Insight Focus

Crude oil prices and upstream costs remain highly volatile, impacting the PTA and PET value chain. Chinese PET resin export prices steady but we should expect downside on the market reopening after holiday. Future PET resin pricing is in the hands of macroeconomics as OPEC signals an oil price war.

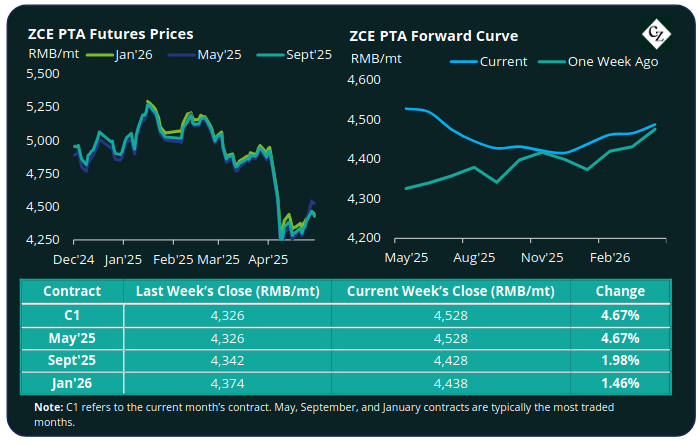

PTA Futures and Forward Curve

PTA futures closed higher last Wednesday ahead of the Labor Day holiday, with the current May’25 contract up by over 4.5%.

These gains are likely to be short lived though with crude set for a weekly loss after the sharp fall Thursday. Friday witnessed a rebound in oil prices due to reports of potential tariff negotiations between China and the US.

Despite crude and naphtha strength, PX fundamentals improved with the PX-N CFR average weekly spread up by around USD 17/tonne to average USD 161/tonne. The PTA-PX CFR spread improved steadily through the week, averaging USD 79/tonne last week.

Several PTA units entered maintenance coupled with downstream polyester operating rates remaining high, supporting PTA fundamentals.

The PTA forward curve has now fallen into backwardation, although is clearly volatile. The Sept’25 contract is now at a RMB 100/tonne discount to the current contract, and Jan’26 holds just a RMB 90/tonne discount.

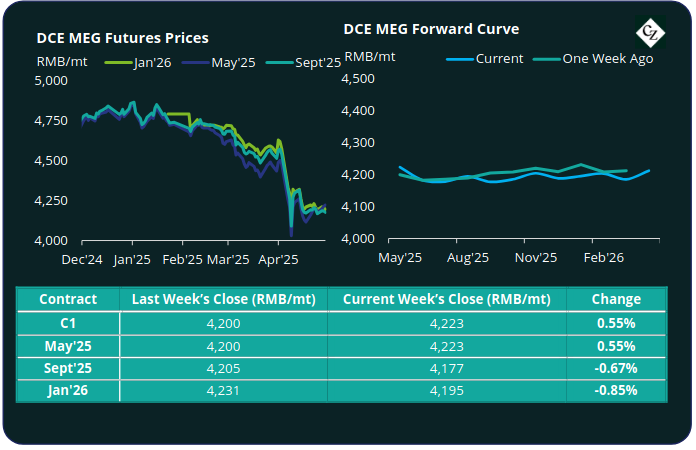

MEG Futures and Forward Curve

MEG Futures contracts remain volatile with large daily swings, although some restocking ahead of the Labor Day holiday helped support pricing.

East China main port inventories jumped by 5.1% to around 743,000 tonnes as deep-sea arrivals intensified. Although import arrivals have slowed with fewer arrivals leading up to the break.

Supported by improved polyester sales and high operating rates, MEG destocking is expected to continue at pace through the remainder of May, keeping tight and potentially alleviating port inventories.

The MEG Futures forward curve remains relatively flat, moving into slight backwardation. The Sept’25 contract held a RMB 46/tonne discount over May’25 and the Jan’26 held a RMB 28/tonne discount.

