insight Focus

Phosphate prices rise on tight supply; Brazil MAP up 15%. Potash market sees 650,000 tonne MOP deal at higher price; Uralkali matches, volume unknown. Yara and Mosaic cut June ammonia contract to USD 392/tonne CFR Tampa after Mosaic’s USD 370 spot buy.

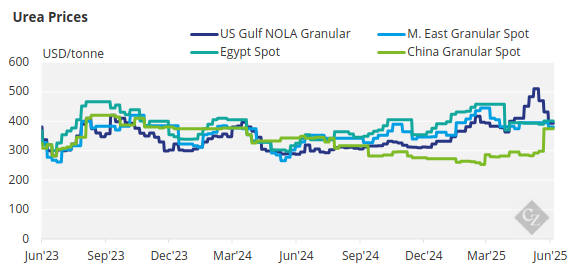

Urea Prices Hold on Tenders

The urea market is in a twilight zone, with major markets like the US and Europe entering the off-season from major buying, whilst others like Brazil are slowly entering into significant second-half-of-the-year buying. Key markets like Australia and Thailand are in the middle of their major season, but dry weather conditions in certain parts of southeastern Australia are causing major concerns for farmers and animal welfare.

On the brighter side, market participants are awaiting the June 12 India tender, calling for 1.5 million tonnes to the west coast only. Opinions in the trading community are that India may struggle to secure more than 800,000 tonnes to 1 million tonnes. Urea inventories in India are said to be around 7 million tonnes at the end of May, which is well below the same month in 2024, when they stood at 11.3 million tonnes. Domestic production is also down, at 2.35 million tonnes in May compared to 2.5 million tonnes in May 2024.

Adding to this, the monsoon has started the earliest since 2009, making it essential for India to reach a successful volume in the upcoming tender. Although China has started concluding urea export contracts with shipments effective at the end of June or early July, it appears that no urea from China will take part in the India tender, as per the announcement by Chinese authorities responsible for overseeing exports. Thus, it is expected that urea origins will be from the Middle East, Russia, and North Africa, with SE Asia’s producers providing marginal quantities.

In addition to India, Ethiopia has announced another tender closing on June 10 for 260,000 tonnes, some of which is said to be a replacement for non-performance from the previous tender. On the trading side, international paper derivatives are in a stand-off, seeking direction. Dangote of Nigeria appears to have sold a cargo with an open destination at USD 393/tonne FOB, while June Brazil paper is at USD 390/tonne CFR. One Chinese urea cargo—possibly two—has changed hands at the low USD 370s, expected to be sold into Latin South America, with Chile as the prime target. China has a floor price of USD 370/tonne FOB.

Petronas of Malaysia appears to have sold 30,000 tonnes to Australia for first-half June shipment, with no price disclosed but likely in line with the most recent Indonesia FOB tender result of around USD 370/tonne FOB. A prilled urea tender in Indonesia this week saw the highest bid at USD 360/tonne FOB, with a floor price in the USD 370s/tonne FOB. Egyptian producers are gradually resuming full production following gas supply issues, and small lots have been sold to Europe at the USD 405–407/tonne FOB level.

Import urea levels for the US have just been published. For the fertilizer year July 2024 to the end of April, the cumulative imports are 4.5 million short tons (4.08 million tonnes) —about what was expected. For the full year ending at the end of June, it is very possible the cumulative number will exceed 5 million short tons, compared to the 2024 volume of 5.6 million short tons. Values at New Orleans continue to slide amid a dearth of activity, with loaded values now at USD 357/short ton FOB compared to the USD 522/short ton FOB level seen last month. Significant falls have also been witnessed inland this week.

The outlook for urea prices over the next 30–45 days will be subject to the outcome of the India and Ethiopia tenders, but is, in most likelihood, stable to strong.

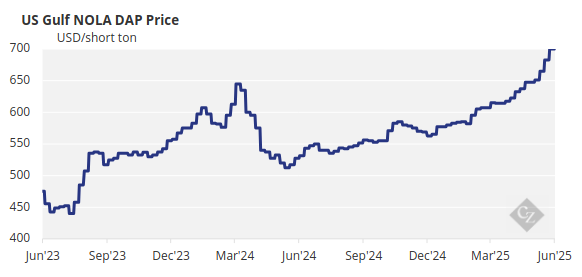

Phosphates Prices Climb on Shortage

Processed phosphate prices continue to rise due to a lack of availability from China. DAP/MAP production in China dipped 2.9% to 2.5 million tonnes compared to the same period last year. DAP declined 18% to 1.15 million tonnes, while MAP increased 13% to 1.4 million tonnes. For the January to April period, DAP/MAP production reached 10.11 million tonnes, up 8% year-over-year. Full-year 2024 DAP/MAP production totalled 30.5 million tonnes, with MAP slightly edging out DAP at 15.32 million tonnes versus 15.11 million tonnes.

