Insight Focus

Raw material costs softened last week following the weakening trend in Chinese commodities. Chinese PET resin export prices also lost ground, as demand was also hit by freight rate volatility. PET resin forward curves have steepened in backwardation, with prices expected to weaken through H2’25.

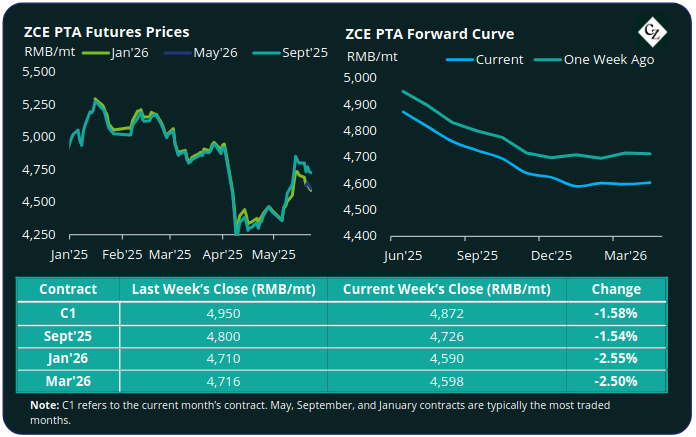

PTA Futures and Forward Curve

PTA futures fell last week as the bounce in Chinese commodities due to the US tariff pause faded, leading to main month contracts to decrease by over 1.5%.

Oil prices slipped as OPEC+ plans to increase daily output, contributed to market concerns of oversupply. By Friday Brent crude was just below USD 65/bbl, marginally below the previous week’s close.

Demand for US crude oil storage has surged amid expectations of increased OPEC+ supply, and rising US oil inventories also added to bearish sentiment among traders.

The PX-N CFR spread has widened significantly over the past two weeks on tighter PX supply, with the average weekly spread steady on last week after increasing by around USD 57/tonne to average USD 242/tonne. Supply tightness may see some relief in the coming weeks as PX units ramp increase output.

The PTA-PX CFR spread also improved slightly, averaging USD 84/tonne, up around USD 2/tonne on last week, as the destocking cycle continued.

Currently both PTA and PX pricing are being supported by strong downstream demand as polyester operating rates maintained high rates. Looking forward, some reductions are expected as the polyester industry now moves into the seasonal lull.

The PTA forward curve remains backwardated with the curve steepening over the past week. The Sept’25 contract is now at a RMB 146/tonne discount to the current month’s contract, and Jan’26 holds a RMB 282/tonne discount.

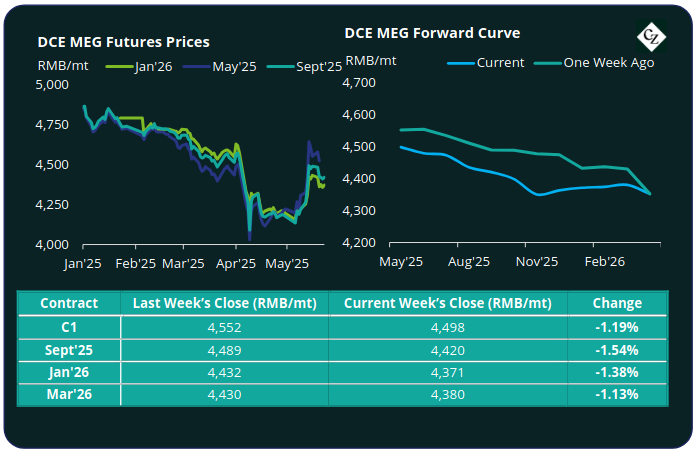

MEG Futures and Forward Curve

MEG Futures contracts also softened following the general weakening in Chinese commodity markets, with main contracts also down by around 1.5%.

East China main port inventories fell sharply by around 7.9% to 631,000 tonnes as expected on a slowdown in arrivals over the last few weeks.

Although supply remains relatively tight, market sentiment has become more cautious with expectations of a seasonal reduction in polyester operating rates through June, impacting raw material demand.