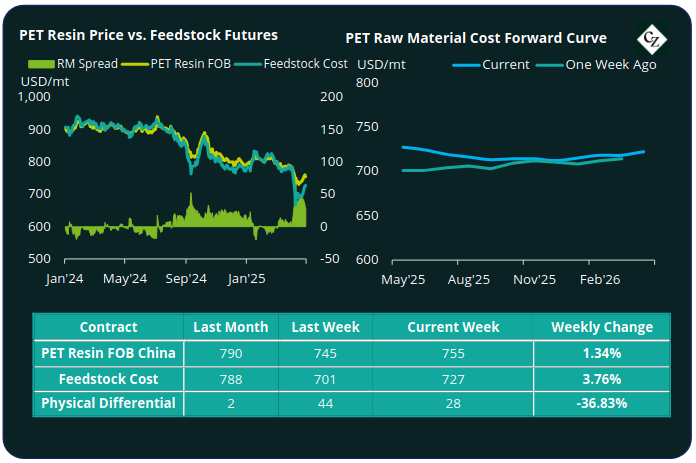

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices firmed slightly to an average of USD 755/tonne FOB China by last Wednesday’s close, up USD 5/tonne on the previous week.

The average weekly PET resin physical differential against raw material future costs fell back to a weekly average of positive USD 30/tonne last week, down USD 14/tonne. By Friday, the daily differential was back down to positive USD 28/tonne.

The raw material cost forward curve remains relatively flat moving into backwardation, with Sept’25 at a USD 14/tonne discount over May’25, and Jan’25 holding a USD 12/tonne discount over May’25.

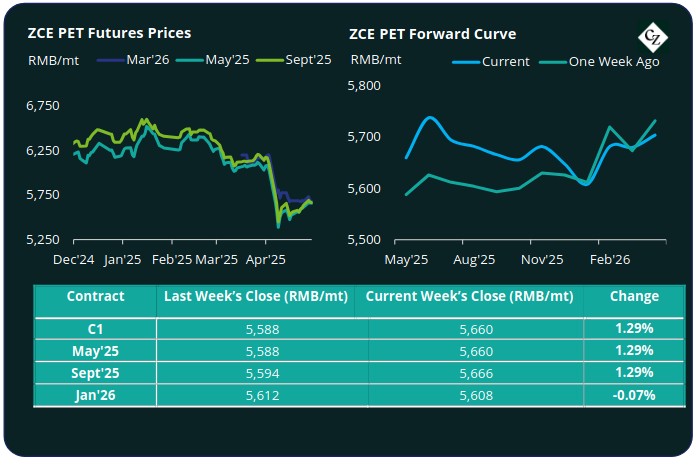

PET Resin Futures and Forward Curve

PET Resin futures also floated higher with rest of the market, with main contract months recovering by around 1.3% on the week.

May’25, the current main month with the highest liquidity increased 1.3% to RMB 5,660/tonne (USD 778/tonne), up around USD 8/tonne on the previous week.

The average weekly premium of the May’25 PET futures over May’25 Raw Material futures decreased to USD 18/tonne, down USD 15/tonne. By last Wednesday’s close, the daily premium was USD 18/tonne.

The PET Resin futures forward curve lost all forward premium, flattening entirely across main contract months. Sept’25 held just a RMB 6/tonne (USD 1/tonne) premium over May’25, and Jan’25 had just RMB 52/tonne (USD 7/tonne) discount over May’25.

Concluding Thoughts

In the immediate term, Chinese PET resin fundamentals are being supported from all angles. Factory stock levels are still below 15 days, low prices have driven demand with some producers proclaiming certain grades sold-out for May and profitability has peaked.

The high physical differential seen over the last few weeks has led producers to delay scheduled maintenance and keep operating rates high while profitability is strong.

Production is expected to remain high through May and into June, with any production increase as a result of line restarts expected to be offset by maintenance plans.

Although forward curves have now moved into slight backwardation, crude and macroeconomics are now in the driving seat, with OPEC+’s decision to boost its production quota and engage in an oil price war likely to lead to a drop in PET resin prices when markets reopen after the holiday.

Close attention should also be paid to changes in ocean freight rates.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.