Insight Focus

PTA Futures are treading water ahead of the Dragon Boat festival. The forward curve has now steepened into backwardation. Chinese PET resin export prices also remained static, despite weaker export demand. Asian PET resin export prices expected to come under increased pressure through H2’25.

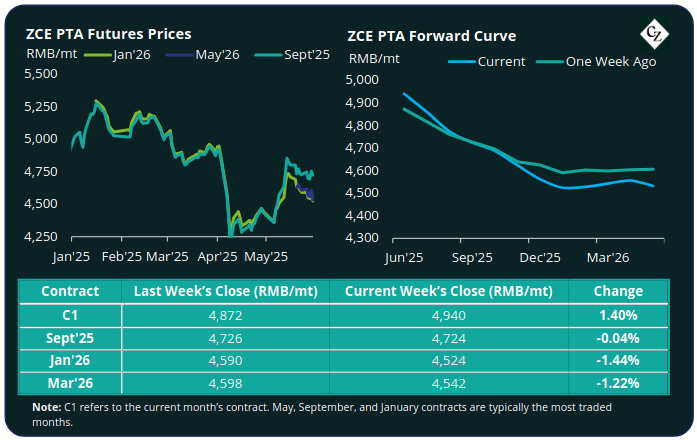

PTA Futures and Forward Curve

While the PTA futures current month increased by over 1%, the next main September contract was broadly flat.

Despite the modest increase in crude prices mid-last week due to the US court’s verdict on US tariffs, Brent crude ended the week broadly in line with the previous week’s close at just above USD 64/bbl.

Bearish sentiment abounded, with latest EIA data showing that US crude oil production surged to an all-time high in March. OPEC+ on Saturday also announced another production boost.

The PX-N CFR spread continued to improve on tight near-term supply despite increased operating rates, with the average weekly spread increasing to average around USD 253/tonne.

The PTA-PX CFR spread remained relatively flat, averaging USD 83/tonne, down just USD 1/tonne on last week. PTA supply and demand fundamentals were also relatively unchanged with balanced restarts and shutdowns, and some downstream restocking.

The PTA forward curve remained backwardated with the curve steepening over the past week. The Sept’25 contract is now at a RMB 216/tonne discount to the current month’s contract, and Jan’26 holds a RMB 416/tonne discount.

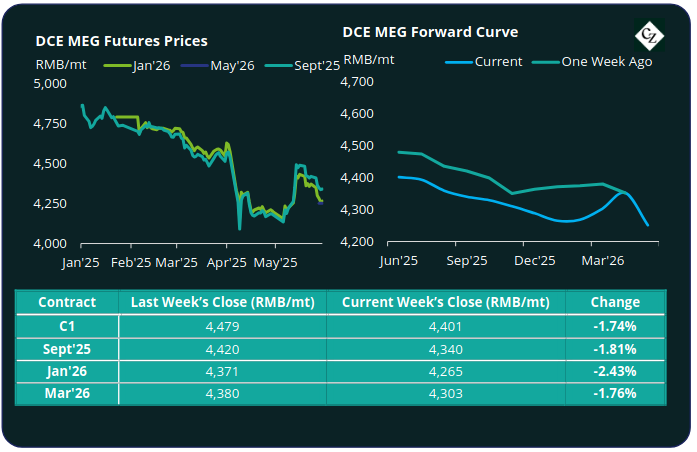

MEG Futures and Forward Curve

MEG Futures contracts fell much more sharply, with main contract months shedding over 1.75% as market sentiment turned increasingly bearish.

This comes despite East China main port inventories shrinking further by around 3.8% to 608,000 tonnes as arrivals remain limited.

Although supply remains relatively tight, market sentiment has become more cautious with expectations of a seasonal reduction in polyester operating rates through June, impacting raw material demand.

The MEG Futures forward curve remains in backwardation. The Sept’25 contract held a RMB 59/tonne discount over current month and the Jan’26 held a RMB 136/tonne discount.