The MEG Futures forward curve remains in backwardation. The Sept’25 contract held a RMB 78/tonne discount over the current month and the Jan’26 held a RMB 127/tonne discount.

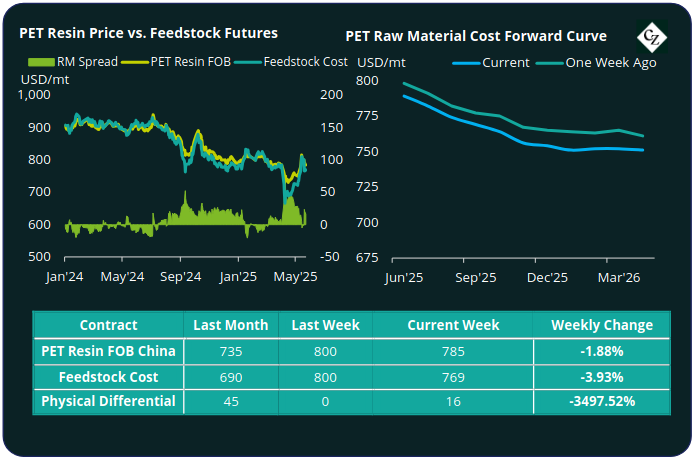

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices slipped last week on softening feedstock costs, to an average of USD 785/tonne FOB China by Friday, down USD 15/tonne.

The average weekly PET resin physical differential against raw material future costs improved to a weekly average of positive USD 15/tonne last week, up USD 10/tonne. By Friday, the daily differential was back down to just positive USD 16/tonne.

The raw material cost forward curve moved further into backwardation, with Sept’25 at a USD 20/tonne discount over current month, and Jan’25 holding an increased USD 38/tonne discount over May’’25.

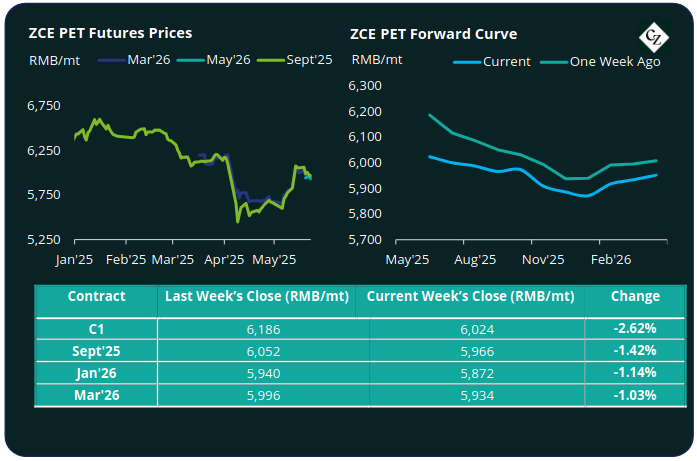

PET Resin Futures and Forward Curve

PET Resin futures also sank back as main contract months dropped on average between 1.5-2.5% versus the previous week.

The current main month fell the most, by over 2.6% to RMB 6,024/tonne (USD 836/tonne), down around USD 23/tonne from last week.

The average weekly premium of the May’25 PET futures over May’25 Raw Material futures increased to USD 26/tonne, up USD 2/tonne.

The PET Resin futures forward curve remains in backwardation. Sept’25 held a RMB 58/tonne (USD 8/tonne) discount over current month, and Jan’25 had RMB 152/tonne (USD 21/tonne) discount over May’25.

Concluding Thoughts

Chinese PET resin export pricing kept in line with raw material costs last week, with the physical differential against raw material futures largely unchanged.

In general, some weakness has been seen in PET resin pricing over the last fortnight with PET pricing unable to match increases seen in feedstock costs.

Demand looks to have been dented as buyers and traders stocked up on low prices seen in early April, and now cautiously view higher values.

The sudden surge in ocean freight rates caused by the pause in China-US reciprocal trade tariffs has also disrupted trade flows and demand.