It is expected, however, that China will soon begin exporting the allocated 2 million tonnes of DAP and 1 million tonnes of MAP. Russian MAP has reportedly been sold in Brazil at USD 730/tonne CFR, up from last week’s benchmark of USD 725/tonne CFR—a robust 15% or USD 93/tonne increase since late February this year. Ma’aden of Saudi Arabia is said to have sold 100,000 tonnes of DAP to India at USD 638/tonne CFR. Southeast Asia offers are rumoured to be higher, in the range of USD 745–750/tonne CFR, largely due to a significant freight differential to India of around USD 10/tonne.

Imports of DAP/NP/NPK to Indonesia have more than doubled compared to the same period last year, with January–April 2025 imports at 272,154 tonnes versus 127,421 tonnes year-over-year. DAP imports totaled 89,990 tonnes, with 47,642 tonnes from Morocco and 41,705 tonnes from Vietnam. All 16,598 tonnes of NP/NPS imports originated from China. The increase in processed phosphate imports to Indonesia is driven by rising NPK production capacity to meet the government’s goal of promoting balanced fertilization. This aims to boost rice production and reduce reliance on rice imports, supporting food security for Indonesia’s growing population.

The outlook for the processed phosphate prices is to increase until China enters the market in earnest.

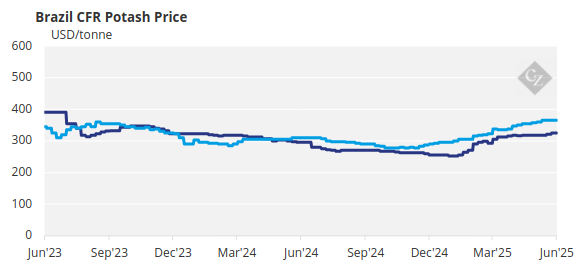

Potash Market Firms in Asia

In the potash market, Chinese importers have signed a cross-border contract with Russia’s Uralkali for white standard MOP at USD 323/tonne DAP Manzhouli (the border between Russia and China) for June shipment. The price remains unchanged from April, after no contract was signed in May. The contracted volume for June is understood to be lower than usual, as the market is currently in its off-season. Differing views on price between the parties may also have limited the volume taken under the contract.

MOP demand in the Chinese market has tapered off following the end of NPK production for the summer corn application season. This lack of buy-side demand has prompted Chinese importers to push for lower prices. However, firm pricing and demand in international markets have made suppliers resistant to lowering their offers. The absence of a contract in May is likely due to this pricing disconnect between buyers and sellers.

China sources most of its MOP import supply by rail from Russia under monthly contracts. It also maintains annual contracts for seaborne supply from Canada, Russia, Belarus, and Israel. China’s annual contract price for this year has not yet been determined, but it is expected to exceed last year’s contract price of USD 273/tonne CFR, which was signed in July.

India’s IPL has also signed a 650,000 tonne contract with BPC of Belarus for delivery through the end of 2025, at USD 349/tonne CFR—up from the previous contract price of USD 283/tonne CFR. The price includes 180 days of credit. Reportedly, Russia’s Uralkali has agreed to the same price and payment terms, although the volume has not been disclosed.

Brazilian MOP prices have firmed slightly, rising by USD 1/tonne to USD 360–376/tonne CFR. While demand remains slow, both buyers and sellers are proceeding cautiously in finalising the remainder of the season’s soybean-related purchases. The price gap between inland and port levels continues to weigh on transaction volumes.

The outlook for potash prices is stable to firm, with firmness particularly expected in SE Asia.

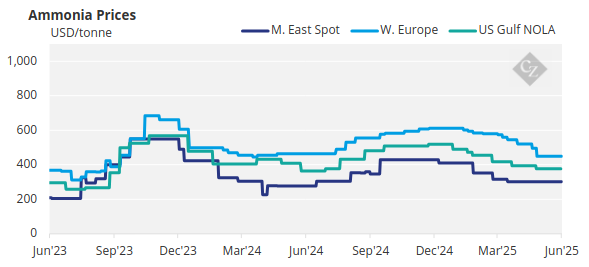

Ammonia Prices Balance Across Suez

Amidst the backdrop of another decline at Tampa, the ammonia picture on both sides of the Suez was partially blurred heading into the first week of June, with buyers and sellers largely in disagreement over current price levels and the direction they may take moving into Q3. Yara and Mosaic have finally announced the June ammonia contract, resulting in a price reduction from the previous level of USD 415/tonne CFR Tampa to USD 392/tonne CFR.

Normally, Yara and Mosaic would announce the contract price a few days prior to the start of the month it covers. However, the recent Trammo sale to Mosaic at USD 370/tonne CFR appears to have clouded negotiations.

Prices on both sides of the Suez currently appear balanced, though fundamentals still suggest there is room for values to decline slightly further in the West.