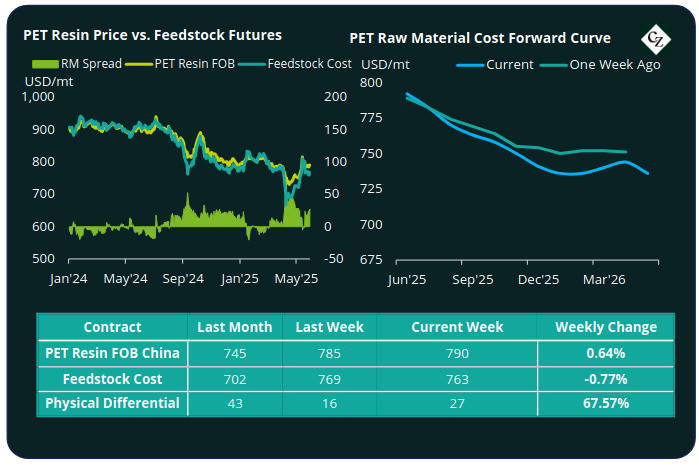

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices kept within a relatively tight range with an average of USD 790/tonne FOB China by Friday, up just USD 5/tonne on the week.

The average weekly PET resin physical differential against raw material future costs improved to a weekly average of positive USD 23/tonne last week, up USD 8/tonne. By Friday, the daily differential had continued to build up to positive USD 27/tonne.

The raw material cost forward curve moved further into backwardation, with Sept’25 at a USD 29/tonne discount over current month, and Jan’26 holding an increased USD 56/tonne discount.

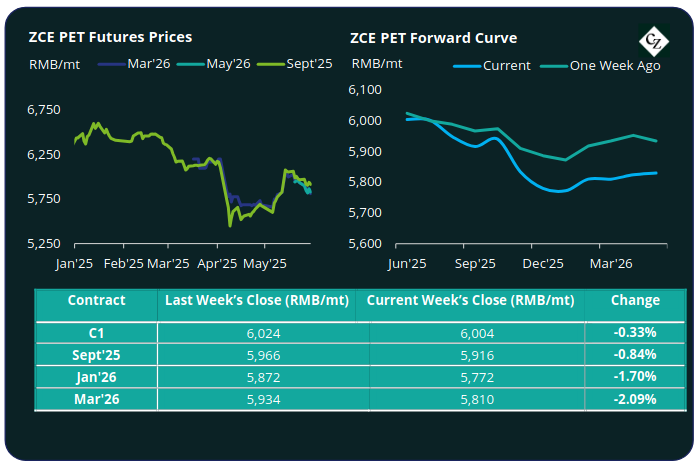

PET Resin Futures and Forward Curve

PET Resin futures also softened as main contract months dropped by an average of just over 1% versus the previous week.

The current main month fell by just 0.33%, having already dropped sharply the previous week, to RMB 6,004/tonne (USD 833/tonne), down around USD 3/tonne from last week.

The average weekly premium of the May’25 PET Futures over May’25 Raw Material futures increased to USD 32/tonne, up USD 6/tonne. By Friday, the daily premium stood at USD 22/tonne.

The PET Resin futures forward curve remains in backwardation. Sept’25 was at a RMB 88/tonne (USD 12/tonne) discount over the current month, while Jan’25 held RMB 232/tonne (USD 32/tonne) discount.

Concluding Thoughts

Chinese PET resin export prices remained relatively static ahead of the short Dragon Boat Festival break (May 31 – Jun 2) with the physical differential against raw material futures showing some improvement.

This comes amid a significant downturn in export demand due to the surge in shipping costs in June, and foreign buyers without immediate requirements adopting a wait-and-see approach.

Although strong domestic sales have supported offtake, sustained weak export demand will inevitably lead to renewed pressure from increasing factory stock. Chinese PET resin producers could look to reduce operating rates in the coming month to support fundamentals.

Overall, Asian PET resin prices are expected to gradually come under increased pressure with PET and Raw Material forward curves backwardated by as much as USD 50/tonne through to Jan’25.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.